Crypto trader Koroush AK, in a post to his more than 300k followers, explains how utilizing technical analysis can help investors capitalize on bull markets to achieve financial freedom. He provides a concise 5-minute guide on reading trends, identifying key support/resistance levels, and putting it all together into an effective trading strategy.

What you'll learn 👉

Step 1: Understand the Trend

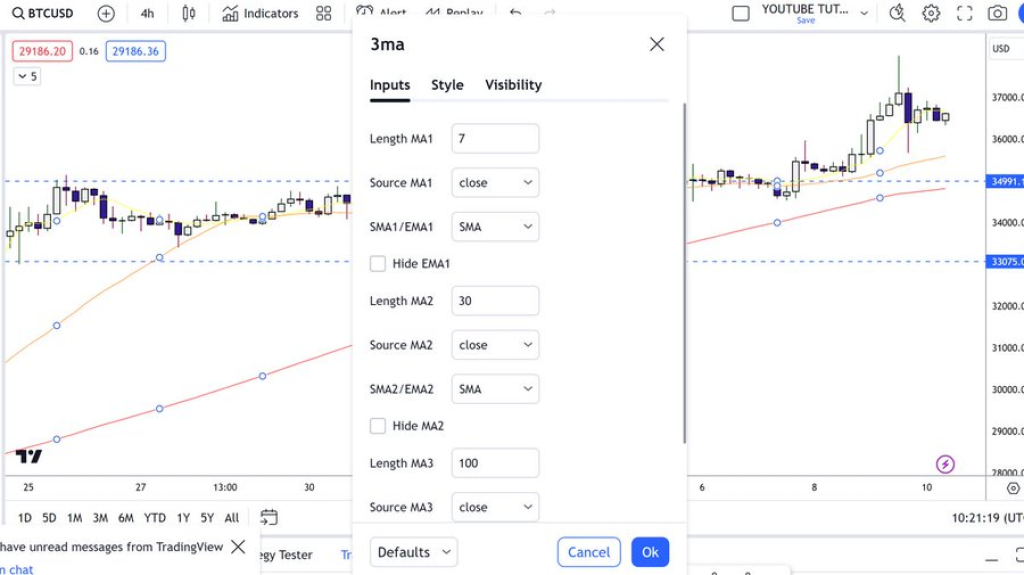

Koroush recommends using moving averages (MAs) on varying timeframes to gauge the overall trend. On lower timeframes like the 7-day MA, look for the MA to fan out above longer MAs like the 30-day and 100-day in an uptrend. The opposite pattern occurs in downtrends. Neutral trends see MAs twisted together.

Trends also manifest in how price interacts with support and resistance. Uptrends see support holding stronger than resistance. Downtrends are the opposite, with resistance exerting more power than support levels.

Step 2: Identify Key Levels

Support and resistance form at areas where buyers and sellers concentrate. Round numbers like $10k or $20k for Bitcoin often act as support/resistance. Any level holding 2+ times has significance. If support breaks, it can flip to resistance, and vice versa.

Applying this methodology clearly highlights key levels on Bitcoin’s chart using simple round numbers. No complexity required.

Step 3: Putting It All Together

With trends and support/resistance identified, apply the rules:

- Uptrends call for buying dips at support

- Downtrends call for shorting rallies at resistance

- Breakouts above resistance in uptrends offer long entries

- Breakdowns below support in downtrends offer short entries

This framework forms the basis of a trading strategy. Koroush notes this is the minimum required to implement effective technical analysis. Further skills like risk management and journaling help maximize gains.

Read also:

- Will History Repeat as Solana (SOL) Faces Tough Resistance Again?

- Polygon Market Cap Surges +54% in 3 Weeks as Whales Continue to Accumulate MATIC

- Bitcoin ETF Token Crosses $100K With BTC Price Surge – 1 Day Left in the Presale Stage

The Bottom Line

According to Koroush, using basic technical analysis to read trends, spot support/resistance levels, and combine it into a rule-based approach can help traders profit enormously in bull markets. While there are more advanced technical techniques, these core concepts offer enough edge to achieve financial freedom in crypto’s explosive bull runs.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.