Recent activity suggests that there’s a significant accumulation of Ethereum among some of the larger players in the market, often referred to as “whales”. The data was shared by on-chain analysts Lookonchain.

Over a recent period, a notable uptick in Ethereum accumulation has been observed. Specifically, four prominent Ethereum addresses have collectively added an impressive 56.1K ETH to their holdings, equivalent to $94 million.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Here’s a breakdown of the accumulation:

- An address, denoted as 0x3CEE, added a substantial 18K ETH, which translates to around $30 million.

- Another address, 0x3478, while not as aggressive as some of its counterparts, still made a significant addition of 2K ETH, valued at approximately $3.4 million.

- The 0x5bA3 address was not far behind, accumulating 17.9K ETH, an equivalent of about $30 million.

- Notably, an Ethereum address with a more recognizable name, smartestmoney.eth, also joined the accumulation spree, adding 18.2K ETH to its coffers, which is roughly valued at $30.6 million.

This activity underscores the confidence that a part of the community has in Ethereum’s potential and future. While the reasons for such large-scale accumulations can vary, it’s evident that some see value in holding onto the cryptocurrency. As always, the crypto landscape remains dynamic, with various entities making moves based on their individual strategies and outlooks.

The size of purchases made by whales gives them an outsized ability to impact market prices and movement. When a whale begins accumulating significant amounts of an asset, it signals a positive outlook that can influence other investors. As the whale buys up available supply, increased scarcity can lead to appreciating prices. Overall, whale accumulation behavior is monitored closely by traders to gauge market confidence and anticipate potential price spikes.

Whale accumulation is often viewed as an indicator of market confidence in an asset. Since whales are large, sophisticated traders, their trading patterns can be interpreted as a reflection of their belief in future appreciation. When whales accumulate instead of selling off their holdings, it demonstrates a bullish view of where prices are headed.

Other traders may follow the whales’ lead and also buy up the asset, amplifying the price impact. Basically, if those most familiar with the market are stocking up on an asset, it sends a positive signal to retail investors and boosts general market confidence in the value of the asset moving forward.

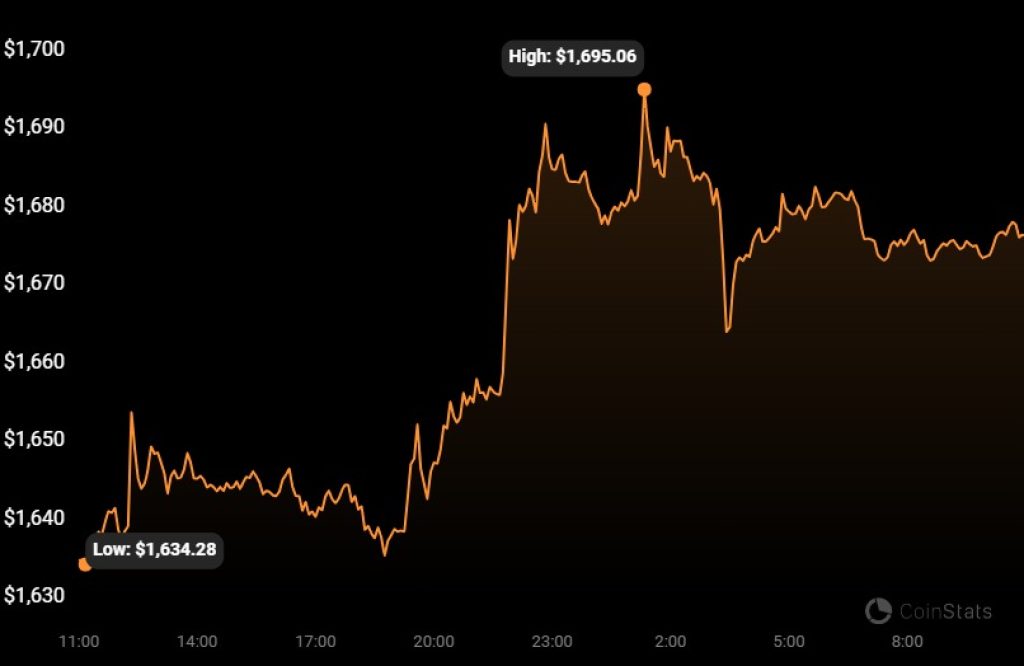

Source: CoinStats – Start using it today

Ethereum (ETH) has been experiencing some fluctuations in its price recently. As of now, the price of Ethereum stands at $1,677.14. Over the last 24 hours, there has been a 2.5% increase in its value. Despite this recent uptick, the past week has seen a decline of approximately 6.6% in its price.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.