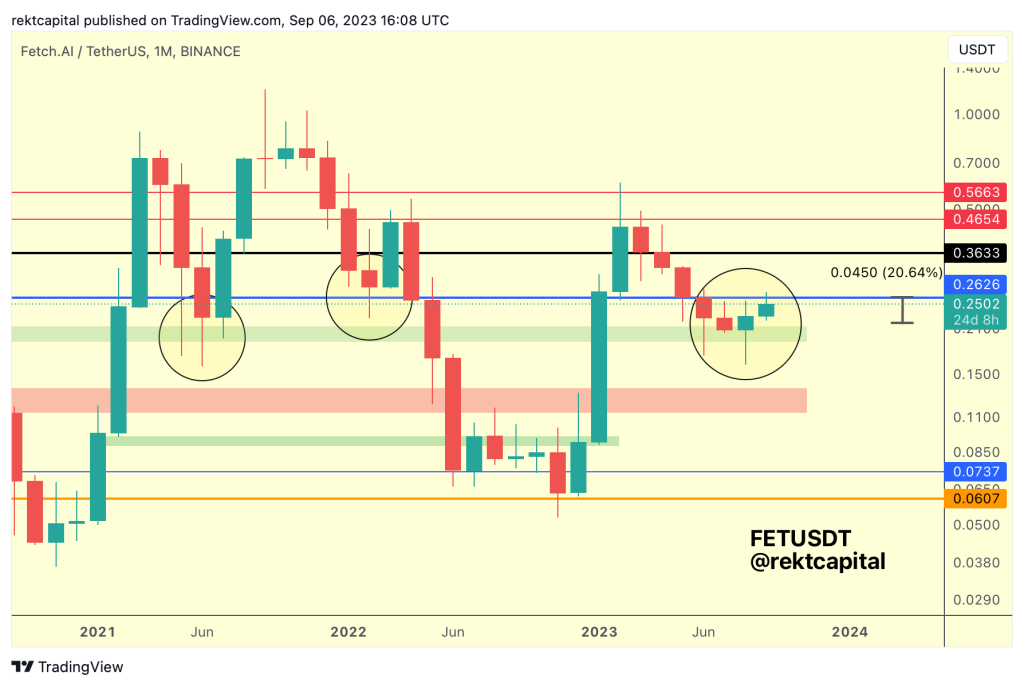

Rekt Capital, a top-notch analyst and well-known trader in the field of technical analysis, provides valuable insights into the behavior of the cryptocurrency Fetch.ai (FET). According to Rekt Capital, FET has recently experienced a significant rally, surging by 20%. This rally began from what is referred to as the “green area of support,” a price level where buying interest is typically strong enough to prevent the asset from falling further.

However, this rally has led FET into a challenging area known as the “blue resistance level.” In the world of technical analysis, a resistance level is a price point that an asset struggles to surpass due to selling pressure. Rekt Capital notes that it would be a bullish sign for FET if it could “reclaim” this blue level as a new support. Doing so would open the door for the asset to aim for even higher price levels, specifically a “black resistance” at $0.36.

Despite the recent rally, FET has faced challenges in breaking through this blue resistance level. The term “upside wicking” is used to describe the asset’s behavior of briefly moving above the resistance but failing to maintain that level. Rekt Capital points out that this has been a recurring theme for FET for the past 2.5 months. As a result, FET is essentially “locked into a range,” oscillating between the green support and blue resistance levels.

If FET continues to face “continued rejection” at this blue resistance level, it could be forced back into the green support area. This pattern has been consistent over the past 2.5 months, and until there’s a significant change, the asset remains in this constrained trading range.

In summary, FET is at a critical juncture. Its ability to break and maintain above the blue resistance level could set the stage for further gains. Until that happens, however, it remains in a somewhat precarious position, caught between key levels of support and resistance.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.