Safety rules were written with blood – this statement sounds familiar to every soldier around. We are not dealing with a risk to human lives. However, losing your expensive Bitcoins by making mistakes trading is definitely not a fun situation.

Cryptocurrency is a prime target for pump and dump scams. It’s an easy way to get rich fast by inflating the price for those with buying power. However, for everyone else you will lose nine out of ten times. This is only one of many reasons why people are afraid to trust Bitcoin.

So, how to avoid those mistakes in the trading and to be mostly on the green side? First, it is important to note that trading is not for everyone. Secondly, to trade right requires attention and your one hundred percent focus because the world of cryptocurrency is filled with people who are looking to gain a financial advantage over others. Considering there is a lot of money to be made, that is not entirely surprising. The altcoin industry especially has seen its fair share of pumpers. Some of whom are more notorious than others. That’s why it is very important to always be careful when listening to others for altcoin investment advice.

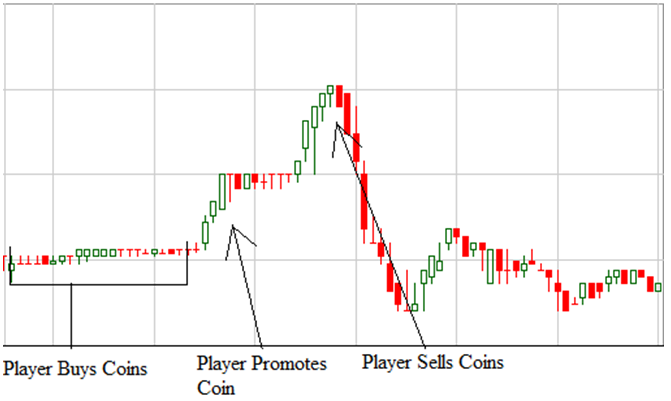

A pump and dump scheme is the process where you buy an asset (usually one with a low market cap) and in an effort to dump the asset at a higher valuation, you promote it to new, unsuspecting investors. The promoter of the asset is left with a profit. On the other hand, those people who were tricked into purchasing the asset by the promoter are left holding the bag.

The pump and dump is fairly straight forward, for those of you who don’t know how it works. They are also illegal in the market. However, it is important to note that federal agencies do not actively protect Bitcoin users.

There are two groups of people that are involved in pump and dump scams. First there are the players. These people artificially increase the price of a coin by endorsing or promoting it. They’ve spent several minutes, hours or even days purchasing up cheap coins, and they build up the buzz when they are ready to dump them. And there are innocent newbies (but sometimes even more experienced traders get cought) that will be dumped on.

Trading volume increase and the coins value goes up as buzz around the coin gains momentum. This means that you are both the pump and dumper. The players sell all their coins once the coin hits a desired price. After that, people start to panic sell, dumping their coins on the market and sending the price plummeting.

How to predict pump and dump crypto? It’s not too difficult to detect a coin that’s being primed for a pump and dump, and there are ways to know when a pump or a dump might be incoming. There will often be purchasing patterns like the ones in the graph above. Each time the players purchase, the price is falling and rising just slightly, loading up on the cheap coins without drawing too much attention.

The players head to the forums and chat boxes after they have bought the coins, where they talk up their coin of choice. They’ll use several different accounts. Also, there can be many players involved helping make this look real. The coin will be talked up until there is a buzz and people begin purchasing. This is when the pumping happens. The chatter picks up on trading platforms, and people begin buying the coin and pumping the price skyward, which fuels the buzz even further, and more people start buying.

The players will begin selling off their coins once the coin hits a high point. However, not all of them at once – this signals the dumping process is about to start. It can happen in a matter of couple of seconds or be dragged out over few hours, and the players will sell small amounts of coins as quick as they can without dragging the price down until their out. A panic sell starts once the players are out. This is when the dumping process happens. The price is no longer climbing the volume is down. People now start realizing that their own sell orders aren’t getting filled. Panic sellers will sell below the market value just to get out. This can send the coin’s value crashing to the floor.

The players are the ones becoming rich, and they have the capital and knowledge to do so. However, that doesn’t mean you have to lose out every time.

You can buy cheap coins yourself if you are able to spot a coin that’s being prepped for a pump and dump. You can make money if you were able to grab up some coins before the pump begins and if you are not greedy. If you’ve spotted the signs early, it shouldn’t be difficult to make decent profit in 5 minutes.

You can still make a profit if you come late to the party and the coin has already started being pumped, but still in the early stages. Your profit will be smaller and your risk greater. However, you should be able to expect a modest return if you enter and exit fast the market fast.

There are many people who are offering to “let you in” for a fee on the next coin to be pumped and dumped. Some people charge as little as .5 Bitcoins. However, the question is, is it worth it?

Most of these are scams in order to get your Bitcoins, and they will tell you what coin is going to be targeted but do nothing because they don’t need to. They have already made their profit, because at .5 Bitcoins, and with only five subscribers these people have already earned over $2,000. This is about what you’d expect to make on pumping and dumping a coin, but now there is no risk.

You’d have to invest a significant amount of money to see a return of half a Bitcoin even if these offers for insider trading were real, and they did pump and dump the coin. This means a smaller return and greater risk for you.

You can use these various methods to get informed about market volatility before pump and dump occurs:

Public Forums and Chat Rooms

There are many forums and chat rooms available to traders who are looking to stay in the loop. The most popular forum is Bitcointalk.org. You have a better chance of getting informed about major upcoming price swings by keeping a close eye on the Alternate Cryptocurrencies section.

Also, trollboxes on exchanges like Poloniex and Bittrex can provide some insight into the market action. These chat rooms might be the worst places for trade advice. However, they are still a valuable information resource for altcoin traders. Instead of listening what these unverified and anonymous people chart and advise, you can go to legit sources like fxempire.com and check what professional traders chart and advise.

Monitoring the Popular Exchanges

This method is great for those of you looking to take matters into their own hands. The problem with this method is that you will probably still miss out on major pumps, because there are hundreds of trading pairs on dozen exchanges. This means that keeping track of them all is impossible.

Private Chat Rooms and Communities

There are also many closed chat rooms and communities available to traders who are looking to stay in the loop. These types of private communities almost always require an upfront payment in order to join, which may put off many people and rightfully so. . Most of the time these communities simply want your entrance fee. Also, the problem is that the information provided is usually unreliable.

Expert’s Predictions and Opinions

Expert’s predictions and opinions is another popular way to stay informed about future market action. Bitcoin blogs, including The Merkle, often write informational pieces and publish price analysis. These information can help traders make more informed decisions regarding their positions. Tradingview is another great resource. It has a plethora of charts with explanations that help rationalize altcoin markets.

Bots That Analyze the Market – Pump and Dump Alerts Crypto

You can have a bot do all the work for you and inform you of potential pumps if you don’t want to sit in front of your computer screen with a dozen windows open trying to predict the next pump. CryptoPing is a great example of such bot. This is a telegram bot that alerts you of upcoming changes in price or volume. This bot gives you a chance to get in on the action.

Using CryptoPing is pretty easy. You need to simply download the Telegram app on your phone, link it with your account, and you are set to go. The bot tracks every single trading pair on the top 3 most popular altcoin exchanges (Cryptopia, Poloniex and Bittrex), and when it finds an anomaly, it will send a notification to your phone letting you know of the change. This bot was free to use. However, once the ICO phase started on May 24th, it switched to a subscription based model.

Happy trading and always remember – buy the rumor and sell the news.