A popular crypto analyst known as @MikoGenno has shared their perspective on why the cryptocurrency Kaspa (KAS) may buck the trend of experiencing a major speculative “blow off top” price surge during this market cycle.

In a recent post, @MikoGenno contrasted Kaspa’s dynamics with Bitcoin, which follows a four-year halving cycle that has historically led to blow off tops near cycle peaks before major corrections.

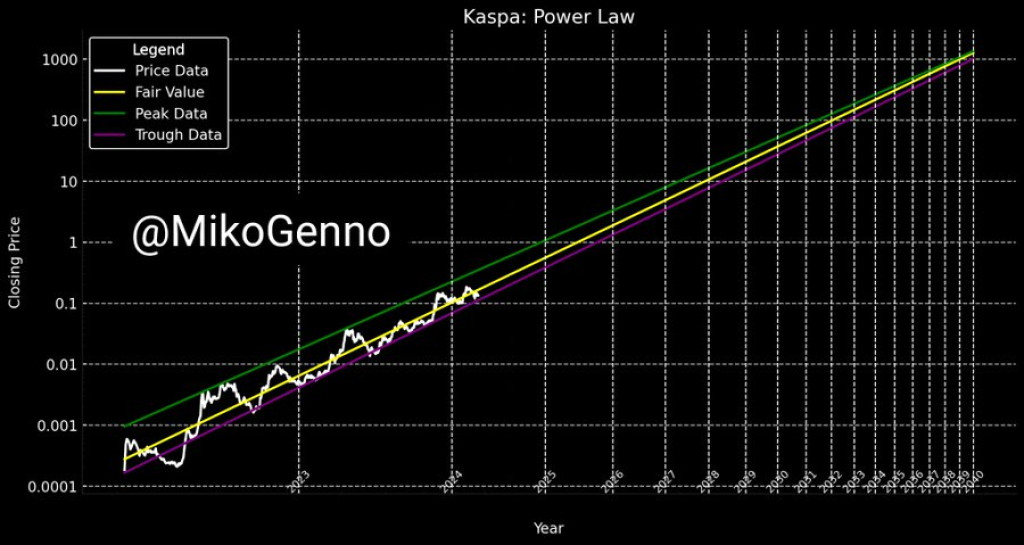

“If Bitcoin had a two-year ‘quartering’ instead of a four-year halving, the price chart would exhibit a two-year cycle with much smaller deviations around the ‘power law fair value’ – in other words, smaller peaks and blow off tops,” they explained.

Kaspa, on the other hand, has a monthly 5% reward reduction schedule. This amplifies the cyclical behavior seen with shorter halving periods. According to @MikoGenno, Kaspa exhibits a clear four to eight-month cycle “with much smaller returns per cycle and much smaller deviations from fair value.”

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +A key benefit of this behavior is avoiding a major unsustainable price blow off. “Kaspa won’t deviate from the power law fair value by a large order of magnitude. This is a good thing, because it also applies to the downside during bear markets,” the analyst noted.

In other words, while other cryptocurrencies may experience massive speculative bubbles during bull markets, Kaspa’s pricing is expected to remain more grounded and less volatile in both directions thanks to its tokenomics.

However, @MikoGenno acknowledges this lower volatility could frustrate some investors seeking bigger gains. “Most people will get fed up with Kaspa during bull markets when other projects have crazy blow off tops, while Kaspa follows its power law with diminishing returns.”

The silver lining is that Kaspa may retain relative strength during Bitcoin bear markets when other assets are crashing hard. As @MikoGenno stated, “Kaspa doesn’t need to ride Bitcoin’s coattails – it’s the ‘Trilemma solver,’ an entirely separate asset, so it will follow its own adoption curve.”

Whether this more tempered pricing behavior ultimately proves to be an advantage or disadvantage for Kaspa in the long run remains to be seen. But the asset’s unique monetary policy does appear positioned to avoid unsustainable bubble pricing, for better or worse.

You may also be interested in:

- Jupiter (JUP) and Mantle (MNT) Prices Pumping – Here’s Why

- Solana (SOL) Price Eyeing All-Time Highs in April?

- Blast’s Dynamic Ecosystem: Leading 5 Innovations in DeFi and Gaming

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.