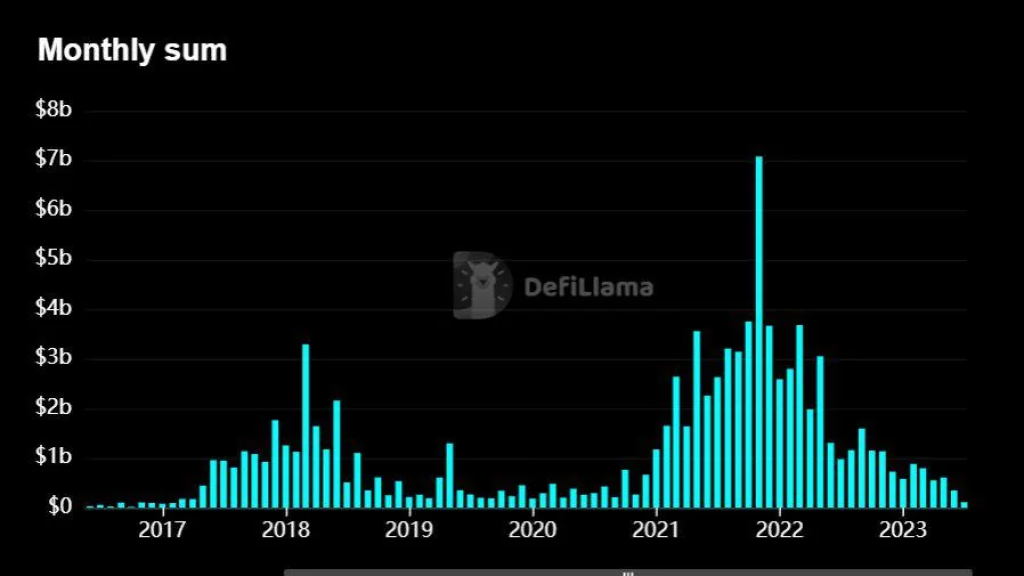

Funding for crypto projects is currently at an all-time low, even lower than during the infamous 2018 bear market. The decline is staggering, with a 98% drop from the 2021 levels. It appears that the days of easy funding for less credible projects, colloquially known as ‘shitcoins’, are over.

Not all crypto projects are backed by billionaire investors or have millions at their disposal. Many are legitimate startups, striving to develop innovative technical solutions for the crypto ecosystem or bring fresh, interesting ideas to the table. These startups are the lifeblood of any industry, daring to think outside the box and bring something new to the table.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +However, these startups often rely heavily on venture capital funding. They need to hire talent, cover operational costs, and more. Venture capitalists, known for their appetite for risk and high returns, often step in to provide the necessary funding. This relationship, while necessary, often comes with strings attached, and startups can find themselves beholden to their investors.

The current bear market has been particularly harsh on crypto startups. A chart from DefiLlama, showing monthly funds flowing into crypto through venture capitals, paints a grim picture. From a high of nearly $7B in monthly funding, we’re now down to a meager $109M. This 98% decline is more severe than any month in 2018, highlighting the severity of the current market conditions.

This bear market has been a test of resilience for crypto startups. Those that survive will have proven their mettle, demonstrating an ability to weather the harshest of storms. Just as individual investors have had to show their endurance, so too have these startups.

While the current situation may seem dire, it’s important to remember that the crypto market is highly volatile and cyclical. Just as we’ve seen bull markets follow bear markets in the past, it’s likely that funding for crypto projects will rebound in the future. However, the landscape may look different, with potentially more scrutiny and due diligence applied to funding decisions.

In the meantime, the bear market serves as a cleansing mechanism, weeding out less credible projects and ensuring that only the most robust and innovative survive. This could lead to a healthier, more mature market in the long run.