PulseChain, the latest venture developed by Richard Heart, the creator of HEX cryptocurrency, has been unveiled, raising both excitement and skepticism within the crypto community.

Positioned as an Ethereum fork, PulseChain promises to offer faster transactions, lower fees, and fee-burning capabilities. However, doubts surrounding Richard Heart’s past and the handling of funds are causing apprehension among potential investors.

What you'll learn 👉

Launch Update: Initial Surge Demonstrates Interest Amidst Lingering Doubts

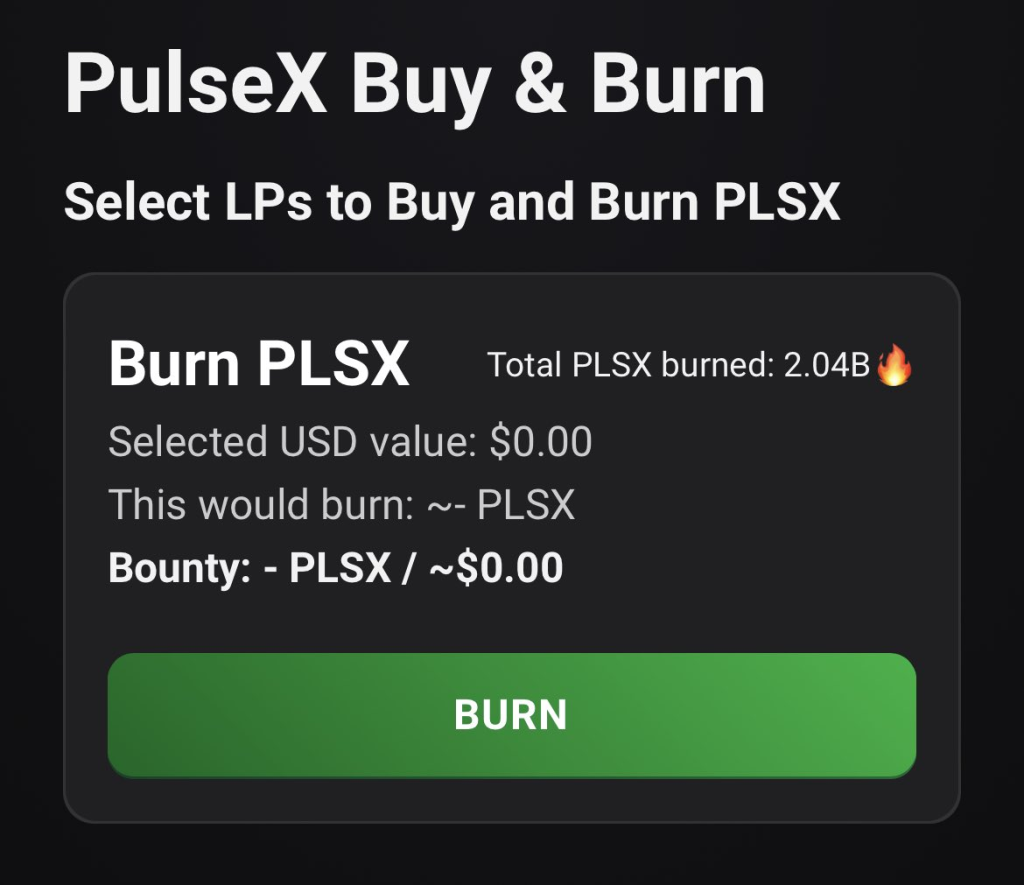

The launch of PulseChain has been shrouded in secrecy, with only hints and speculation circulating on platforms like Reddit. The project’s official launch is underway, and early reports suggest a successful start, with an astonishing 2 billion tokens burned in the first 12 hours.

This initial surge demonstrates the interest and engagement surrounding PulseChain, but it also adds to the existing debate surrounding the project’s nature and viability.

According to reddit.com, the LP buy and burn function for PLSX works by using a portion of all trade fees of any asset to buy PLSX and then burn it, which removes it from circulation forever. This creates two aspects that help the token’s value: automatic buy pressure and deflationary over time. Although the process is manual, people will likely engage in it constantly since it costs practically nothing and pays a bounty to the person who engages the process, giving them an incentive to do so.

Furthermore, pulsechain.com states that PulseChain doesn’t burn “waste” energy as it replaces proof of work miners with proof of stake validators, making it environmentally friendly. In addition, it reduces the issuance of PLS by 25% per block compared to Ethereum, which improves game theory. According to reddit.com, PulseChain is an Ethereum fork that brings the ETH system state and ERC20s, rewarding holders and founders of Ethereum based projects.

Supporters vs. Skeptics: Assessing Richard Heart’s Credibility

Supporters argue that Richard Heart’s track record of fighting for users and the success of HEX lend credibility to PulseChain’s potential. If PulseChain manages to surpass Ethereum, it could become the go-to network for transactions. Proponents highlight the project’s design focus on volume rather than token value, with the aim of collecting fees in volume perpetually.

Nevertheless, critics remain wary. Skeptics question Richard Heart’s intentions, suggesting he may divert funds for personal gain and delay the project’s launch. Concerns have also been raised about the value of HEX tokens on the PulseChain HEX contract. Critics argue that HEX coins lack intrinsic value and are purchased with real Ethereum, casting doubt on the overall worth of PulseChain’s replicated tokens.

Addressing High Gas Fees: The Promise of PulseChain’s Hard Fork

PulseChain, described as a forthcoming hard fork of the Ethereum blockchain, aims to address Ethereum’s high gas fees and alleviate network congestion. The project boasts a significant airdrop, with a reported $1.2 billion already sacrificed for future native tokens. During the hard fork, every aspect of the Ethereum network, including tokens, liquidity pools, NFTs, and smart contracts, will be copied to PulseChain. The two chains will subsequently diverge, with users able to ignore PulseChain without affecting their experience on the Ethereum mainnet.

Concerns About Funds and Allocation: Questioning Richard Heart’s Intentions

However, Richard Heart’s involvement and the handling of funds have emerged as primary concerns. Criticism centers on the sacrifice phase, where users contributed ERC20 tokens with the expectation of receiving PLS tokens after the fork. Some speculate that the sacrifice wallet is Richard Heart’s personal wallet, leading to doubts about the allocation of funds. Additionally, the lack of immediate value for PLS tokens raises questions about the purpose of the sacrifice and whether it primarily benefits Richard Heart.

Skepticism and Labels: Is PulseChain a Glaring Ponzi Scheme?

On social media, skepticism about the project has grown, with some individuals labeling it a “glaring Ponzi scheme.” Detractors argue that PulseChain’s sacrifice phase resembles an initial coin offering (ICO), with investors sacrificing their coins in hopes of future returns. While the project may hold potential, critics caution that the large amounts of money sacrificed and their destination remain unclear.

Launch Progress and Participation: Adding PulseChain Copies to MM

It is essential to note that the current launch of PulseChain demonstrates early interest and engagement from the crypto community. To add your PulseChain copies to MM, you can visit PulseX, select the desired token (PLSX, HEX, etc.), and then click the little MM logo to add the contract address.

Looking Ahead: PulseChain’s Fate Hangs in the Balance

Ultimately, the success of PulseChain hinges on garnering support from the crypto community. While alternative chains with substantial market capitalization have flourished despite not being fully functional, concerns persist regarding the transparency and intentions behind PulseChain. As the launch progresses, investors and enthusiasts eagerly await further information to determine whether Richard Heart’s new venture will revolutionize the crypto landscape or fall victim to skepticism surrounding his previous endeavors.

PulseChain’s ability to deliver on its promises of faster transactions, lower fees, and fee-burning capabilities will be closely monitored. The debate surrounding Richard Heart’s credibility and the allocation of funds will continue to shape the narrative around the project. Only time will tell whether PulseChain will emerge as a successful Ethereum fork, attracting widespread adoption and bringing about significant advancements in the crypto space, or whether it will be mired in controversy and skepticism.

As investors navigate the evolving landscape of cryptocurrencies, it is crucial to exercise due diligence, thoroughly research projects, and consider the potential risks before engaging with any new venture.

FUD, this article was trash.

People sacrificed money for freedom of speech and movement, with NO Expectations of anything happening, that’s why it’s a sacrifice

You are just another Rich Heart paid shill

HEX and pulse are outright scams

Concerned about funds given? We gave with no expectations. We expressed our beliefs in freedom of speech and movement to be protected rights.

We care not where the sacrificed coins went.