The traditional banking sector still struggles with low liquidity, limited access, and hard-to-get loans. Many people are dissatisfied with today’s banking services, but have nowhere to turn to simply because the Ethereum-based DeFi sector still lacks adequate infrastructure that can cater to their needs. However, all that is set to change with the upcoming launch of the PayDax Protocol (PDP).

What you'll learn 👉

PayDax: Bringing Borrowing, Lending, and Insurance Services to DeFi

The PayDax Protocol (PDP) is rewriting the rules of DeFi banking by leveraging peer-to-peer (P2P) interactions to create access to new sources of liquidity. The platform features a robust DeFi lending protocol where users can leverage high-value assets ranging from cryptocurrencies to RWA options like gold and Art, turning them into collateral for competitive loans with flexible LTV ratios.

In PayDax’s ecosystem, users can get up to 97% LTV when they borrow stablecoins. Picture, for instance, Dave, a crypto investor with $100,000 in XRP. Instead of selling out of his tokens, he can take a collateralized loan from the PayDax Protocol (PDP).

If he chooses a 97% LTV ratio, he will get up to $194,000 in loans. Lenders who provide such loans earn up to 15.2% APY, a figure that is higher than what many banks offer on savings accounts.

Users can also leverage loan insurance on the PayDax Protocol (PDP), staking their tokens as part of the network’s Redemption Pool.

Whenever a borrower defaults on their loan, the original lender will be compensated from the Redemption Pool, ensuring zero losses. Yet, when there are no defaults, stakers in the Redemption Pool will earn a high APY of up to 20% for the incurred risk.

This facilitates a healthy DeFi ecosystem where lenders are always repaid and stakers who underwrite loans are compensated adequately. In addition to lending services, users can also participate in Protocol staking, earning up to 6% APY for contributing to the network’s stability and solvency. Protocol staking also comes with governance benefits that allow you to influence decisions in PayDax’s ecosystem.

For an even higher earning potential, the PayDax Protocol (PDP) offers yield farming, allowing advanced users to access high leverage. This leverage goes as high as 5x while offering up to 41.25 APY.

In a nutshell, the PayDax Protocol (PDP) stands out for creating practical ways to earn value from its ecosystem. It doesn’t, unlike other projects, promise hype based gains. Rather, belonging to PayDax’s ecosystem is an opportunity to help provide the infrastructure and liquidity needed to power DeFi lending and banking.

PayDax Protocol (PDP): Building Trust Through Partnerships and Robust Infrastructure

PayDax’s ambition to revolutionize DeFi lending and banking is backed by tangible initiatives. Firstly, the network offers robust infrastructure to take care of asset custody, valuation, and user safety.

Through confirmed partnerships with Sotheby’s and Christie’s, PayDax allows easy authentication of valuable assets. For custody of hard assets like gold, the PayDax Protocol (PDP) taps Brinks’ infrastructure through another highly rated partnership.

The PayDax Protocol (PDP) goes further by leveraging price feeds from Chainlink. While this is not a full-on partnership, leveraging Chainlink’s price feeds grants PDP holders access to real-time asset pricing from industry-standard sources.

Another solid initiative aimed at user safety is the robust audits of PayDax’s smart contracts. The platform has been audited by Assure DeFi, an authority figure in the blockchain security space. Its smart contracts have also been audited by Hacken, Quill Audits, and Rapid Innovation.

Finally, unlike other DeFi lending platforms, the team behind the PayDax Protocol (PDP) is fully public. Through AMAs and regular meetups, you can also get close-up interactions with this team.

Beyond its robust infrastructure and major partnerships, one thing that has surprised many investors is the project’s commitment to tangible results. Although PayDax is still in its presale, version 1.0 of its Dapp is now live, turning the platform’s bright ideas into a concrete reality.

What Experts are Saying About the PayDax Protocol (PDP)

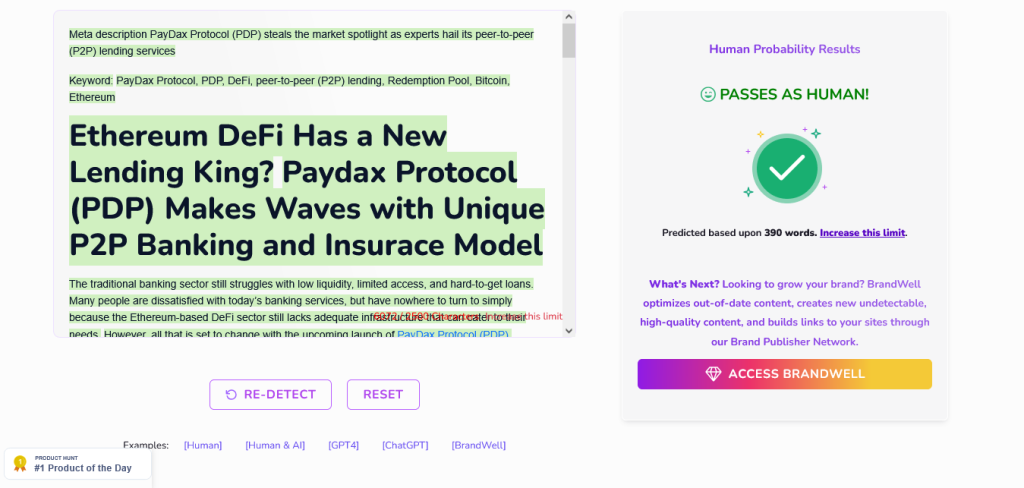

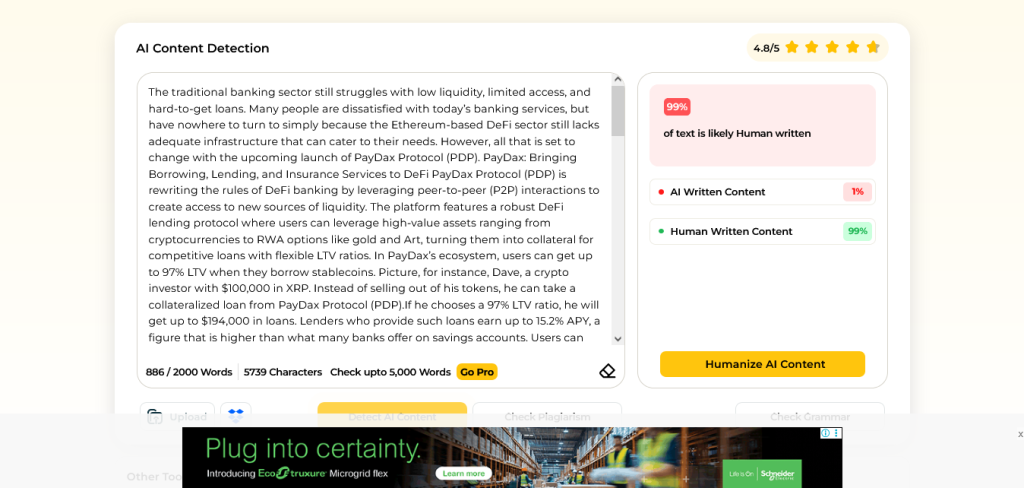

The PayDax Protocol (PDP) is getting high ratings from many participants in the DeFi sector. It has been hailed for its value generation model, which relies on solving everyday problems in the lending industry. Unlike many other projects, PDP doesn’t rely on speculations or hype. Instead, the token’s value comes from powering an ecosystem that fulfills the role of a traditional bank but within the crypto world.

With Bitcoin surging on the back of excitement around interest rate cuts, experts say the DeFi sector might be in for another boom. Additionally, the growth of Bitcoin and Ethereum ETFs shows that institutional players are now taking more interest in the crypto sector. This could fuel another DeFi expansion by bringing fresh capital to the market.

A situation like this is advantageous to PayDax Protocol (PDP) as it seeks to replace traditional banking with a decentralized ecosystem that functions with more efficiency. Sentiments like these have fueled the surge of investors joining the PayDax Protocol (PDP) through its ongoing presale.

Now trading at $0.015, PDP is at its lowest ever price. Joining now gives investors the best opportunity to capitalize on its stage-based price increases and post-launch excitement.

Additionally, using the PD80BONUS code during signup allows you to seize an ongoing 80% bonus. Furthermore, joining now offers the best opportunity to help reshape the future of DeFi banking. You can seize that opportunity now by joining the PayDax Protocol (PDP) through its presale.

Join the PayDax Protocol (PDP) presale Today

Join Paydax Protocol (PDP) presale | Website | Whitepaper | X (Twitter)

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.