What you'll learn 👉

Table of Contents

As traders, our job is to take advantage of opportunities in the markets, and sometimes, these opportunities come in the form of entirely new markets.

I’ve been interested in cryptocurrencies for a couple of years now. However, I’ve been very reluctant to trade them, much less write about trading them because I felt that there was just too much risk, and quite frankly, I didn’t understand them well enough myself.

However, I have found that there are tremendous opportunities as I have done more research and have actually started trading them, and with some coins, it’s potentially like being able to get pre-IPO shares of Microsoft.

But there are also big risks, and there will probably be losses of a considerable magnitude too.

So in this guide, I want to explain how to invest in cryptocurrencies and try to give answers to the most urgent questions about investing in cryptocurrencies.

Hopefully after reading this guide you will be able to understand a little better on the basics of:

- What cryptocurrencies are

- Where they started

- Why you should use cryptocurrencies

- Why should you invest in cryptocurrencies

- How to earn them

- Which cryptocurrencies you should put in your portfolio

- Where you can purchase cryptocurrencies

- How to store them

- How you need to tax cryptocurrencies

This will be very simplified for you crypto veterans. However, my goal is to make this information as easy to understand as possible so beginner traders can make an informed decision about the opportunities. People can geek out about the details once they get the general concepts.

Introduction: Investing in Cryptocurrencies: The Ultimate Guide for a Super Beginner

What is a Cryptocurrency?

Cryptocurrency is a form of digital currency that can be sent through the internet. The currency’s value is not controlled by any central bank or government in the world. The currency’s value is determined by the network of people using that cryptocurrency and when the users of a cryptocurrency decide to accept the currency as a valid form of payment, this in turn gives the cryptocurrency its perceived value.

Where Cryptocurrencies Started

Bitcoin was the first ever cryptocurrency to come about. Bitcoin traces its beginnings since 2008. Nobody knows who the real creator(s) of Bitcoin is. However, the whitepaper concept for a ‘Peer-to-Peer Electronic Cash System’ first appeared on a cryptography mailing list posted under the pseudonym “Satoshi Nakamoto”.

From then on, many other cryptocurrencies have emerged such as Ethereum, Zcash, Ripple, Monero, Litecoin, Dash, and many others.

[thrive_leads id=’1055′]

Is Cryptocurrency Real Money?

Of course it is.

The concept will take some time to become widely accepted since it is new to most people, and this is where Bitcoin has been instrumental in paving the way for this new technology.

Websites like Newegg accept Bitcoin, and here is what the checkout screen looked like after I added a drone to my cart.

Stripe Payment Processor also allows online merchants to take Bitcoin.

As you can see, other coins like are not accepted, but the fact that Bitcoin is accepted, is a big step towards the adoption of other cryptocurrencies.

Investing in Cryptocurrencies

You might be already interested in investing in cryptocurrencies if you landed on this guide. Virtual or cryptocurrencies like Ethereum and Bitcoin are without a doubt the hottest investment product currently available, and these immutable and exchangeable cryptographic tokens promise to become a hard and non-manipulatable money for the whole world. Their advocates see a future in which Euro, Pound, Dollar and so on will be substituted by Bitcoinor other cryptocurrencies. In this way, the first free and hard world currency will be created.

Holding Bitcoin means to have a share in this venture, and if Bitcoin ever becomes the dominant currency for international trades or replaces monetary reserves of central banks, the value of one Bitcoin will be far beyond $10,000. Purchasing and keeping cryptocurrencies is a bet on the success of this silent revolution of money, and it’s like a security of a large ecosystem.

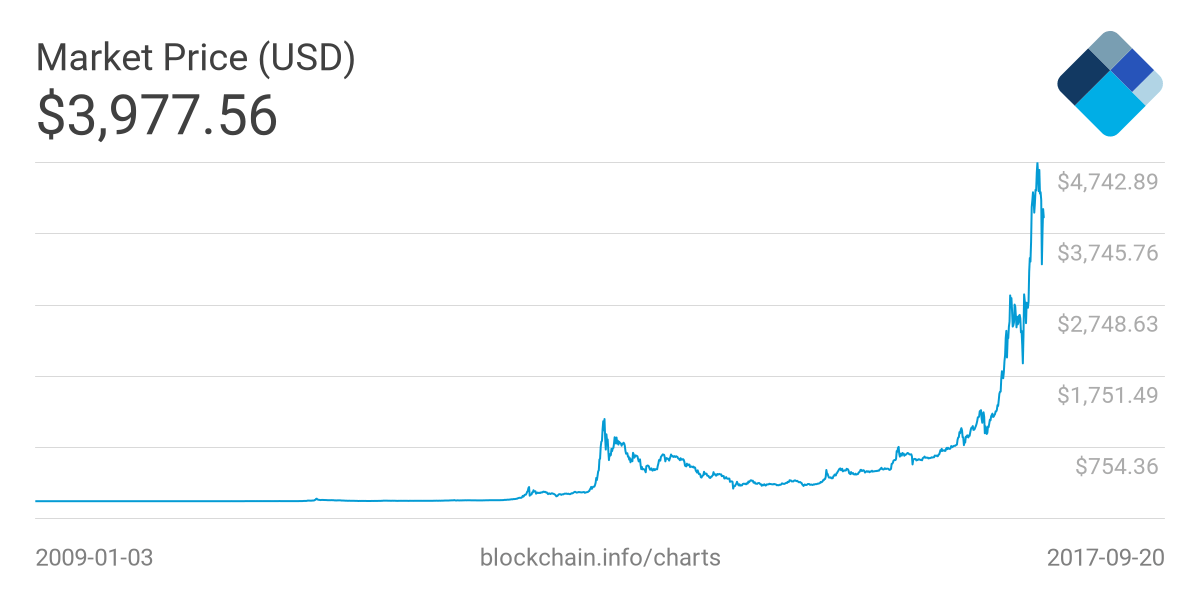

Investors in cryptocurrencies have been extremely successful in the past. Let’s have a look at three charts. They show the price of Ethereum, Bitcoin, and all cryptocurrencies combined.

Bitcoin generated an increase in the value of at least 25,000 % since 2011. We need to use an exponential chart because a linear chart can’t represent this increase.

Ethereum value shot up by 2,700 % since May 2016 and that’s probably the fastest rally a cryptocurrency ever demonstrated.

And talking about all cryptocurrencies – since mid-13, the complete market cap soared by 10,000 %.

Can you trust an asset that showed this amazing vertical take-off? Could it be a bubble?

Sure: it would have been better to invest a couple of years ago. But today might be the best day possible to start investing in it if you understand the potential of cryptocurrencies and you believe in their vision of money. That’s the reason why I wrote this guide for beginners. I tried to explain how to invest in cryptocurrencies. I will show you where to purchase cryptocurrencies, how you create a cryptocurrency-portfolio, how to store cryptocurrencies and how to tax your gains.

This said, it is important to note that cryptocurrencies are not an ordinary investment and that the investment is to some parts unregulated. Cryptocurrencies are a high-risk investment because there is the risk that cryptocurrencies get outlawed, that you lose your cryptocurrency key, or that exchanges get hacked.

You should only invest as much that you can keep on living and be if all of it goes to zero. This is very important advice. CEO of Xapo, Wence Casares, once said:

“I always tell them [my family] that to own an amount of Bitcoins they cannot afford to lose is the second most stupid thing they could do right now and the most stupid thing they could do would be to not own any. “

Why Invest in Cryptocurrencies

There are three major good reasons why you should invest in cryptocurrencies:

- You want to hedge your net-worth against the fall of the Dollar imperium. Many people think that this is inevitably going to happen at some time.

- You understand and like the technology.

- You support the social vision behind cryptocurrencies – that of a free and hard money for the entire world.

[thrive_leads id=’1055′]

Risks of Cryptocurrency Investing

There are also some risks of trading these cryptocurrencies. Here are the top three.

- There’s a Lot of Broker and Technology Risk

This is emerging technology. This means that there are still a lot of unknowns with trading at scale and how brokers and the software will react to certain surprise events. You should consider cryptocurrency brokers at least twice as risky if you think that Forex brokers are risky. The reasons for that are that they could be shady, and there are still so many unknowns with the technology.

However, I would still trust the larger cryptocurrency exchanges over many offshore binary options brokers.

So the lesson is: Move your coinage off to your own wallet as soon as possible and don’t keep too much of them at the brokers.

- Investing Requires Technical Savvy

Cryptocurrencies were created by super nerds, so there is still quite a bit of technical know-how that is required.

You don’t need to know how to code. However, you may want to stay away from cryptocurrency trading if you are “not good with computers”, at least until they start building more user friendly interfaces.

I’m not calling anyone dumb, don’t get me wrong. I’m just saying that you shouldn’t get involved in that area if you don’t possess a certain skillset, because you could lose a lot of money, very quickly.

For instance, I don’t make my own clothes because I don’t know how to sew. If I did try to make my own clothes, everyone would think I’m a weirdo for wearing fucked up clothes.

I believe you get the picture here.

So you should find someone you trust to trade for you if you aren’t so tech savvy, but still want to get involved.

- Some Technologies Will Fail

Cryptocurrencies are basically software, created by companies or individuals. So some of these technologies will fail, just like Webvan or Pets.com in the dot-com bust.

…and their fall will be spectacular.

There is a lot of talk right now about certain cryptocurrencies increasing several thousand percent, in a couple of months. This has a lot to do with publicity and ignorance.

Just like when people found out that the world of business would be changed by this new thing called the “internet”.

Did the internet change the world?

Of course it did.

However, there was also so much dumb money which overhyped the first wave of internet companies.

Trading cryptocurrencies is kind of like trading a software stock. Some of the software will explode in a giant ball of fire, while others will change the world.

Also, be careful because there are a lot of scam coins out there. Almost anyone can create a new cryptocurrency, so it is very important to learn how to separate the scams from the deeply underpriced currencies. After that, use proper risk management and play the odds.

What Cryptocurrencies Should You Purchase? Building your Portfolio

Bitcoin was the cryptocurrency up until late 2016, and you bought Bitcoin if you wanted to invest in the success of cryptocurrencies. Other cryptocurrencies – called “Altcoins” – have just been penny stocks on shady online-markets. They were mostly used to keep miner’s GPUs working, pump the price and dump the coins.

But this has changed. Bitcoin is still the dominant cryptocurrency. However, its share of the whole crypto-market has rapidly fallen in 2017, from 90 % to about 40 %, and many people saw this coming as a result of the ongoing self-tearing of the Bitcoin community over the blocksize problem and the growing popularity of Ethereum. This again shows that it is very important to listen to what the communities say. So keep your eyes open.

Bitcoin is still a standard item of every portfolio if you want to invest in cryptocurrencies. However, it is no longer the onliest asset and in every well-balanced crypto-portfolio today you find other coins, like:

- Ethereum

- Monero

- Dash

- Litecoin

- Ripple, and more

Here you can see the “market cap” (the value of all token available) of all relevant nations. It is not a perfect metric. However, it is probably the best we have to recognize the value of a cryptocurrency.

It might be a nice strategy to simply reflect the 10 most valuable currencies in your portfolio if you want to have a balanced portfolio at one point in time. However, more interesting is to take some time and read about those coins. Finally, if their vision gets you, you can make them the base of your asset selection.

For instance, there are some coins that are focused on privacy, such as:

- Zcash

- Monero

- Dash

Or some on scaling payments, like:

- Litecoin

- Dash

Or some on smart contracting, like:

- Ethereum

- Ethereum Classic

Some coins seem to be less open and decentralized than Bitcoin and other coins. These are some of them:

- Ripple

- Bitshares

- Nem

The cryptocurrency markets are a blazing, often confusing ecosystem. There you will find thousands of chances to win a lot of money and also to lose it. Every day sees some coins heavily falling, and some vertically raising, and every day gives birth to new coins and death to some old coins.

If you are interested in purchasing altcoins you should know that there are some rules to discriminate the good altcoins from the bad ones. Good coins have a vivid, enthusiastic community, an active development team, and a transparent technical vision. On the other hand, bad coins have a community that is mostly focused on becoming rich, and they are in transparent, promote fuzzy technical advantages without explaining how to reach them. The MLM coins are probably the worst shatter of cryptocurrencies, so you should beware of them!

How to Purchase Bitcoin?

It was a real Odyssey to purchase cryptocurrencies few years ago. However, you have a full scope of options today.

Exchange traded notes and more

Let’s start with purchasing Bitcoin because that’s the easiest part.

Some people want to invest in Bitcoin without having the trouble of storing them and they can use investment vehicles like: the Bitcoin ETI (available on German and Gibraltar exchanges), the Bitcoin investment trust on Second Markets (the United States of America), XBT tracker (German and Swedish), and some more. More and more brokers and exchanges try to setup a Bitcoin based financial product as Bitcoin rises, and all these investment products have in common that they enable investors to bet on Bitcoin’s price without actually purchasing Bitcoin. Most cryptocurrency-fans think that this takes away the whole fun and sense of it. However, this is the simplest way to invest in Bitcoin’s success for many people. You can use the investment channels you already are used to, and you have your certificate and someone to take to the court if something goes wrong.

Currently, no such investment product exists which covers more cryptocurrencies, nut there are some in progress, both in Europe and in the USA.

Purchasing Real Bitcoin on Exchanges

You should start purchasing Bitcoin directly if you want to experience possessing real Bitcoins – or avoid paying the partly high fees for investment products.

For instance, in the USA, you can use:

- Gemini

- BitStamp

- BitFinex

- Coinbase

Europe

- Kraken

- de

Asia

- BitFlyer

- BTCChina

- OKCoin

Mostly, purchasing Bitcoin is not a big issue. You open up an account at the exchange, verify your identity, and fund your account with Dollar or Euro or whatever paper money you use. You don’t need to fund your account on some exchanges, like Bitcoin.de. Here you trade directly with other users.

„What exchange should I use? “ That depends mostly where you live. It’s always better to use an exchange that is physically close to you because if some bad things happen, you have better chances to get money legally back if the exchange is located in the same jurisdiction as you. On the other hand, it is better to use exchanges based in stable countries with a good legal system if no exchange is located in your jurisdiction.

Other factors to decide which exchange to use are your patience and the amount of coins you want to purchase. You need to use one of the major exchanges which provide enough liquidity if you want to acquire large sums of Bitcoins quickly. If you are not in a hurry, and you only want to purchase small amounts of coins, you can try to purchase them on small exchanges. You will most probably get better prices than on big exchanges if your order gets filled.

Purchasing Other Cryptocurrencies

Altcoins are somehow more difficult to acquire. Some major exchanges like BitStamp, BitFinex, and Kraken have started to list some popular Altcoins, like Ripple, Monero, Ethereum, and Litecoin. Don’t hesitate to purchase all at one stop shop if they are part of your portfolio.

Nowadays there are hundreds of cryptocurrencies available on the market. You need to register at what is usually called an altcoin exchange if you want to go to a crypto supermarket, where you can purchase and sell most of them.

These are some of the examples:

- Poloniex

- Bithumb

- Yunbi

- Bittrex

Again, the site coinmarketcap is very helpful. It lists all crypto exchanges, sorted by trade volume.

You usually don’t trade with fiat money at the Altcoin exchanges, so they have less strict KYC (know your customer) rules. You can fund your account with Bitcoin. Bitcoin serves as a unit of account for the altcoin markets, similar to the Dollar’s function on the Forex markets.

It is highly important to choose an exchange with a high trust level. However, many altcoin exchanges are located in Asia and most of them are not regulated. So you should never place too much trust in them, because if they are hacked or file bankruptcy, you have nearly no chance to get anything back. On the other hand, exchanges like Bittrex and Poloniex are based in the United States. They have a long history of providing a secure and safe trading environment.

Is There a Good Time to Purchase Cryptocurrencies?

There is no general rule when it is a good time to purchase cryptocurrencies. Usually, it is not a good idea to purchase it when it is crashing, and, usually, it is also not a good idea to buy in at the peak of a bubble. As the trader’s wisdom says: „Never catch a falling knife. “ When the price is stable at a relatively low level is probably the best time to purchase cryptocurrencies.

The art of trading is to decide when a crypto reached the bottom after falling, and when it is in bubble mode. This is a very difficult question and it can never be answered with absolute certainty. Sometimes a coin begins to raise, and passes a mark, where everybody thinks this must be the peak of a bubble. However, only after the coin passes the mark, the real rally begins.

For instance, many people did not purchase Ethereum at $100 or Bitcoins at $1,000, since they thought that was insanely expensive. However, these prices appear to have been a good moment to start after only couple of months later.

I can give you only two advice about timing. First, crypto bubbles shouldn’t be compared with traditional financial bubbles. 10 % up is not a bubble. However, it can be daily volatility. 100 % up can be a bubble. However, it is often just the start of it. 1,000 %might be a bubble usually. However, there is no guarantee that it pops.

Second, you should take some time to watch. Don’t purchase in because there was a dip, because there might be another one. Also don’t purchase in because you are afraid that it will explode tomorrow. Watch it, get yourself informed, and when you think the timing is good – purchase it. And probably the most important thing: don’t be a weak hand and don’t sell too early. You should hold because the monetary revolution has just begun.

[thrive_leads id=’581′]

How to Earn Cryptocurrencies

There are a couple different ways to earn cryptocurrencies, and let us look at a common few:

- Cryptocurrency Exchange

Cryptocurrency exchanges work like forex exchanges, which means that you can purchase, sell or exchange cryptocurrencies for other digital currency or traditional currencies like Euro or US dollars.

These are some of the most popular cryptocurrency exchanges:

You can check out the monthly trade volumes for each cryptocurrency here.

- ATMs

Cryptocurrency ATMs have been installed all around the world. They dispense not only the popular bitcoins, but even Litecoin, Dash, and Ether.

There are ‘one-way’ ATMs, where you can buy coins but not sell them. There are also ‘two-way’ machines where you can sell coins in exchange for fiat cash.

- Mining

Remember that we talked about those blockchain ledgers that keep track of all transaction records, and we said that the users who are verifying each transaction are called “miners”. They do this work by solving complex math issues while simultaneously verifying transactions on the digital currency network.

In mining bitcoin, miners are rewarded with new bitcoin when they complete a block of calculations. This is the way to add new bitcoin supply into circulation.

Mining is a race. Rewards for solving a block started at 50 bitcoins. However, this is halved every 210,000 blocks, and this feature gives bitcoin its finite supply. Mining coins depends on your computer performance. This means the more powerful your computer is, the more chance you will have in completing the block calculations first.

- Micro-tasking

You don’t have a super powerful computer? You’re also not confident to dabble in the digital currency exchange?

You should your hand at micro-tasking then. Some websites offer free coins for completing easy tasks, for example visiting websites, answering surveys, or watching videos. But you will most likely only be offered a very small amount of coins. However, this is still a simple way to get yourself acquainted with cryptocurrencies.

Here are some of the examples of these sites:

- BitcoinGet

- Coin Bucks

- Prize Rebel and many others

The Features of a Currency to be Aware of

Cryptocurrencies are all based on blockchain technology. However, they are not all created equal and here are some differences that you need to understand to make informed trading decisions:

- Total supply available at this moment.

- Speed of processing transactions.

- Is there going to be an unlimited supply of currency?

- Is there going to ultimately be a limit on the total number of currency available?

- Do the founders have a good reputation?

- Are there any big investors in the project?

- Is there a real-world adoption of the technology?

- Does the use of the software make any sense?

- Is there a real-world demand for this currency/software?

These are just a couple of the features of cryptocurrencies that you should be aware of. However, you will start to see which projects could work for their intended purpose and which ones are most likely frauds once you start digging into these details.

This understanding will also allow you to see which of these different currencies will be more desirable in the future, and it will also allow you to assess the long-term viability of these currencies.

How to Store Cryptocurrencies?

It’s pretty straightforward with fiat currency like Euro or US Dollars – they can be stored at the bank or in your wallet.

But with digital currencies, there are a few wrinkles that you need to get your head around. However, the idea is similar. After you acquired cryptocurrencies, the most important question is how to store them, so let’s take a look at how cryptocurrency storage works.

Keep Cryptocurrencies off an Exchange

There is usually no way around keeping coins on an exchange if you invested not only in Bitcoin but in several Altcoins. You definitely don’t want to worry about installing, using, malware checking, compiling, syncing and updating the software for every coin you invested in.

More as in the process of purchasing, when you store your coins in an exchange, the trust in the exchange becomes extremely important. There is a long history of bankruptcies and hacks in cryptocurrency markets. The most notorious was the hack of Mt. Gox, which sucked up hundreds of million dollars of customer’s money. So you should gather some information if you use an exchange to store your coins.

- Since when does an exchange operate?

- Where is it located?

- Are the owners of an exchange known?

- How do they react to customer’s requests and complaints?

- Do the owners provide some audits to ensure you that all your coins are available?

For instance, Bitcoin.de enjoys a strong trust level for people in the EU. The owners are well known in the German and European community, the exchange operates without loss of customer’s funds since 2011, and an annual audit by external company checks if all coins are available. However, it is important to note that when you hold a lot of altcoins, this level of trust can rarely be achieved. Unfortunately, that’s the risk you need to take.

My Recommendation – Store Cryptocurrencies by Yourself

The true revolutionary feature of cryptocurrencies is the autonomy they grant the individual, and this feature can be also found in storing cryptocurrencies. This means that you don’t need anybody, you don’t need help and you don’t need to trust anybody. Downloading a free and open software is all you need.

Again, with Bitcoin, you have most options. For Bitcoin, there are a lot of wallets for every device. You can use this software to receive, store and send Bitcoins. There is the Bitcoin client, the so called full node, that grants the highest level of autonomy. However, it also requires a lot of time to sync and disk to store the blockchain. Thin clients like Electrum are easier to use, and also they are available for every device.

It’s important to know that it is solely you who is responsible for the safety and security of your coins when storing crypto by yourself. Your coins could be gone if you get a malware on your computer. Your coins could be gone if your Smartphones fall in the water. And so on.

Fortunately, to make a backup you have more than one option. First, you can print out your private key, because this is the onliest information you need to reconstruct access to coins belonging to a certain address, everywhere and every time. Second, you can copy your wallet file on a USB stick, but it’s better to use two or three. Third many wallets support so called seeds, which are sentences of 12 to 24 random words, and with them, you can not only rescue a single address, but every address ever made with this wallet. You don’t need to worry about your coins if you print them out.

Each wallet has a private address and a public address. The private address is the “password” that you use to access and send your funds, while the public address is the address that people send funds to.

You should never expose your private key until you are ready to spend your funds. If you do that you might lose all the money in your wallet.

Here’s an example of a Bitcoin paper wallet:

Let us now look at the different wallet options out there. Here are the different ways that your loot can be stored:

- Online wallet – Online wallets are probably the easiest way to store your money, but also the least secure. It is great for purchasing things and funding your trading accounts, but it’s not a good long term storage solution. It is important to note that exchanges like Coinbase also have their own wallets built in.

- Mobile wallet – To store your spending money, you can download a mobile app like Mycelium (https://wallet.mycelium.com/index.html). Mobile wallets are more secure than online wallets. But it is important to note that everything in your wallet will be gone if your phone ever breaks or it gets hacked.

- Desktop wallet – Desktop wallets are similar to a mobile app but just for desktop computers.

- Hardware wallet – Hardware wallets are hardware devices like Ledger Nano S that are designed especially for storing cryptocurrency keys. They are safer than the options above. However, it is important to note that they are still susceptible to the things that can damage all electronic devices.

- Paper wallet – This is the most hacker proof. However, it is also the least convenient. Be sure to store them in a safe place and don’t actually use paper if you are going to go this route.

Hardware wallets like Ledger or Trezor are one of the safest options to store Bitcoins. These are either smartcards or micro machines. They can generate keys and sign transactions without the main computer directly involved.

However, the infrastructure of Altcoins can’t compete with Bitcoin’s. Hardware wallets can also be used for storing some popular altcoins, like Ethereum, Ripple, and Litecoin. You can also use paper wallets for any Altcoin if you know what to do, as the fundamental cryptographic concepts remain the same.

Some Lightwallets, for instance, Exodus, can store several coins beside Bitcoin, e.g. Dogecoin, Litecoin, Dash, and Ethereum. Also, Electrum can store Dash and Litecoin.

But there is no easy one stop shop to store a huge variety of Altcoins by yourself, because you need to download the client of all these coins, download its blockchain and keep it updated if you want to do so. However, you can safely cut this option and use exchanges if your portfolio consists of 10 or 20 coins, and playing around with software is not your hobby.

Cryptocurrency Tracking Applications

You will also probably need an application to track cryptocurrency prices on your phone, so here are a couple of apps that might help you:

Coincap : This tracking application allows you to display currencies by market capitalization, volume and other ranking elements. They also have nice charts, which can be extremely useful for seeing what is being actively traded. The most useful thing about this app is that it displays prices in the currency of your choice. Some applications insist on displaying the value in Bitcoin. However, this is very annoying.

Blockfolio: This is a simple tracking application that allows you to add a watchlist and add trades so you can track your portfolio. This app also displays all currencies on your watchlist in your currency of choice.

It is important to note that these app are just to check the markets, and not for storing or trading currency.

[thrive_leads id=’581′]

How Do You Need to Tax Cryptocurrencies?

Currently, there are only a couple of tax consultants who know how to deal with cryptocurrencies, but it can be safely assumed that the number is growing fast and that cryptocurrencies will soon be a standard issue for tax experts like realestates, shares, ETF-s and securities are.

Here is an overview of the typical problems with cryptocurrencies and taxes.

No free lunch

As you already know, nothing is for sure except death and taxes. The same goes on with cryptocurrencies, because you likely have to pay taxes if you earn money by investing in cryptocurrencies.

The important question is: „How to tax cryptocurrency investment returns? “ This is up to your national tax jurisdiction.

The Good News

There are some good news about cryptocurrencies and taxes. The first good news is that in some countries you have to pay nearly no taxes. For example, Germany is a country usually known for very high tax rates. However, amazingly Germany has become a tax haven for cryptocurrencies. Like the United States of America and many other countries, Germany considers Bitcoin a property and not a financial product. This means that you don’t pay a flat tax for financial income if you earn money by trading it. However, you have to tax the profit of purchasing and selling cryptocurrencies like income.

- You purchased one bitcoin for 100 Euro and ordered a 10-Euro-pizza when they cost 1000 Euro? Your taxable income increased by 9 Euro, and the tax rate for this is higher than for financial gains in most cases.

- You purchased 10 Bitcoins and you paid them 1,000 Euro. You sold them for 2,000? Your income increased by 10,000 Euro.

However, there are means to avoid this. You don’t need to pay taxes at all when you sell your coins if you hold them for more than one year. This rule was added to dis-incentivize day trading of other properties and stabilize prices by incentivizing holders, and for cryptocurrencies it made Germany and the Netherlands to tax havens. Some countries might also have similar rules, so you should ask your tax advisor to help you out.

However, there is a problem with „one year rule“. You have to prove that you hold the crypto for this timeframe. Usually, exchanges can help you with prints of your trade history, and you can also use the public blockchain as a proof of storage. In most cryptocurrencies, it is transparent when coins are received and spent by a particular address, but not in all. For instance, Ring Signatures and Confidential Transactions are used by Monero. These are amazing tools to maintain anonymity, but the problem is that they make it almost impossible to prove that you hold coins more than one year. When selecting coins for your portfolio you should take this into account.

The Bad News

Taxing Bitcoin is possible if you use a good exchange and keep track of your trades. However, it is also a pain in the ass because you need to calculate every single profit, not just from trading, but also from using Bitcoins to pay for things.

But that’s just the beginning, and if it comes to Altcoins, things become really a complicated nightmare. An Altcoin counts like Bitcoin for the tax authorities, and in many countries, this means it is a property and not a financial product. If you purchase it with Bitcoin and sell it for Bitcoin, you have to tax the difference. However, you don’t use Bitcoin to tax the difference, you use the US Dollar or you national paper money. This means that you need to keep track of all your Altcoin trades, and also take into account the price of Bitcoin when purchasing and selling.

Evidently, this makes things exceedingly complicated, because you can have a bad trade, resulting in getting less Bitcoin back than you invested, but being still, in theory, accountable to taxes. So, you have to pay taxes for trading although you lost money in it.

At this moment you should accept the fact that cryptocurrencies are a new thing. You are probably no expert in dealing with your financial authorities, so you should go for a tax consultant, educate her/him about cryptocurrencies and look forward to talking with confused financial authority officials.

Conclusion

So that is The Ultimate Guide for a Super Beginner to trading cryptocurrencies. I hope that it answered any questions that you may have had about trading cryptocurrencies. Of course the world of cryptocurrencies goes much deeper and more complex than this guide, but hopefully you are now able to understand what exactly cryptocurrencies are the next time a family member, colleague or a friend brings it up over dinner!

Enjoy investing in cryptocurrencies!