Ethereum is trading around $3,165, and many traders are asking the same question this week: Can the current rally push ETH to the $3,500 level, or will resistance cap the move? Recent ETF inflows and improving sentiment keep the bullish side alive, but the upside from here is not huge.

At the same time, some investors are looking beyond this short move and want a realistic chance at 3x. That is why a growing group is comparing a modest Ethereum price prediction with the higher upside on Remittix, a PayFi-focused project that is still early in its journey.

What you'll learn 👉

Ethereum Moves Toward The $3,500 Ceiling

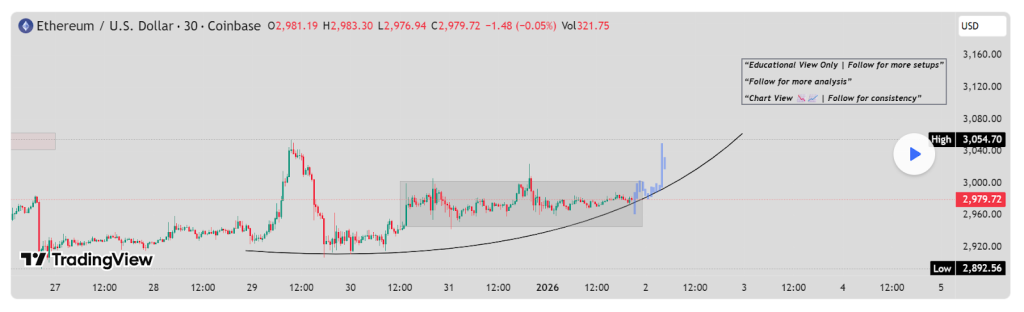

Ethereum currently trades at $3,165, with a market cap of $382 billion and daily trading volume above $24.5 billion. From a chart point of view, recent technical reports point to strong support between $2,800 and $3,000, with the $3,018 area acting as a key line that flipped from resistance to support.

Analysts at Zebpay highlight the 200-day moving average cluster near $3,300 to $3,400 as a major supply zone that ETH needs to clear, while other sources say a move toward $3,500 in the coming weeks is possible if buyers hold that structure.

ETF flows add fuel, with Bitget and other trackers recording over $165 million of net inflows into spot Ethereum funds on January 5 and 6, alongside record early-year ETF volumes. This cluster of views suggests that a push into the $3,500 area in the near term is reasonable, but it still represents a move of roughly 10% rather than a major breakout.

Remittix Appeals To Traders Looking To 3X Their Investment

When traders compare that 10% move on Ethereum with the idea of tripling their capital, attention naturally shifts to smaller-cap projects where price can move faster. This is where Remittix stands out, because it links a clear payment use case with strong security credentials and a visible launch timeline, which is exactly what many early-stage crypto investment buyers now want.

Ethereum may edge from $3,200 to $3,500 if current Ethereum price prediction targets land, but Remittix is starting from a low base and is already being treated by some investors as a next 100x crypto candidate with a realistic chance to 3x around its launch window.

The numbers behind Remittix already point to strong traction. The project has sold over 696 million RTX tokens and has raised more than $28.6 million so far, with the team moving quickly toward the $30 million mark that will unlock its largest exchange reveal and fresh platform details.

BitMart was secured after raising $20 million, LBank followed after $22 million, and a third major centralized exchange listing is now being prepared. Remittix is fully audited and verified by CertiK, ranked number one among pre-launch tokens on CertiK Skynet with a recent score above 80 and more than 24,000 community ratings, which gives the project rare transparency for a token at this stage.

On top of this, Remittix is running a 200% bonus campaign with the RTX2026 code, where a separate allocation is being claimed rapidly as the February launch approaches.

Also, the Remittix wallet is already live on the Apple App Store, an Android release on Google Play is in motion, and the full Remittix Platform launch date is now set for 9 February 2026, when the PayFi stack will begin routing real crypto to fiat payments.

Key points that support the idea of traders looking to 3x with RTX include:

- Solving a real-world $19 trillion cross-border payments problem

- Utility first token model built around real transaction volume

- Deflationary tokenomics with growth potential

- Global payout rails are expanding, with a focus on key remittance corridors

- Built for adoption rather than short-term speculation

Why Remittix Leads The Search For Bigger Upside

Short-term traders who focus only on whether Ethereum touches $3,500 this week may capture a small move, but they also accept that the upside from current levels is limited. The recent Ethereum price prediction updates show that much of the gain is now about timing the next push above resistance rather than discovering a new growth story in the crypto market.

For investors who want more than a single-digit move, Remittix offers a very different path, where the launch of a live PayFi platform, active listings on major centralized exchanges, and a strong CertiK-backed security profile support a 3x jump as adoption grows.

This is why many traders now see Remittix as the project that truly answers the three times upside-down question in this market.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Frequently Asked Questions

Is an Ethereum Price Prediction Of $3,500 Realistic In The Near Term?

Recent analysis from several research desks points to resistance near $3,300 to $3,400, with some models targeting the $3,500 zone in the coming weeks. That makes a short push to that level possible, but the expected move is closer to 10% than a major trend change.

Is Remittix Meant To Replace Ethereum Or Complement It?

Remittix is a complement rather than a replacement for Ethereum. Many traders view ETH as a base layer holding while using RTX as a higher upside satellite position tied to payments and adoption growth.

How Does Remittix Create Passive Income Potential In The Current Crypto Market?

The 15% USDT referral program means that supporters can earn ongoing rewards from each buyer they bring in, and those rewards are claimable every 24 hours through the dashboard, which turns community growth into real cash flow.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.