Cardano has been under pressure for weeks, and the drop below $0.50 last week looked like it could open the door to even more downside. But just when sentiment started to lean bearish, something interesting happened behind the scenes.

According to new data from Santiment, Cardano’s largest buyers quietly stepped back into the market, and they’ve been loading up hard over the last few days.

What you'll learn 👉

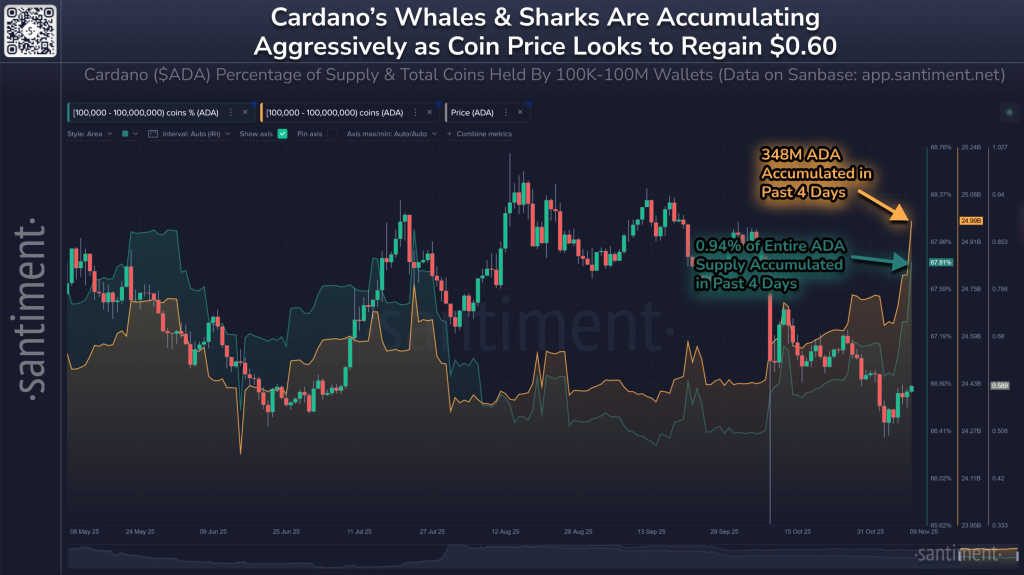

Whales Accumulate 348 Million ADA in Just 4 Days

Santiment’s chart shows an aggressive spike in accumulation from wallets holding between 100,000 and 100 million ADA. These wallets, often referred to as “whales” and “sharks,” are typically the smartest money in the network because they tend to accumulate when sentiment is weak and distribute when FOMO is high. The new data reveals that in just the last four days, these key holders scooped up a massive 348 million ADA, worth more than $200 million at current prices. That alone accounts for nearly 1 percent of the entire circulating supply being bought during a period when the broader market was still uncertain.

When you look closely at the chart, the accumulation line shoots upward almost vertically right after ADA dipped below $0.50. This is the type of behavior that has historically preceded strong recoveries for Cardano. Every time the accumulation curve has moved up sharply, ADA has followed with a price rebound soon after. And even though retail sentiment is still mixed right now, it’s clear that whales are positioning early, not waiting for confirmation.

Can ADA Reclaim the $0.60 Level?

The price chart on the right side of the graphic also shows ADA attempting to reclaim the $0.58–$0.60 range. That’s a key zone because it has acted as short-term resistance during the latest downtrend. If ADA manages to break above that area, it would be the first real sign of strength in weeks and could open the door to a move back toward $0.65 or even $0.70. But the ADA price needs consistent buy support to stay above $0.60, especially with Bitcoin still controlling broader market direction.

Whale activity alone isn’t enough to guarantee an immediate breakout, but in crypto it almost always signals a shift in sentiment before price action confirms it. The fact that high-value holders were willing to deploy this much capital during a 33 percent monthly pullback suggests that they see ADA as oversold and undervalued at these levels. It also signals renewed confidence in Cardano’s long-term fundamentals, especially its growing DeFi ecosystem, increasing stablecoin liquidity, and upcoming governance upgrades.

Read also: Cardano, Ripple, or Hedera: Which Could Be the Next Big Crypto Winner?

What Happens Next for ADA?

Going forward, the market will be watching two things closely. The first is whether whales continue accumulating or if this was a one-off spike. Sustained accumulation over multiple weeks has historically led to multi-month rallies for ADA. The second is whether ADA can break back above the $0.60 level and hold it as new support. If that happens, price could build momentum toward the mid-$0.60s, and from there, the next major resistance sits around $0.68 to $0.72.

On the downside, if ADA fails to reclaim $0.60 and Bitcoin begins retracing again, the price may revisit the $0.50 region or even dip back to the $0.47 support that buyers defended last week. But given the size and timing of this whale accumulation, the market appears to be leaning toward recovery — unless something unexpected hits the macro landscape.

Overall, the message from the Santiment data is pretty clear. Whales are buying weakness again, and historically, that has been one of the strongest early signals that ADA is preparing for its next move. With nearly 1 percent of the supply grabbed in just four days, Cardano may be gearing up for a short-term rebound as long as market conditions remain stable.

If ADA breaks above $0.60 with strong volume, the next leg higher could arrive faster than most retail traders expect.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.