Bitcoin ETFs were finally approved in the United States earlier this month, marking a major milestone for cryptocurrency adoption. However, since then, Bitcoin price has pulled back, declining from around $48,000 to $41,000 at the time of this writing.

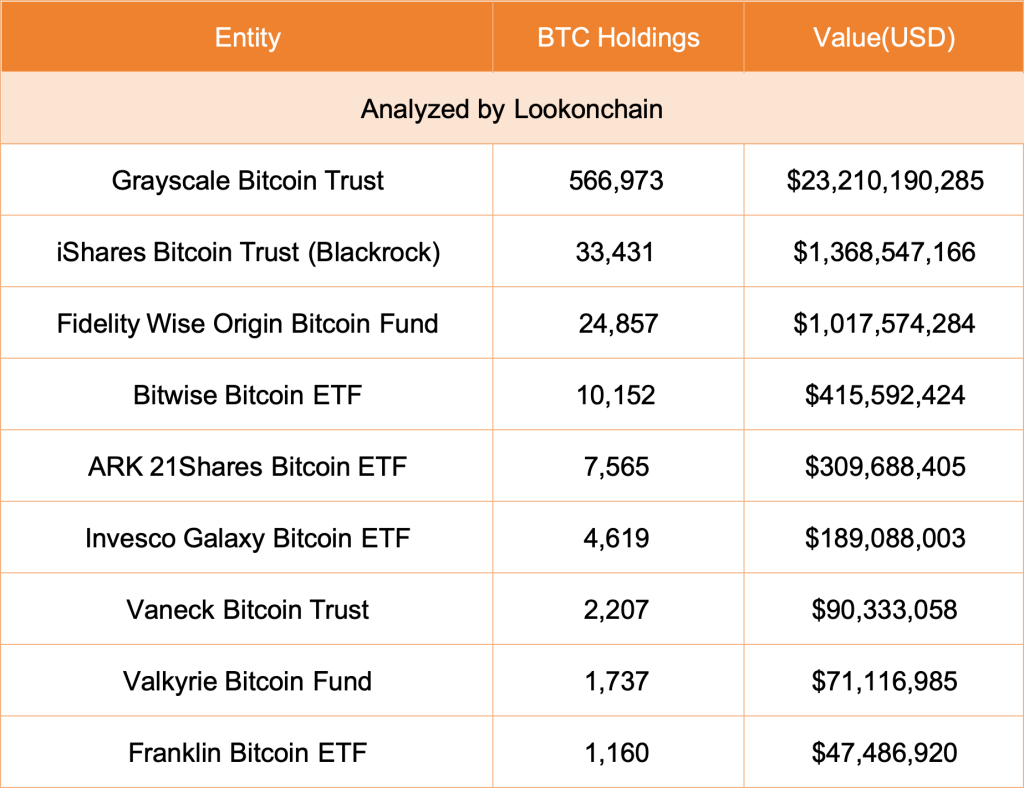

Despite the price decline, major financial companies are accumulating significant Bitcoin holdings within their newly approved ETFs. According to data shared by on-chain analytics account LookOnChain, here’s how much BTC some major players have stockpiled:

As we can see, Grayscale still holds the most Bitcoin with 566,973 BTC valued at around $23.21 billion. However, they have decreased their holdings by about 52,227 BTC or $2.14 billion since their ETF was approved.

Other notable holdings include BlackRock’s iShares Bitcoin ETF with 33,431 BTC worth around $1.37 billion and Fidelity’s Wise Origin Bitcoin Trust holding 24,857 BTC valued at approximately $1.02 billion. Additional companies like Valkyrie, Bitwise, and Osprey also have significant and growing Bitcoin positions.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Even as prices oscillate, these substantial cryptocurrency stockpiles by institutional giants validate Bitcoin’s long-term staying power. Major financial players are making big bets that digital assets are here to stay and will increasing impact global markets. Their massive buys even during price dips signals confidence that current weakness is temporary.

As companies race to build their Bitcoin war chests, it’s clear they see plenty of future upside potential still to come.

You may also be interested in:

- These Are the Two Possibilities for BTC Price With the Current Bitcoin Cycle

- Why Ripple’s Recovery Will Be Faster Than Anticipated, XRP Expected to Rise to This Price Level

- Why investors from Polygon (MATIC) and Tron (TRX) are buying into the new Pushd (PUSHD) presale

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.