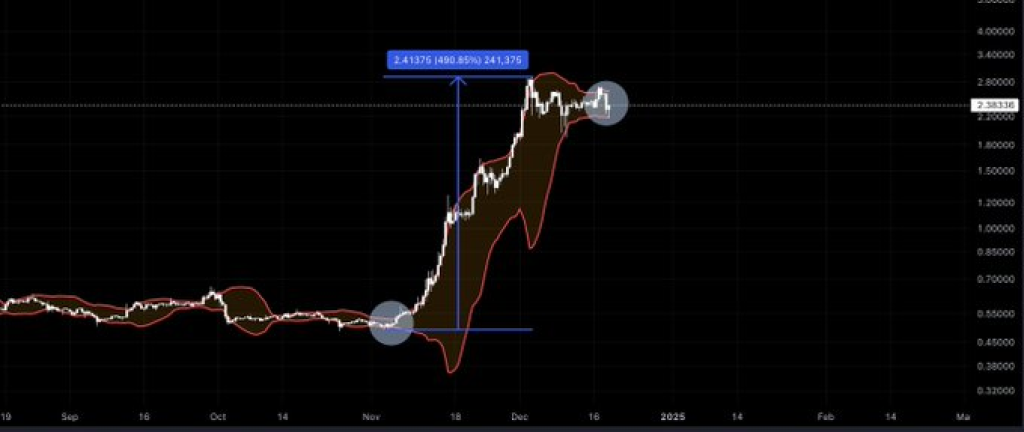

Popular analyst Steph Is Crypto shared on X (formerly Twitter) that XRP’s Price Bollinger Bands are tightening once again, a pattern that preceded a dramatic 490% price surge last month. Market observers are now analyzing whether this historical trend could repeat, leading to another significant price rally.

XRP’s price hasn’t moved much lately. It stayed pretty flat before November, barely going up or down at all. This sideways movement eventually gave way to a sharp upward breakout in mid-November, resulting in a parabolic price increase of nearly 490%. After reaching its peak, the asset entered a consolidation phase near the $2.30 mark, with price corrections remaining relatively minor.

This current phase of consolidation is generating speculation about the potential for another explosive move, particularly with the Bollinger Bands showing signs of compression. Historically, this tightening of the Bands has preceded major price action, a pattern that traders are monitoring.

What you'll learn 👉

The Role of Bollinger Bands in Predicting Volatility

Looking at the technical charts, specifically the Bollinger Bands on the 12-hour timeframe, we’re seeing the bands squeeze together again. The last time this happened, XRP’s price took off in a big rally. When these bands get tight like this, it often means a big price move is coming – could be up or down.

Right now, XRP is holding steady at around $2.30 after hitting its recent high. The Bollinger Band compression suggests that the market may soon see another breakout, though the direction of the move is uncertain. The historical precedent of the November surge adds weight to the possibility of an upward breakout.

Support, Resistance, and Key Levels to Watch

XRP’s Price key support level remains at $0.50, which served as the base for its previous breakout. This price level represents a strong foundation where buyers previously stepped in to propel the asset upward. Conversely, resistance is evident near the recent highs around $2.30, where the price has struggled to make further gains.

With Bollinger Bands tightening and the asset hovering near its peak, traders are watching for a decisive move. A breakout above resistance could potentially signal the start of another rally, while a drop below support would indicate a bearish shift in sentiment.

Read Also: Solana (SOL) Price Could Dip Further – Here’s Why

Analyst Speculation and Market Anticipation

Steph Is Crypto added to the growing anticipation amongst XRP traders. By referencing the prior 490% surge, the analyst underscores the potential for history to repeat itself. The question posed, “Will history rhyme again?” has left market participants eagerly awaiting XRP’s next move.

While these tight Bollinger Bands might hint at what’s coming next, it’s smart to look at the whole market picture too. Everyone’s watching XRP closely right now—whatever it does next could really shift how people feel about the market.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.