Bitcoin DeFi just took a historic step forward – on Cardano. Charles Hoskinson, founder of Cardano, announced on X (formerly Twitter) that the first-ever Bitcoin DeFi protocol built for Cardano is now live. In his words: “Welcome to the first Bitcoin DeFi protocol developed for Cardano.”

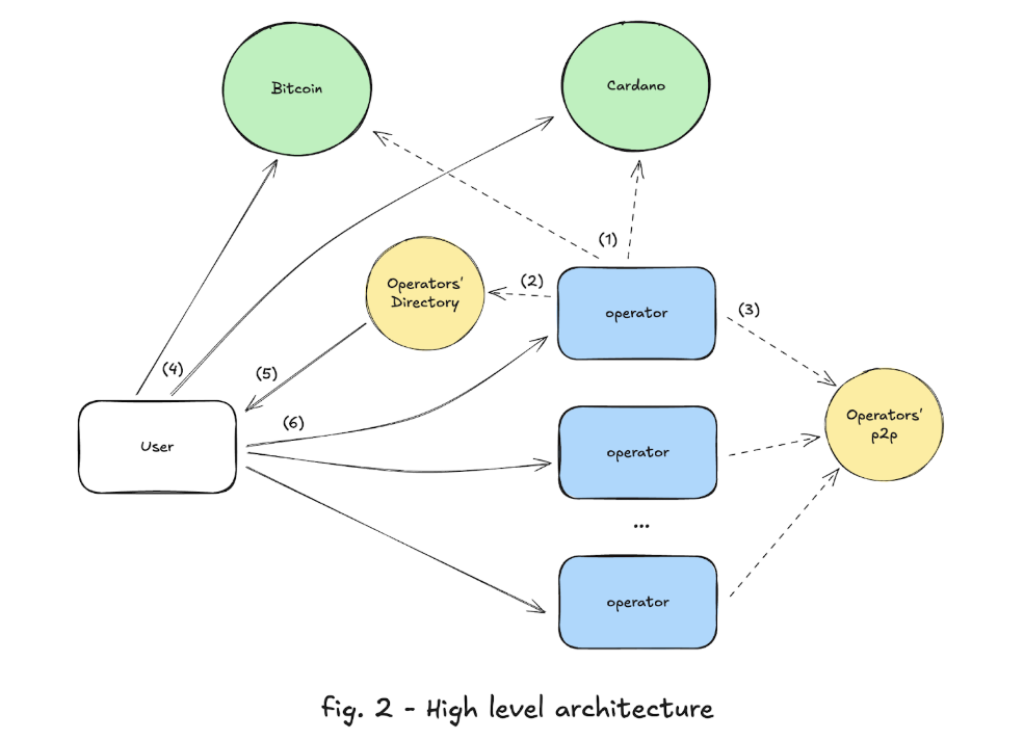

This protocol is called Cardinal, and it introduces a whole new way to wrap and use Bitcoin in DeFi- without relying on centralized custodians or federations. Cardano’s CTO, Romain Pellerin, broke down the tech behind it in a detailed thread that explains how this cross-chain bridge works and why it matters.

What you'll learn 👉

A New Way to Use Bitcoin in DeFi

The Cardinal Protocol allows users to wrap any BTC UTXO and use it across a growing number of DeFi applications – lending, staking, borrowing, trading Ordinals, or even using them as collateral.

This isn’t your usual wrapped Bitcoin solution. There’s no trusted custodian holding your coins. Instead, Cardinal uses MuSig2-based multisig wallets and Bitcoin’s HTLCs (Hashed Timelock Contracts) combined with Cardano smart contracts to lock Bitcoin securely and issue wrapped tokens on Cardano.

According to Pellerin, users can redeem their BTC at any time using a fraud-proof exit process. The wrapped version of Bitcoin – whether used as a token or NFT- is always pegged 1:1 and fully backed.

Why This Matters

Cardinal flips the typical wBTC model. Instead of giving up custody to a federation, Bitcoin stays locked on-chain using secure multisigs. The wrapped asset lives on Cardano (or any other smart contract chain) and can be used in DeFi while the original remains untouched.

Pellerin explained that this eliminates common risks like rehypothecation and third-party failure. He also noted that this is the first time Ordinals can move cross-chain and still retain their provenance.

That means Bitcoin NFTs can now enter DeFi – used for borrowing, lending, trading, or even farming – without losing their original identity.

A Fully Working Cross-Chain Bridge

This isn’t just a whitepaper or testnet experiment. The team behind Cardinal completed a full end-to-end wrap and redemption flow across Bitcoin and Cardano mainnets. You can see the full transaction history – lock, mint, burn, and claim – in the transaction table shared alongside the announcement.

The process begins on Bitcoin with a lock transaction, followed by minting on Cardano, and eventually ends with a burn and unlock claim to recover the original BTC. It’s all trust-minimized and verifiable on-chain.

Why Cardano?

Pellerin said Cardano is a natural fit for this protocol because of its eUTXO model, which closely matches Bitcoin’s own architecture. Cardano also offers low fees, strong smart contract controls, and native NFT support, which makes it ideal for managing wrapped assets like Ordinals.

However, Cardinal is chain-agnostic. The tech can be extended to other blockchains like Ethereum, Solana, and Avalanche in the future.

What Can Bitcoiners Do With Cardinal?

Thanks to Cardinal, Bitcoin holders can now use their assets across Cardano’s DeFi landscape. Some early integrations include:

- Staking via Indigo Protocol

- Lending through Liqwid Finance

- Loans with Lenfi Finance and FluidTokens

- Farming on Minswap and SundaeSwap

- Ordinal trading on jpg.store

This opens up real utility for Bitcoin holders without giving up ownership of their assets.

What’s Next?

Cardinal is still early, but it already works. The team now wants to expand the protocol’s reach and capabilities. According to the roadmap, future improvements include:

- Lighter clients

- ZK-proof systems for improved fraud resistance

- Better wallet integrations

- Support for more types of assets and liquidity tools

Cardinal is a wrapped Bitcoin protocol. It’s also a modular and secure bridge that gives Bitcoin real DeFi power without compromising trust. With full support for NFTs, yield farming, collateralized lending, and even auctions, this could be a positive development not just for Cardano – but for Bitcoin DeFi as a whole.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.