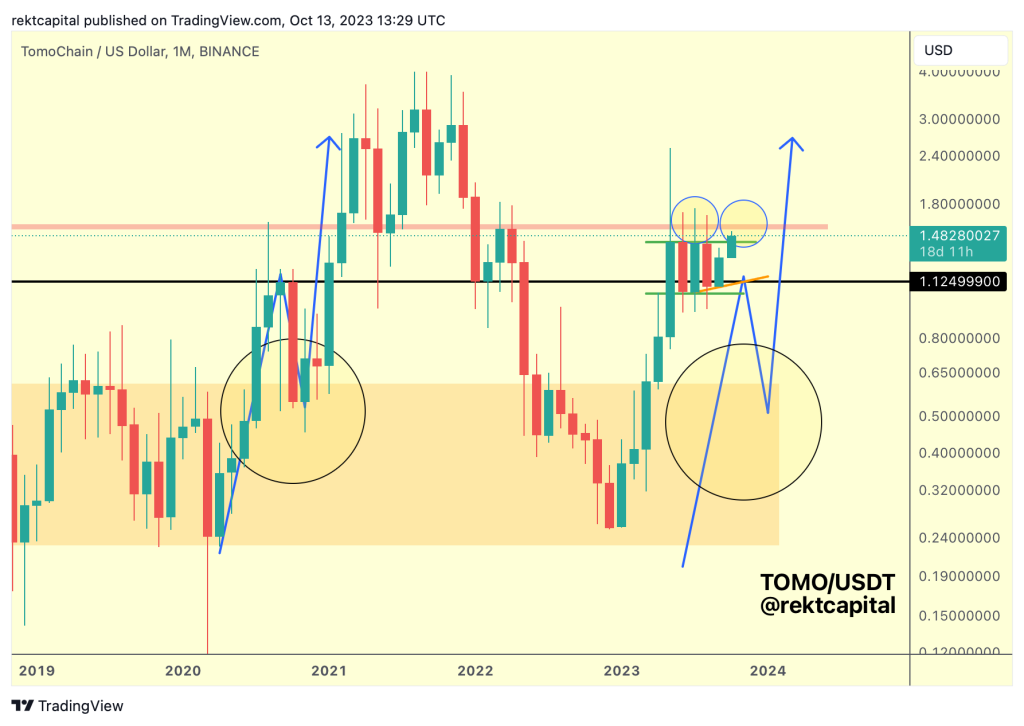

Popular crypto analyst Rekt Capital sees potential in TomoChain (TOMO) based on its recent price action and consolidation pattern. In his latest analysis, Rekt Capital notes that TOMO has been range-bound for months now between support around $1 and resistance around $1.60.

Within this range, TOMO has formed a higher low which shows bullish sentiment may be returning. Now TOMO is pushing up against the top of its trading range and attempting to break out higher.

As Rekt Capital points out, TOMO has formed upside wicks beyond the range high several times which trapped FOMO buyers. It has also wicked down below the range low, capitulating panic sellers. This back and forth price action has kept TOMO bounded in consolidation.

For a convincing breakout, Rekt Capital wants to see a monthly close above the key $1.60 resistance level. This would likely propel TOMO to test the next overhead resistance around $2.00. At the very least, a successful retest of the range high is needed after any failed breakout attempts.

Rekt Capital believes this trading range may turn out to be a re-accumulation area before a new uptrend forms. This view is supported by TOMO’s steady 20% gain over the past 30 days. It continues holding support around $1.50 as it pushes for an upside breakout.

If TOMO can close above its recent range highs, Rekt Capital’s analysis suggests considerable upside potential. The analyst will be closely watching if TOMO can start a new impulsive move towards $2.00 and beyond.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.