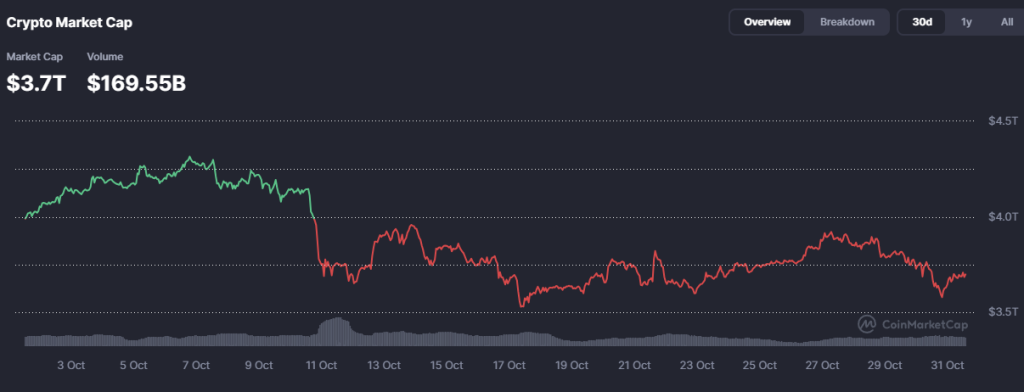

So much for “Uptober.”

The last day of the month is here, and the scoreboard doesn’t lie – almost every major crypto asset just wrapped up one of its roughest months of 2025.

Bitcoin slid more than 4%. Ethereum fell over 7%. XRP and Solana both dropped double-digits. Memecoins? Even worse. Some of the most hyped plays of the year (like XPL, FARTCOIN, and PENGU) were absolutely crushed. Even strong AI plays like HYPE and TON couldn’t escape the red.

This wasn’t the October most traders were preparing for.

A month ago, expectations were sky-high. Rate cuts were on the table. ETF breakthroughs were stacking up. Institutional inflows were building momentum again. Many believed Uptober was guaranteed. Instead, October delivered a very different story.

Why Did Everything Drop?

A storm of caution hit the market all at once. Traders watched Bitcoin struggle at the $120k zone and decided it was safer to rotate funds back into stable value. Liquidity drained out of altcoins fast. Each pullback triggered more selling, and that snowballed into the chaos we’ve just lived through.

Macro fear didn’t help. Concerns around the U.S. government shutdown lingered. The Fed kept delaying its big move. And when Bitcoin doesn’t lead, the rest of the market tends to suffer.

It wasn’t just retail panic either. Smart money protected profits and waited for clearer signals. Uptober turned into “Wait-and-See-tober.”

November Can’t Be Worse… Right?

Here’s the interesting part: despite the carnage, bullish catalysts didn’t disappear. They just got overshadowed.

Multiple ETFs are launching or lining up regulatory clearance, including Solana and XRP. Major utility upgrades are coming across chains. Rate-cut optimism hasn’t gone away – if anything, expectations are rising heading into the November FOMC meeting.

Markets needed a reset. Now they have one.

Read also: XRP ETF Launch Date Set, But the Biggest Upside Might Come From a Different Altcoin

Where Do Crypto Prices Go from Here?

Whenever the entire market gets washed out together, two things usually follow: cautious rebuilding and the first sparks of fresh accumulation. Whales love sweeping up discounts, and November enters with most major assets sitting at strong long-term support levels.

That doesn’t guarantee an instant reversal, but the worst-case fear has already been priced in. If Bitcoin steadies, November is positioned to look very different from October.

So yes, “Uptober” failed us.

But No-vember still has a chance to live up to its name.

Because if the crypto market teaches anything, it’s this: momentum can flip faster than anyone expects. And after a month like this one, the only direction traders want next… is up.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.