This article will show you how to purchase crypto with Citibank, the fees associated with it, and the exchanges it allows. So buckle up and get ready for a thrilling ride into the world of cryptocurrency!

| Topic | Summary |

|---|---|

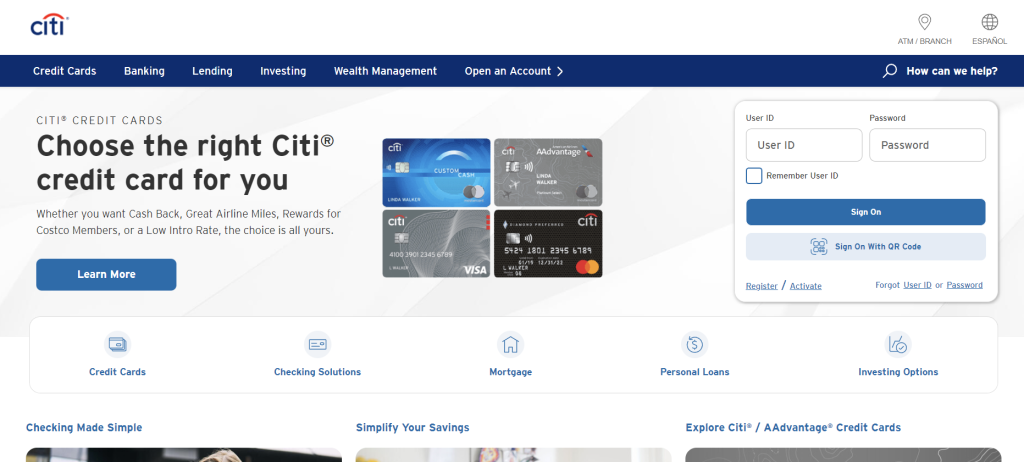

| 🏦 Purchasing Cryptocurrencies with Citibank | Customers can purchase cryptocurrencies using their credit or debit cards, or wire transfers via eToro. |

| 💳 Citibank’s Cryptocurrency Policy | Citibank allows customers to link their accounts to FINRA-regulated crypto exchanges for secure cryptocurrency purchases. |

| 🏧 Citibank’s Position on Cryptocurrencies | While Citibank doesn’t offer cryptocurrency services, it’s exploring digital assets and allows customers to buy crypto assets from US exchanges regulated by FINRA. |

What you'll learn 👉

How to buy Crypto with Citibank

Are you looking to buy Bitcoin and other cryptocurrencies with Citibank? It’s now easier than ever before, thanks to the wide range of banking products offered by Citi Bank.

With Citi GPS, customers can purchase crypto assets using their credit cards or debit cards, as well as wire transfers and other financial institutions. Moreover, there are no cash advance fees and a grace period of up to 56 days depending on the type of card used.

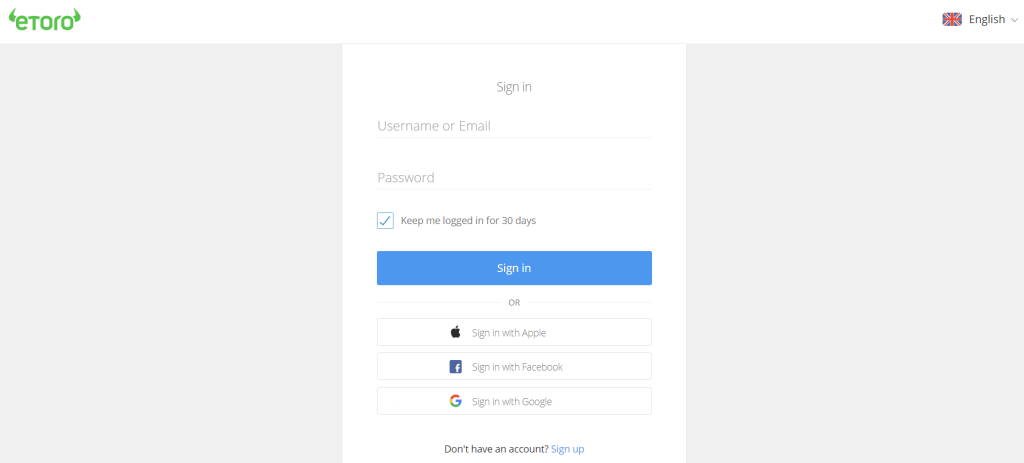

The process is straightforward: first, open an account on eToro and complete the onboarding process.

Tap ‘Deposit Funds’, pick a method and transfer money from Citibank.

Then go to the search bar, find the token you want to buy and click ‘Trade’.

Once your payment has been received, you will have access to a wide range of digital currencies such as Bitcoin and Ethereum.

Additionally, customers can benefit from credit card rewards and access their credit card balance for cryptocurrency purchases via Credit Cards.

What are the fees to buy Crypto?

When it comes to buying cryptocurrencies, the fees associated with each transaction can vary depending on the exchange you use.

Generally speaking, the most cost-effective way to purchase cryptocurrencies is through a crypto exchange such as eToro. They have some of the lowest fees around, as they don’t charge any deposits and only have a flat rate of $5 for withdrawals.

Additionally, their trading (buy/sell) fee for cryptocurrencies is only 1%, which is much lower than other exchanges.

On top of that, stocks and ETFs are completely free!

So when you’re looking to buy Bitcoin or other digital assets, make sure you compare the fees between different exchanges and opt for one that offers competitive rates. With eToro you can rest assured knowing that your funds are safe while also benefitting from their low fees – making them an ideal choice for anyone looking to invest in cryptocurrencies.

We recommend eToro

Take 2 mins to learn more

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

How to buy crypto with Citibank: Step-by-Step

In just four simple steps you can buy your digital currencies of choice with Citibank.

First, create an account on eToro and complete the verification process.

Then select the amount in USD that you’d like to deposit onto the eToro platform.

Thirdly, connect your Citibank account to deposit your fiat currency.

Finally, find the cryptocurrency of your choice and execute your trade! It’s that simple!

In addition to making it easy to invest in cryptocurrencies, Citibank also offers its users great rewards for purchases made via credit card. This includes cash back rewards which could help offset any fees incurred from buying cryptocurrencies as well as a grace period for paying off credit card balances before incurring interest charges.

About Citibank

Not only do they offer a comprehensive range of banking products–from personal and business banking to wealth management services–but they also provide great rewards for purchasing digital assets via credit cards.

With their low fees and cash back rewards, you can offset any costs associated with buying crypto, as well as benefit from a grace period for paying off credit card balances before incurring interest charges.

Plus, you can use Citi’s global presence and its innovative Citi GPS platform to make international transfers easier than ever. So if you’re looking to invest in Bitcoin or Ethereum securely and conveniently, then Citibank is the perfect solution for you.

Citibank’s crypto policy

Citibank allows customers to link their accounts directly to FINRA-regulated crypto exchanges, allowing them to purchase a wide range of cryptocurrencies such as Bitcoin and Ethereum quickly and securely.

With Citi’s global presence and its innovative Citi GPS platform, international transfers have become easier than ever.

Whether you’re a seasoned investor or just starting out in the world of cryptocurrency, Citibank provides all the resources and services necessary for successful crypto purchases.

What crypto exchanges does Citibank allow?

The bank allows customers to link their accounts to FINRA-licensed crypto exchanges, giving them access to a variety of digital assets such as Bitcoin, Ethereum, and Litecoin.

By linking your account directly to a trusted exchange, you can rest assured that your funds are secure and your information is protected. With Citi’s exceptional customer service and wide range of options, purchasing cryptocurrencies has never been easier or more convenient.

Does Citibank allow crypto purchases?

Yes, Citibank does allow crypto purchases. Customers can link their accounts to a FINRA-regulated crypto broker and access a variety of digital assets including Bitcoin, Ethereum, and Litecoin.

Final Thoughts

Citibank is quickly becoming one of the most popular financial institutions for those looking to purchase crypto assets.

With its wide range of services and products, customers have access to a variety of digital currencies and can make secure transactions with ease. Plus, the bank’s low fees, secure platform and exceptional customer service help ensure that customers have an enjoyable experience when making cryptocurrency purchases.

With Citibank’s reputation for reliable service and its commitment to providing customers with a wide range of options to trade in digital currencies, it’s no wonder they are quickly becoming one of the top choices for those looking to invest in crypto assets.