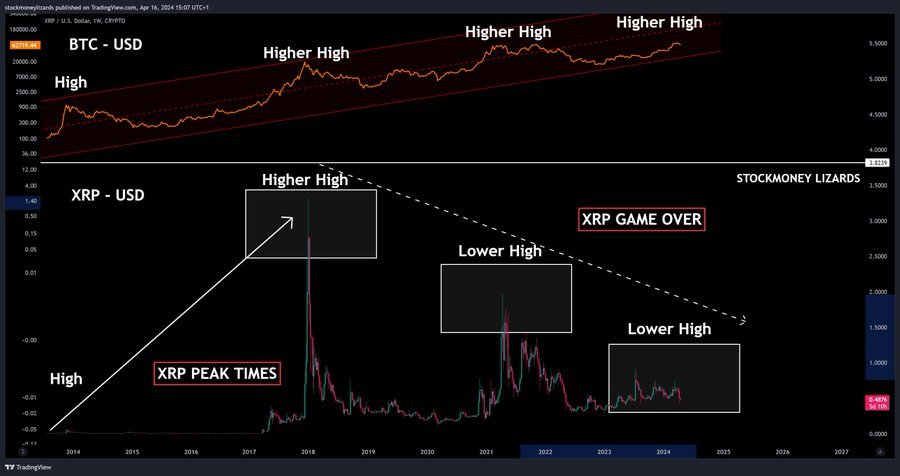

Top crypto analyst, known as @StockmoneyL on X (formerly Twitter}, has raised concerns about the performance of Ripple’s XRP cryptocurrency. In a tweet, the analyst compared XRP’s price trajectories to Bitcoin’s gains, advising investors to steer clear of XRP for the time being.

What you'll learn 👉

Bitcoin’s Resurgence Outshines XRP

The analyst highlighted Bitcoin’s noteworthy recovery, stating that from its peak in 2017 to its subsequent peak in 2021, Bitcoin recorded a 250% increase. Furthermore, even during the current market cycle, spanning from 2021 to 2024, Bitcoin has managed to achieve a 6% gain thus far, despite the overall market volatility.

In contrast, @StockmoneyL pointed out XRP’s lackluster performance. “From 2017 to 2021, XRP’s peak-to-peak performance was a disappointing -40%,” the analyst noted. Even more concerning is XRP’s performance during the current market cycle, where it has experienced a substantial 60% decline from its peak.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Lack of Buying Pressure and Technological Limitations

While acknowledging that XRP might find support at current levels, @StockmoneyL emphasized the lack of significant buying pressure for the cryptocurrency. The analyst further criticized XRP’s technology, describing it as outdated and heavily centralized, referring to it as “kind of considered the first rugpull in crypto history.”

Consequently, investors appear to be favoring more modern cryptocurrencies with higher demand, such as Solana (SOL), which the analyst mentioned as having a comparatively higher demand.

In light of these observations, @StockmoneyL advised caution to “homies” who might be overly bullish on XRP. The analyst’s tweet serves as a reminder that technical analysis and a critical assessment of a cryptocurrency’s fundamentals are crucial when making investment decisions in the volatile crypto market.

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.