Chainlink has been making waves in the crypto world, establishing itself as a foundational pillar of the entire cryptocurrency ecosystem. But what makes Chainlink so significant, and what can we expect from it in the future? Crypto analyst Jarzombek shares a detailed thread on it.

What you'll learn 👉

Chainlink: More Than Just an Oracle

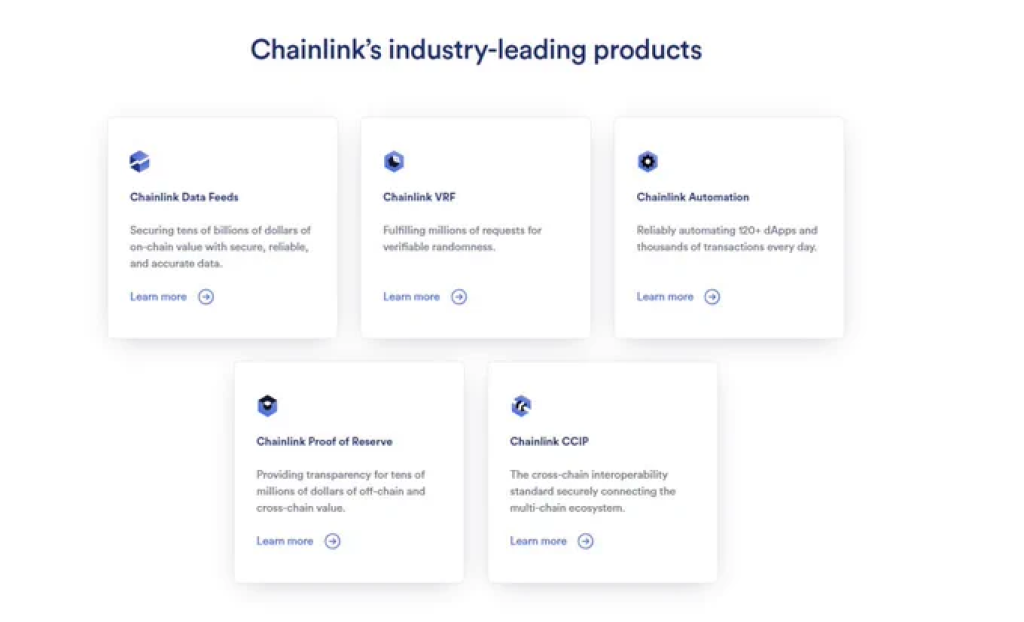

While Chainlink is often dubbed the “Oracle of crypto and DeFi,” its capabilities extend far beyond just providing price feeds. Chainlink offers a comprehensive suite of data and computation services, all of which are of the highest quality. This extensive range of services, combined with its unparalleled security, has positioned Chainlink as not only the backbone of the crypto world but also as a trusted project in the traditional finance (TradFi) realm.

One of the testaments to Chainlink’s credibility and influence is its impressive list of partnerships. From global financial giants like SWIFT, BNY Mellon, Citigroup Inc., BNP Paribas, and many others, Chainlink’s reach is undeniable. Moreover, with over 2150 integrations, Chainlink stands as the largest Oracle Network in the crypto sphere.

The Cross-Chain Interoperability Protocol (CCIP) is one of Chainlink’s groundbreaking innovations. This cross-chain messaging solution addresses the challenges of insecure bridging, paving the way for a more interconnected crypto future. With CCIP, projects can seamlessly exchange information, allowing for enhanced interoperability between platforms like Polygon and Arbitrum.

One of the standout features of CCIP is the Burn-and-Mint bridging, which has already been adopted by prominent projects like Aave and Synthetix. This mechanism, along with other solutions introduced by CCIP, is set to revolutionize the way different crypto projects interact and collaborate.

Bridging the Gap Between Crypto and TradFi

The trend of tokenizing assets, such as bonds or stocks, is on the rise. High-profile figures and institutions predict that by 2030, 5-10% of all global assets will be tokenized. This movement towards tokenization presents a massive opportunity for platforms that can facilitate the onboarding of these tokenized assets.

Chainlink, with its robust infrastructure and innovative solutions like CCIP, is poised to play a pivotal role in this transition. The protocol’s potential to onboard TradFi and integrate with Real World Assets (RWA) could lead to an influx of transactions and a significant increase in revenue.

The Future of Chainlink and the $LINK Token

The $LINK token has garnered significant attention, reaching an all-time high of $52.70 in 2021. With the introduction of CCIP and its potential to drive value, many speculate that the token’s history of success could repeat itself.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Furthermore, Chainlink’s BUILD Programme, an incubator for upcoming projects, is another factor contributing to the token’s potential growth. With over 40 projects already part of the BUILD initiative, $LINK stakers stand to benefit from various incentives, including profitable staking opportunities and token airdrops.

Chainlink’s future appears promising, with its innovative solutions like CCIP positioning it as a key player in the crypto world’s evolution. However, the crypto landscape is ever-evolving, and new competitors are emerging. While Chainlink has set a high bar, it will require continuous effort and innovation to maintain its lead. Only time will tell if Chainlink can deliver on its promises or if another contender will rise to the challenge.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.