Scammers have been conducting fraudulent withdrawals from cryptocurrency exchanges to wallets linked to decentralized finance (DeFi) projects, generating false signals of developer activity.

What you'll learn 👉

Small Fake Transactions Exploit Blockchain Transparency

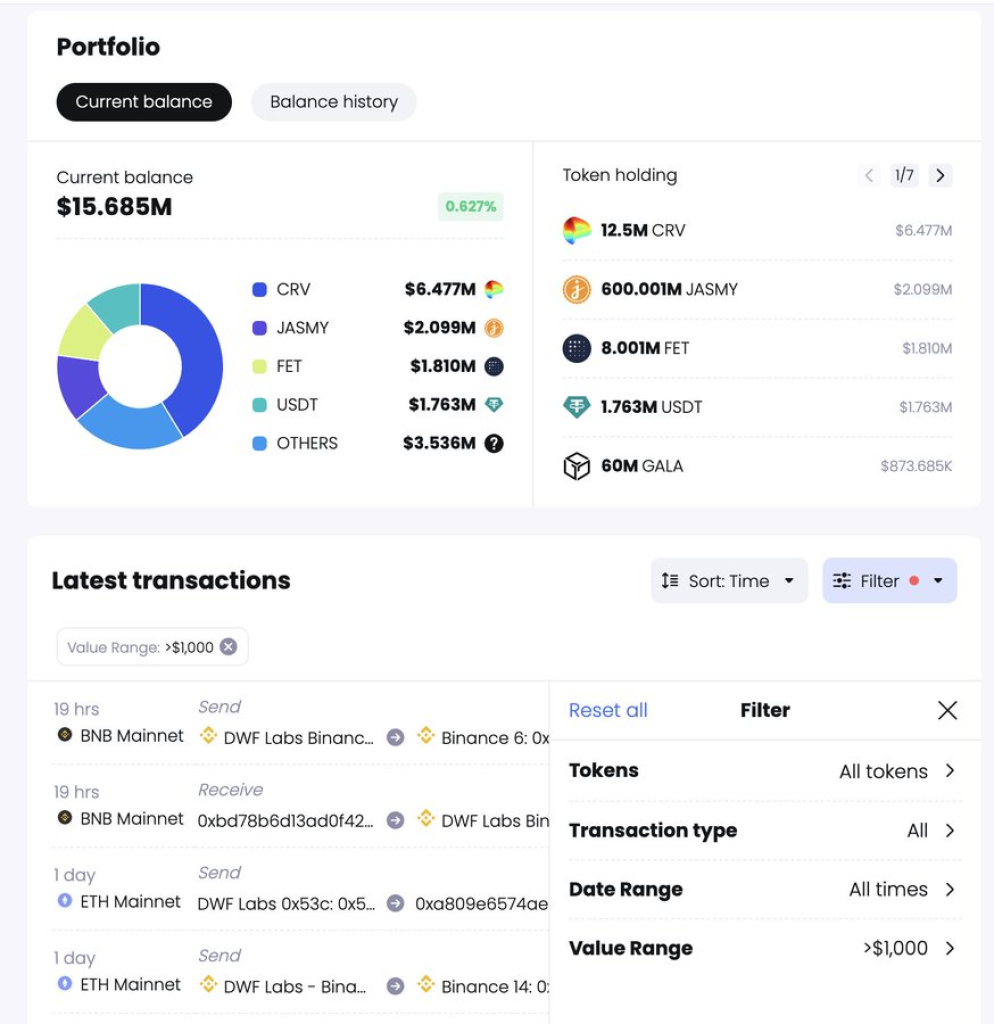

According to analytics firm Spot On Chain, over the past few days Binance has seen fake withdrawals totaling $193 in value sent to addresses associated with DWF Lab, a DeFi project building on Polkadot.

The fraudulent transactions involved 121 million $PEPE ($100 value), 49 $API3 ($52), 65.47 $SUSHI ($39), and 583 $JASMY ($2). DWF Lab head @ag_dwf has confirmed these transactions were not legitimate and did not originate from the project’s team.

While the amounts are small, these fake withdrawals can create misleading impressions of developer engagement and project health. They exploit the transparency of blockchains to trick market participants scanning on-chain data.

How to Avoid Being Misled

Experts recommend taking precautions to avoid being misled by this scam activity:

- Use on-chain analytics platforms like Spot On Chain to filter out low-value “spam” transactions. Their platform has a feature for this purpose.

- Set up customized alerts for specific project entities you are monitoring. Advanced platforms like Spot On Chain use AI to automatically filter out suspicious transactions in alerts.

- As always, conduct due diligence beyond just on-chain signals to assess project legitimacy and development activity.

By being aware of these fraudulent tactics and using the right tools, crypto investors can avoid false signals when analyzing blockchain data. Responsible platforms are deploying AI and other advanced methods to maintain data integrity for their users.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.