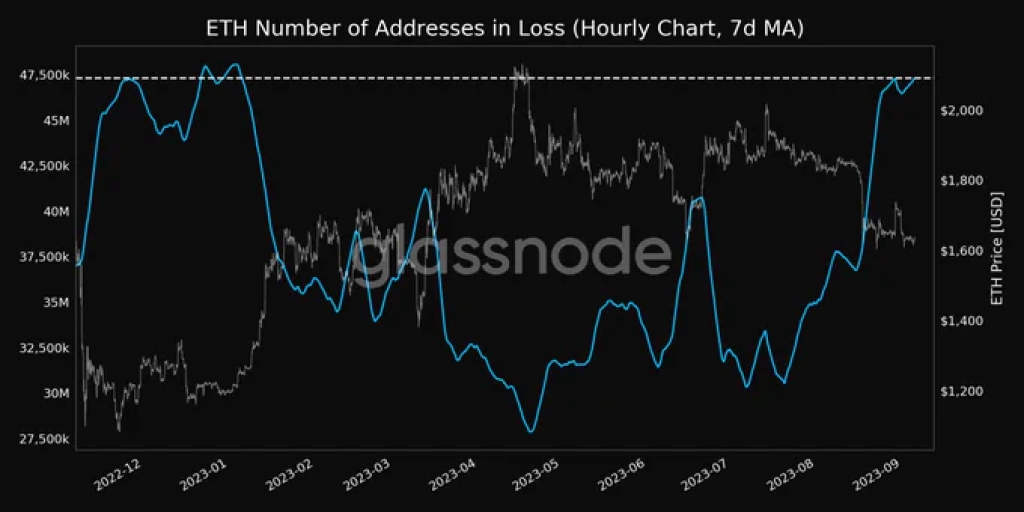

In a noteworthy development, the 7-day moving average (7d MA) of Ethereum addresses in a loss has surged to an 8-month high, standing at 47,304,857.667 according to data from on-chain analyst Glassnode.

This indicates a growing number of investors who are currently underwater on their Ethereum investments. The metric serves as a barometer for investor sentiment and could signal caution in the market.

What you'll learn 👉

Whales Make a Splash with $425 Million Purchase

Amidst this backdrop of increasing addresses in loss, Ethereum whales have made a significant move. Data reveals that approximately 260,000 $ETH tokens were acquired by large holders within the last 24 hours.

The value of this massive purchase is estimated to be nearly $425 million. This could be interpreted as a bullish sign, suggesting that big players are seeing current prices as a buying opportunity.

Exchange Deposits Reach 1-Month High

Adding another layer to the market’s complexity, the 7-day moving average of Ethereum’s exchange deposits has just hit a 1-month high of 2,145.685.

This comes close on the heels of the previous 1-month high of 2,145.327, which was recorded on September 4, 2023. Elevated levels of exchange deposits often imply that investors are moving their assets to exchanges, possibly in preparation for selling.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The confluence of these metrics presents a mixed picture for Ethereum. On one hand, the rising number of addresses in loss may indicate a bearish sentiment among retail investors. On the other hand, the hefty purchases by whales and the uptick in exchange deposits could signify contrasting strategies or expectations among different market participants. As always, investors should exercise due diligence and consider multiple indicators before making any investment decisions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.