DeFi analyst Ignas dives into the complex tapestry of the crypto market, questioning not just the valuation but the societal impact and ethical considerations within the space.

Ignas begins by highlighting the monumental achievement of the crypto market cap surpassing $1.5 trillion. However, the key question surfaces—have we truly earned this valuation?

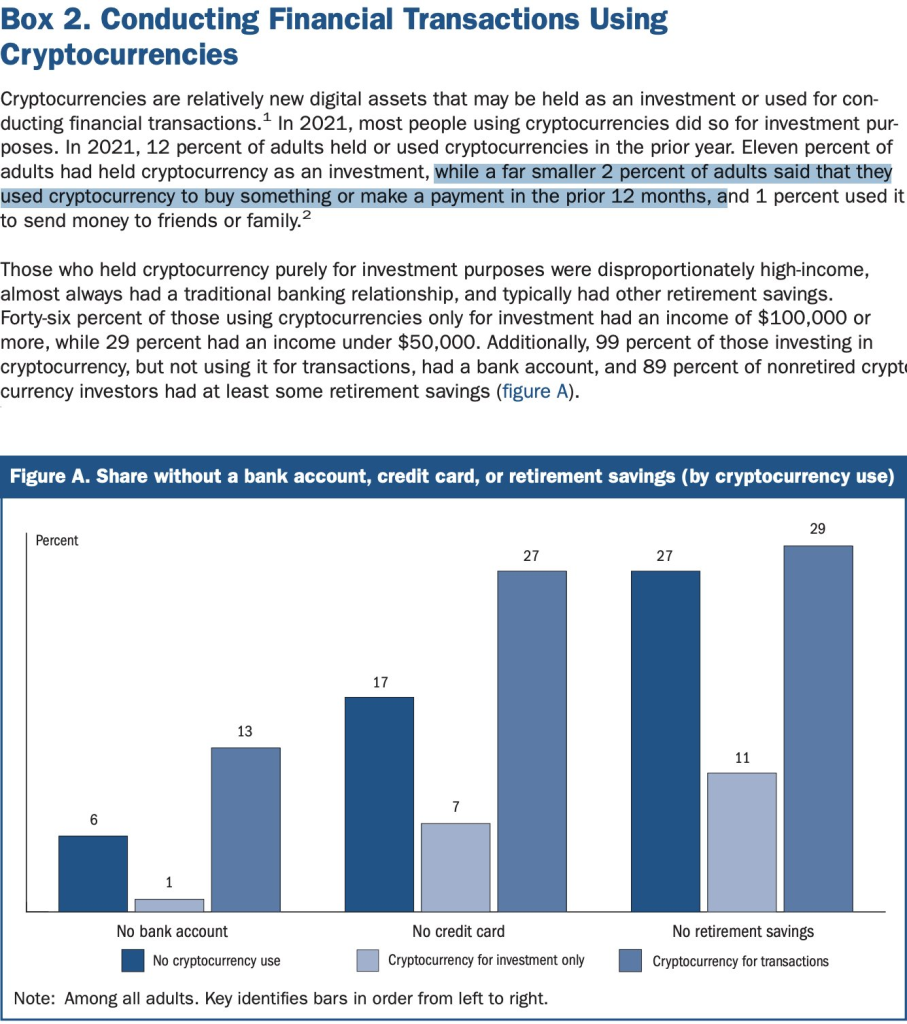

A sobering reality check follows. Ignas draws attention to the 1.4 billion unbanked individuals globally, with 4.5% even in the US facing financial exclusion. A Federal Reserve study reveals the nuanced usage of crypto, with high-income individuals treating it as an investment, while a significant portion, 60%, employing it for transactions earning less than $50,000, and 13% lacking a bank account.

What you'll learn 👉

Crypto as a Lifeline Against Inflation

Venturing into geopolitical landscapes, Ignas points to Venezuela’s 40th rank in the Chainalysis Crypto Adoption Index. Stablecoins emerge as a vital tool against rampant inflation, akin to Argentina, showcasing the profound impact of crypto adoption.

Beyond financial utility, crypto becomes a weapon against oppressive regimes. Ignas narrates instances of crypto aiding in Covid relief efforts in Venezuela and fundraising in Ukraine, spotlighting crypto’s resilience in the face of adversity.

Transitioning to the decentralized finance (DeFi) arena, Ignas notes a staggering Total Value Locked (TVL) at $47 billion. DEXes challenge centralized counterparts, and projects like Maker, Avalanche, and censorship-resistant stablecoins contribute to the growing ecosystem.

Decentralized Social Apps on the Rise

Ignas shines a light on the adoption surge in decentralized social apps. Platforms like Farcaster and LensProtocol witness thousands of daily users, indicating a shift towards non-speculative, decentralized alternatives.

While the narrative around crypto for micropayments has faded, Ignas predicts a potential resurgence. Layer 2 solutions and low-gas fee blockchains like Solana may pave the way for renewed interest in micropayments.

Reflecting on Innovations

In a reflective tone, Ignas revisits the innovations over the past five years, emphasizing the 300% growth in the total crypto market cap. The question lingers: have these innovations warranted the substantial valuation?

The thread concludes with an open question to the community: Have we earned it? Ignas invites discussion on the societal, economic, and ethical dimensions of crypto’s journey to $1.5 trillion and beyond. What perspectives and nuances have been missed?

Read also:

- Ripple (XRP) Needs to Exhibit These Three Moves to Go Parabolic: Analyst

- How is Tether (USDT) Preparing for The Biggest Bull Run in History

- Missed Out On Pepe? This Could Be The Next 10x Meme Coin After ICO Hits $600k

In essence, Ignas’ exploration transcends market figures, inviting a thoughtful reflection on the broader implications and responsibilities that come with the monumental growth of the crypto space.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.