President Trump prepares to host the first-ever White House Crypto Summit this Friday, March 7. The historic gathering aims to tackle regulation and innovation in the cryptocurrency sector. There will be a particular focus on the newly announced U.S. Crypto Reserve.

Crypto analyst Miles Deutscher has shared his thoughts on what this means for investors and which coins might benefit most.

“This is by far the most pivotal crypto event of Q1,” Deutscher explained in a recent thread, where he broke down his expectations and highlighted potential winners leading into the event.

Alongside Trump, numerous prominent figures are expected to attend the summit.

— Miles Deutscher (@milesdeutscher) March 6, 2025

Some note-worthy mentions include Coinbase CEO Brian Armstrong, Michael Saylor, and potentially even Vitalik. pic.twitter.com/UDDErRFwYK

What you'll learn 👉

A Gathering of Crypto Heavyweights

The summit was announced last Friday by David Sacks, who serves as Trump’s crypto czar. Coinbase CEO Brian Armstrong will be there, as will Bitcoin advocate Michael Saylor of MicroStrategy. There’s even talk that Ethereum founder Vitalik Buterin might make an appearance.

While the exact agenda remains under wraps, analyst Sith Sou has suggested several likely topics for discussion. These range from establishing a U.S. strategic crypto reserve to regulatory clarity, stablecoin policies, tax reforms for digital assets, DeFi opportunities, and anti-money laundering compliance.

Commerce Secretary Howard Lutnick recently dropped a major hint that has investors watching closely. He suggested that Trump would unveil complete Bitcoin reserve plans during the summit. This news alone has already pushed Bitcoin prices upward.

The U.S. Crypto Reserve Takes Shape

In what many see as a preview of Friday’s announcements, Trump officially announced the U.S. crypto reserve last Sunday. According to Deutscher, this reserve will definitely include Bitcoin, Ethereum, XRP, Cardano, and Solana. More details are expected at the summit.

“It’s no surprise Trump wants to support US-based protocols to make America the ‘crypto capital of the world,'” Deutscher noted. “Think about it, Trump wants to bring crypto innovation back on shore. And the best way to do this is via supporting homegrown talent.”

This focus on American innovation has already started shifting investor attention toward U.S.-based projects, even before the summit begins.

Which Altcoins Could Benefit?

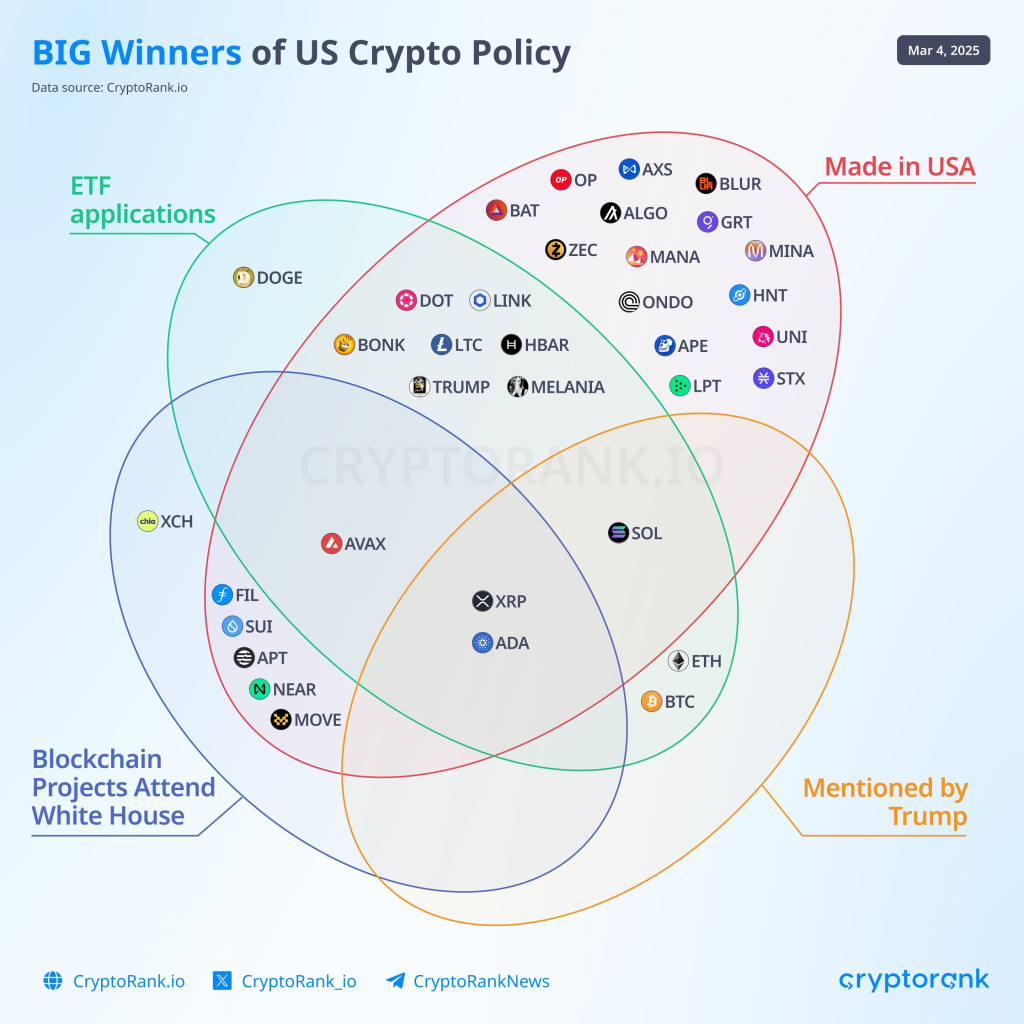

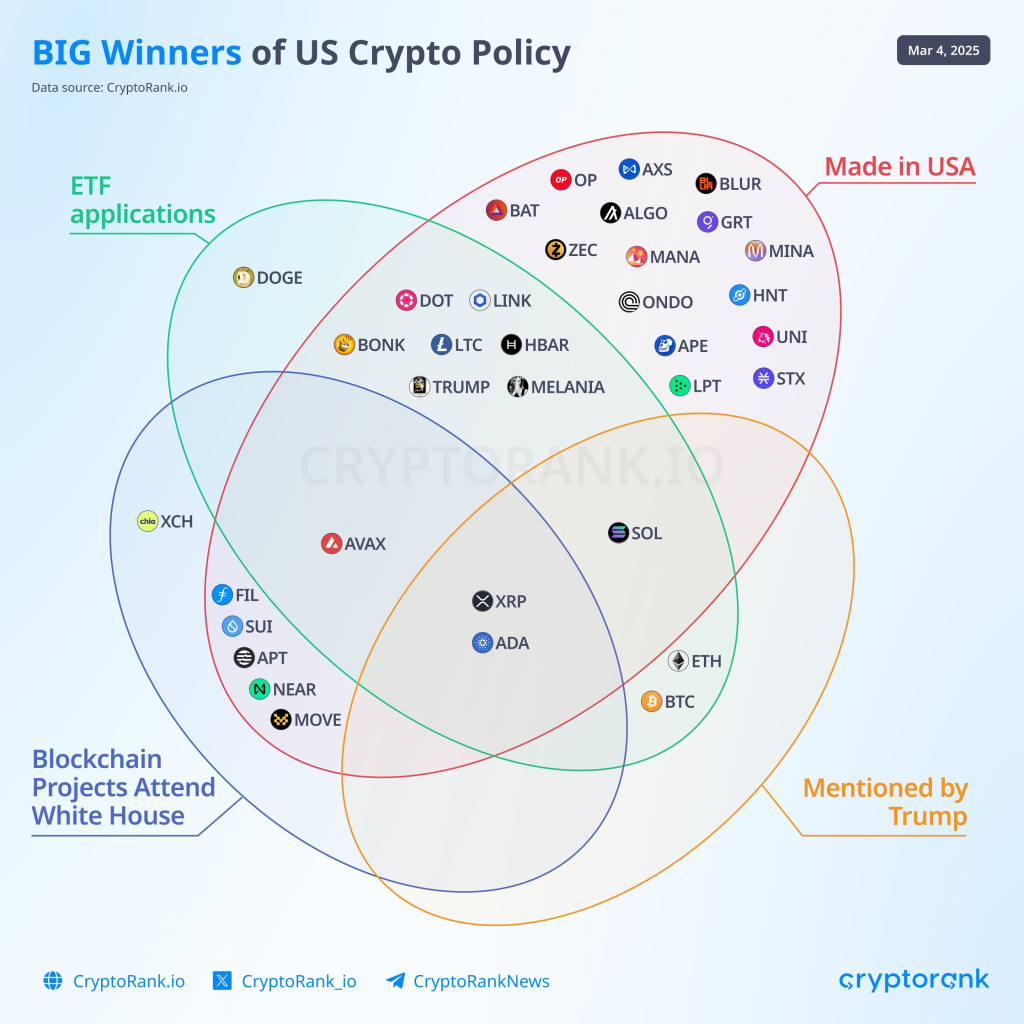

Deutscher has identified four key categories that investors should watch:

- Tokens with ETF filings

- Tokens made in the USA

- Tokens Trump has previously mentioned, and

- Projects that will have representatives at the summit.

Looking at coins that tick multiple boxes across these categories, Deutscher narrowed down eight tokens not currently included in the reserve that could benefit: Bonk, Polkadot, Chainlink, Litecoin, Hedera, TRUMP, MELANIA, and Avalanche.

He also highlighted projects with team members speaking at the conference, including Filecoin, Sui, Aptos, NEAR Protocol, and Movement. Other “Made in USA” tokens worth watching include Aave, Hedera (which appears in multiple categories), and Stellar.

Fellow analyst Wacy_time1 has also compiled a watchlist leading into the summit, featuring Ondo Finance—a project that’s received public support from Trump’s WLFI and Eric Trump.

The historic gathering aims to tackle regulation and innovation in the cryptocurrency sector. There will be a particular focus on the newly announced U.S. Crypto Reserve.

Crypto analyst Miles Deutscher has shared his thoughts on what this means for investors and which coins might benefit most.

“This is by far the most pivotal crypto event of Q1,” Deutscher explained in a recent thread, where he broke down his expectations and highlighted potential winners leading into the event.

Alongside Trump, numerous prominent figures are expected to attend the summit.

— Miles Deutscher (@milesdeutscher) March 6, 2025

Some note-worthy mentions include Coinbase CEO Brian Armstrong, Michael Saylor, and potentially even Vitalik. pic.twitter.com/UDDErRFwYK

A Gathering of Crypto Heavyweights

The summit was announced last Friday by David Sacks, who serves as Trump’s crypto czar. Coinbase CEO Brian Armstrong will be there, as will Bitcoin advocate Michael Saylor of MicroStrategy. There’s even talk that Ethereum founder Vitalik Buterin might make an appearance.

While the exact agenda remains under wraps, analyst Sith Sou has suggested several likely topics for discussion. These range from establishing a U.S. strategic crypto reserve to regulatory clarity, stablecoin policies, tax reforms for digital assets, DeFi opportunities, and anti-money laundering compliance.

Commerce Secretary Howard Lutnick recently dropped a major hint that has investors watching closely. He suggested that Trump would unveil complete Bitcoin reserve plans during the summit. This news alone has already pushed Bitcoin prices upward.

The U.S. Crypto Reserve Takes Shape

In what many see as a preview of Friday’s announcements, Trump officially announced the U.S. crypto reserve last Sunday. According to Deutscher, this reserve will definitely include Bitcoin, Ethereum, XRP, Cardano, and Solana. More details are expected at the summit.

“It’s no surprise Trump wants to support US-based protocols to make America the ‘crypto capital of the world,'” Deutscher noted. “Think about it, Trump wants to bring crypto innovation back on shore. And the best way to do this is via supporting homegrown talent.”

This focus on American innovation has already started shifting investor attention toward U.S.-based projects, even before the summit begins.

Which Altcoins Could Benefit?

Deutscher has identified four key categories that investors should watch:

- Tokens with ETF filings

- Tokens made in the USA

- Tokens Trump has previously mentioned, and

- Projects that will have representatives at the summit.

Looking at coins that tick multiple boxes across these categories, Deutscher narrowed down eight tokens not currently included in the reserve that could benefit: Bonk, Polkadot, Chainlink, Litecoin, Hedera, TRUMP, MELANIA, and Avalanche.

He also highlighted projects with team members speaking at the conference, including Filecoin, Sui, Aptos, NEAR Protocol, and Movement. Other “Made in USA” tokens worth watching include Aave, Hedera (which appears in multiple categories), and Stellar.

Fellow analyst Wacy_time1 has also compiled a watchlist leading into the summit, featuring Ondo Finance—a project that’s received public support from Trump’s WLFI and Eric Trump.

Read Also: Why Are Bitcoin (BTC) and the Crypto Market Up Today?

Managing Expectations

Despite the excitement, Deutscher urges caution. “Remember that there are no guarantees that we’ll receive a full list during Friday’s summit,” he warned. “And even if we do, attention is likely to be diluted across many altcoins.”

He points out the common “buy the rumor, sell the news” effect that often follows highly anticipated crypto events. While he believes the strategic reserve will provide long-term support for the altcoin market, short-term trading around the event requires careful planning.

“I think there ARE trading opportunities on these alts,” Deutscher said, “BUT only based on strict technical setups with invalidation.”

Overall, Deutscher views the summit as a positive development for the crypto industry and plans to provide updates before and after the event.

Read Also: Ripple’s Bold Move: How XRP is Disrupting Cross-Border Payments in Portugal and Brazil

Managing Expectations

Despite the excitement, Deutscher urges caution. “Remember that there are no guarantees that we’ll receive a full list during Friday’s summit,” he warned. “And even if we do, attention is likely to be diluted across many altcoins.”

He points out the common “buy the rumor, sell the news” effect that often follows highly anticipated crypto events. While he believes the strategic reserve will provide long-term support for the altcoin market, short-term trading around the event requires careful planning.

“I think there ARE trading opportunities on these alts,” Deutscher said, “BUT only based on strict technical setups with invalidation.”

Overall, Deutscher views the summit as a positive development for the crypto industry and plans to provide updates before and after the event.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.