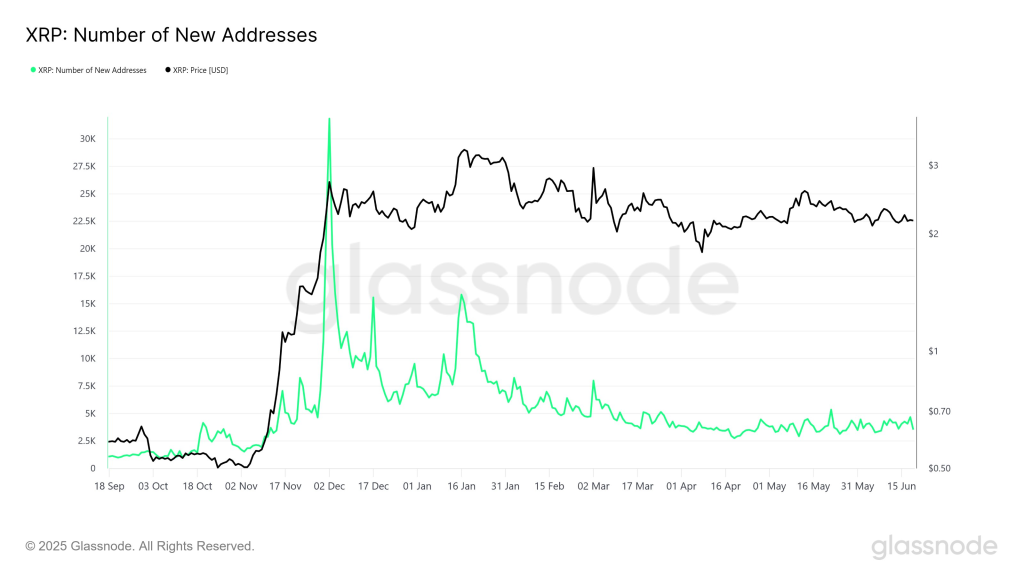

The chart and post by Crypto Uncle paint a clear, cautionary picture of what’s happening under the surface of XRP’s price. While the token remains relatively stable around the $2 mark, on-chain metrics are telling a different story – one that means growing disinterest or user fatigue.

New address growth is one of the cleanest ways to track user interest. When it slows down like this, it often means fewer new participants are entering the ecosystem.

This drop means that retail and maybe even institutional excitement is cooling off, even though the price has held steady.

Active Wallets Are Falling Too

Crypto Uncle also points out that daily active addresses have dropped from 577,000 to just 34,000 – another huge red flag. This steep fall in interaction indicates that many XRP holders are either sitting on their assets without using them or have exited the network entirely.

Fewer active users typically mean lower transaction volumes, slower ecosystem activity, and reduced demand. And even if price holds up for a while due to low supply or trading inertia, that divergence between price and actual network use rarely lasts long. It either corrects downward – or something major needs to reignite participation.

Read also: Here’s the XRP Price If Ripple Partners With 50+ Central Banks

A Warning Sign?

The fact that XRP has remained in the $2–$2.30 range while usage metrics crater is what makes this concerning. It creates a bearish divergence between on-chain fundamentals and market price. Historically, when this happens, price tends to follow the network – not the other way around.

Crypto Uncle’s note that “on-chain trends often shift before price does” is worth highlighting. Many traders look only at charts, but when new wallet creation and user activity are fading this fast, it often signals a coming slowdown in momentum – unless there’s a fresh catalyst to drive adoption again.

In short, XRP’s price may look stable, but the foundation under it is getting weaker. If activity doesn’t pick back up soon, it becomes difficult to imagine the price holding these levels for much longer without a reset. It’s a classic case of “looks fine on the outside, but the internals are flashing warnings.”

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.