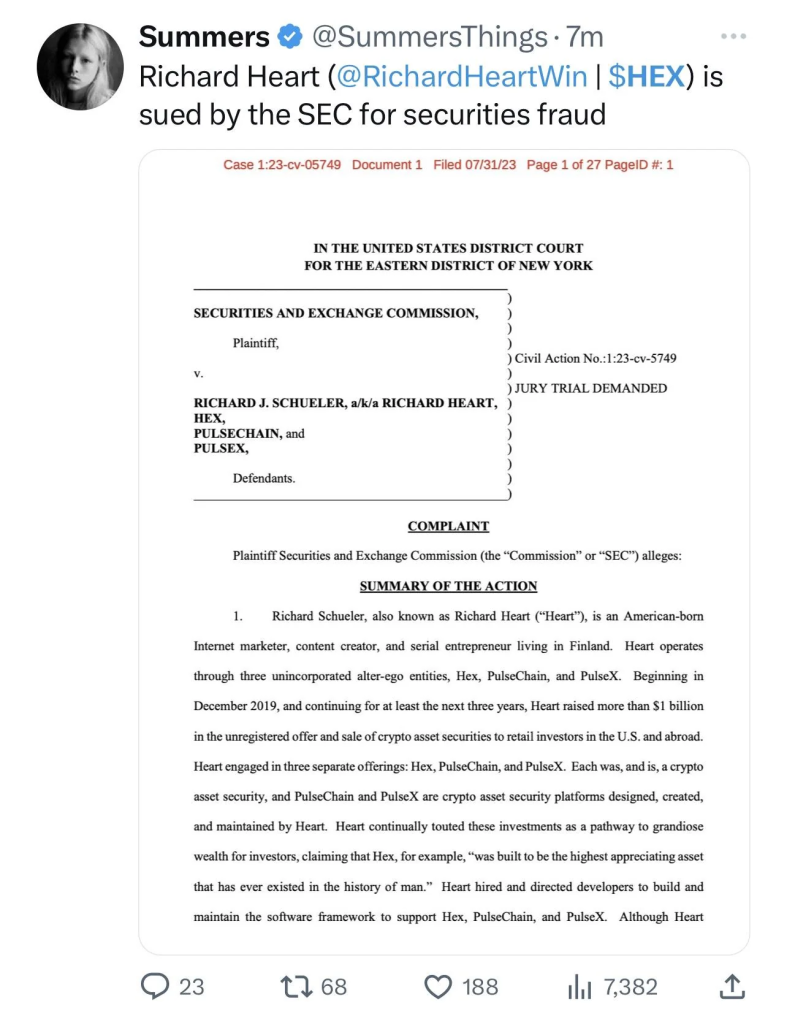

Richard Heart, the creator of HEX and PulseChain, is facing legal action from the Securities and Exchange Commission (SEC) over accusations of securities fraud. Heart, who operates through three unincorporated entities – HEX, PulseChain, and PulseX, is said to have raised over $1 billion from retail investors through these platforms since December 2019.

According to the SEC, each of these three offerings qualifies as a crypto asset security. Heart designed and maintains the PulseChain and PulseX as crypto asset security platforms. Throughout their operation, Heart consistently promoted these investments as a golden route to substantial wealth, particularly with HEX, which he advertised as “the highest appreciating asset that has ever existed in the history of man.”

In a move that now seems prescient, Heart previously made efforts to sanitize his social media profiles, erasing the expansive claims and adjusting the terminology from HEX ‘staking’ to ‘mining.’ Despite the strange shift, given Ethereum’s Proof-of-Stake protocol upon which HEX is built, these changes now appear to reflect a possible anticipation of the legal challenge he now faces.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +A Closer Look at Richard Heart’s Controversies

Richard Heart’s projects, particularly HEX and PulseChain, have been the subject of much controversy. HEX has been widely criticized for its alleged pyramid-like structure and questionable marketing practices, leading many experts to caution against investing in it. Similarly, PulseChain has faced scrutiny for its claim of superiority over Ethereum, which many see as misleading given Ethereum’s recent transition to a proof-of-stake consensus mechanism with the Ethereum 2.0 upgrade.

Heart’s background also raises concerns. His involvement in contentious projects like HEX has led to doubts about his intentions with PulseChain. Furthermore, Heart has been accused of making misleading claims about his projects, further damaging his reputation.

The SEC’s lawsuit against Heart for allegedly selling unregistered securities related to HEX and PulseChain has only added to these concerns. Despite the controversies, however, Heart has made significant contributions to the crypto industry, including raising over $27 million for medical research via the PulseChain network. His actions have led to a mixed public perception within the cryptocurrency community, with some applauding his contributions and others wary of his projects’ legitimacy.

The Potential Fallout: HEX and PulseChain’s Uncertain Future

Given the gravity of the SEC’s allegations and the pivotal role Richard Heart plays in both HEX and PulseChain, it’s reasonable to speculate that these projects may face significant challenges in the near future.

HEX and PulseChain have largely thrived on the hype and promotional efforts led by Heart. His charismatic presence and grandiose claims have been instrumental in attracting investors and building a community around these projects. However, with Heart now under legal scrutiny, this source of momentum is at risk.

The lawsuit could potentially undermine investor confidence, leading to a sharp decline in the value of both HEX and PulseChain. The projects’ survival hinges on their ability to maintain investor trust and deliver on their promises, which may prove difficult without Heart’s influential presence.

Moreover, the allegations of selling unregistered securities could deter new investors and potentially lead to further legal consequences. This could result in a significant decrease in liquidity, making it harder for existing investors to sell their holdings.

In the worst-case scenario, HEX and PulseChain could see their market values plummet to near-zero levels, effectively rendering them dead in the water. This is not an uncommon fate for crypto projects that lose the confidence of their investors, particularly those built on hype and charismatic leadership.

While it’s important to note that this is speculative and the future of HEX and PulseChain remains uncertain, the current situation serves as a stark reminder of the risks and volatility inherent in the crypto industry.