Cardano’s founder, Charles Hoskinson, has hinted at a major Cardano news that could shape the network’s next phase. Investors are watching closely to see whether the news signals a fresh push for ADA’s growth. The token has been steady in recent weeks, and many believe this could be the trigger that decides its next direction.

As the market turns its attention to Cardano, another project, PayDax (PDP), is gaining quiet traction among traders looking for innovative utility and long-term value. Unlike ADA’s gradual roadmap, PayDax is moving fast to bridge decentralized finance with everyday usability, creating a new point of interest for investors exploring early-stage opportunities.

What you'll learn 👉

What We Know So Far About the Cardano Announcement

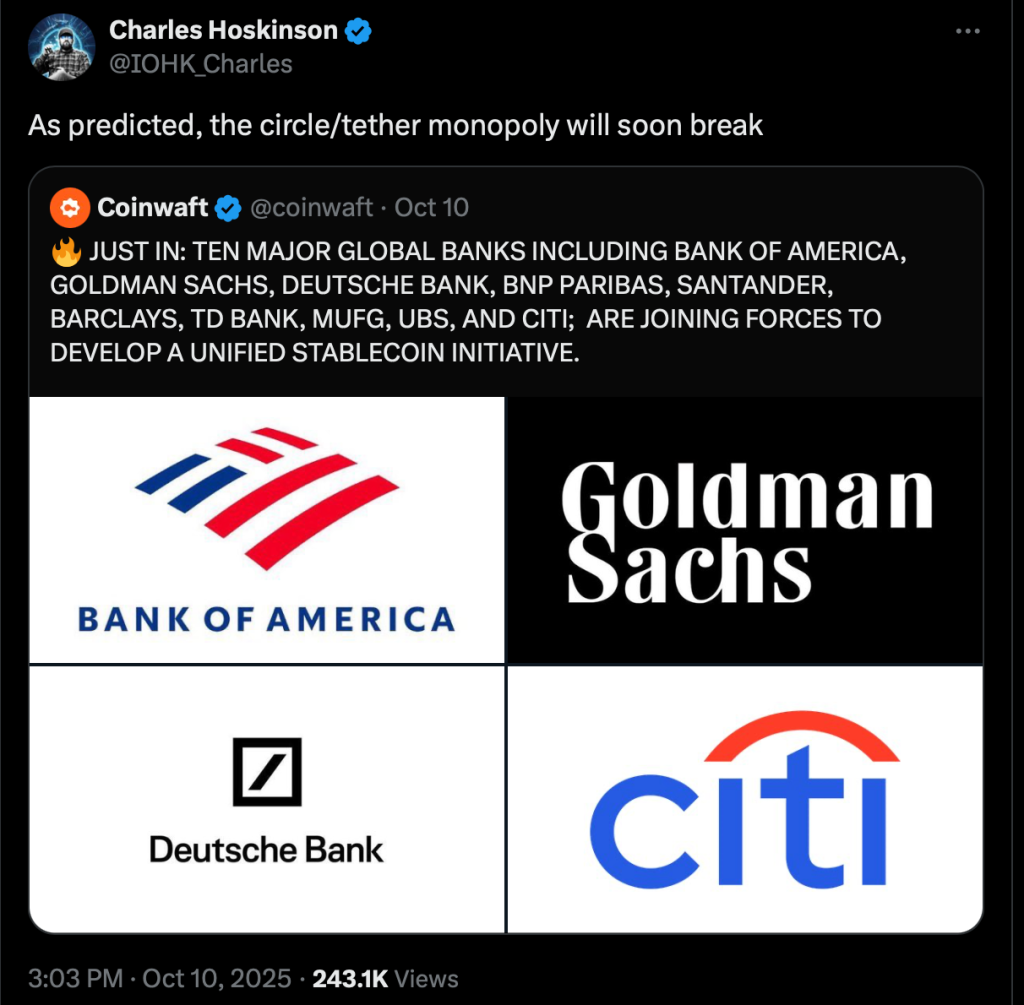

Charles Hoskinson has once again stirred the crypto waters. Analysts believe the upcoming Cardano news could be tied to a new stablecoin initiative capable of challenging giants like USDC and USDT. If true, this could reshape how DeFi operates on the Cardano network and potentially boost long-term ADA adoption.

Circle and Tether currently dominate the stablecoin landscape, with USDT valued at over $181 billion and USDC sitting near $76 billion. Cardano’s development arm, Input Output Global (IOG), had previously launched DJED; a “fun experiment,” as Hoskinson called it; which has maintained strong stability but struggled with adoption.

Crypto analysts now predict ADA could climb as high as $3 by 2027, or even $10 by 2030, if the new stablecoin achieves mass traction. But with ADA trading around $0.62, that would require a about 1,400% surge. It’s a tall order, even in bullish markets, and it’s why some traders are exploring newer opportunities, like Paydax Protocol (PDP), with better upside potential.

A Shift Toward Real Utility and Community Value

While the Cardano news keeps investors watching the big player, others are looking toward fresh opportunities. PayDax (PDP) has quickly become a standout project, offering a platform that bridges crypto lending, staking, and real-world asset tokenization in one clean ecosystem.

Through PayDax, users can borrow stablecoins by locking up digital or tokenized assets; from BTC and ETH to luxury watches and even real estate. Borrowers enjoy flexible loan-to-value ratios, while lenders earn up to 15.2% APY and stakers up to 20%. At the core lies the Redemption Pool; an insurance that covers lenders from borrowers’ defaults automatically.

Every transaction is transparent and on-chain, backed by custody partners like Brinks, Sotheby’s, and Jumio. It’s banking reimagined; borrowers set their rates, lenders set their returns, and insurance providers offer protection at peer-driven premiums. No middlemen. No hidden rules. Just a balanced, user-controlled market that works as freely.

Why PayDax Is Earning Trust from Retail and Institutional Traders

PayDax has built trust early through transparency, security, and tech-backed credibility. The platform has been fully audited by Assure DeFi, its core team is doxxed and KYC-verified, and it integrates global leaders like Chainlink for price accuracy, Jumio for KYC, MoonPay for fiat on-ramps, and Prosegur for the custody of tokenized assets.

These integrations create a safer environment for investors. KYC verification reduces the risk of rug pulls and builds accountability. It also aligns with global compliance standards, making PayDax more likely to secure major exchange listings. That’s why institutions are taking notice as the project has already raised over $1 million in presale funds, with interest growing steadily.

For small investors, this level of transparency is rare. It gives confidence that the team, led by verifiable names visible on PayDax’s site, isn’t hiding. It’s the kind of approach that keeps communities loyal and turns early adopters into long-term believers.

Why Early Entry Could Make the Difference in 2025

ADA may have a bright future if its stablecoin succeeds, but even a jump to $10 (a 1,400% rally) might not rival what an early-stage project like PayDax could deliver. In the fast-moving world of crypto, established giants grow slow, while innovative newcomers can multiply overnight.

With PDP priced at $0.015 in its current presale, the potential upside is huge. A $1,000 entry could be worth over $50,000 by Q1 2026 if momentum continues. This is because early PayDax investors are stepping into a growing ecosystem with built-in demand and transparent partnerships.

Institutional players are starting to circle, and with each presale phase, the price edges higher. Those who act early often capture the biggest gains. For anyone eyeing the next major opportunity beyond ADA, PayDax might just be it. Investors can even grab a 25% bonus using the code PD25BONUS before the next price stage begins.

Join the Paydax Protocol (PDP) presale and community:

Website

Telegram

X (Twitter)

Whitepaper

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.