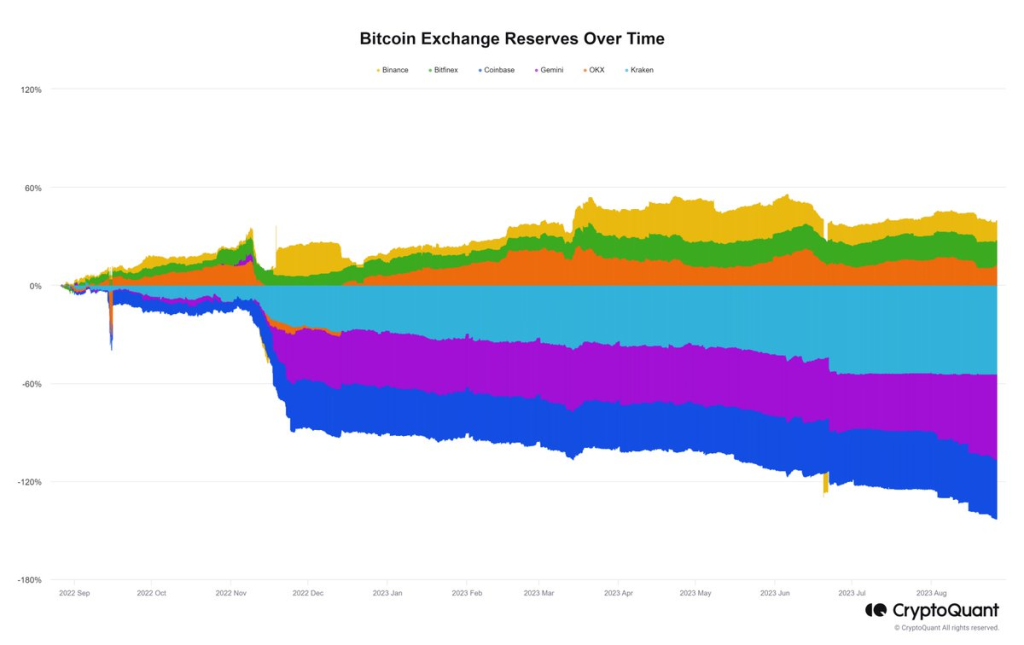

Recent data by Cryptoquant.com indicates notable shifts across three key Bitcoin market sectors – exchanges, institutions, and futures platforms. Reserves held by major exchanges like Coinbase, Gemini, and Kraken have declined substantially, with drops of 30-50% observed. Concurrently, indicators point to increased institutional accumulation of Bitcoin, while futures markets are seeing a surge in activity and exposure.

This convergence of trends has piqued the interest of analysts. Some view it as reflective of a maturing market, while others question what heightened futures activity could mean for price stability.

This article will break down the data around declining exchange reserves, increased institutional participation, and the ramp up in futures trading. The potential implications of these developments will also be explored. As always, readers are encouraged to draw their own conclusions based on the presented information.

Now, examining the data in more detail…

What you'll learn 👉

Centralized Exchanges See Decline in Bitcoin Reserves

Centralized exchanges based in the United States, including prominent names like Coinbase, Gemini, and Kraken, have witnessed a significant decline in their Bitcoin reserves. The reserves have decreased by at least 30% and in some cases, have plummeted by more than 50%. This trend has caught the attention of market analysts and investors alike, as it could signal a shift in market dynamics.

Institutions Continue to Accumulate Bitcoin

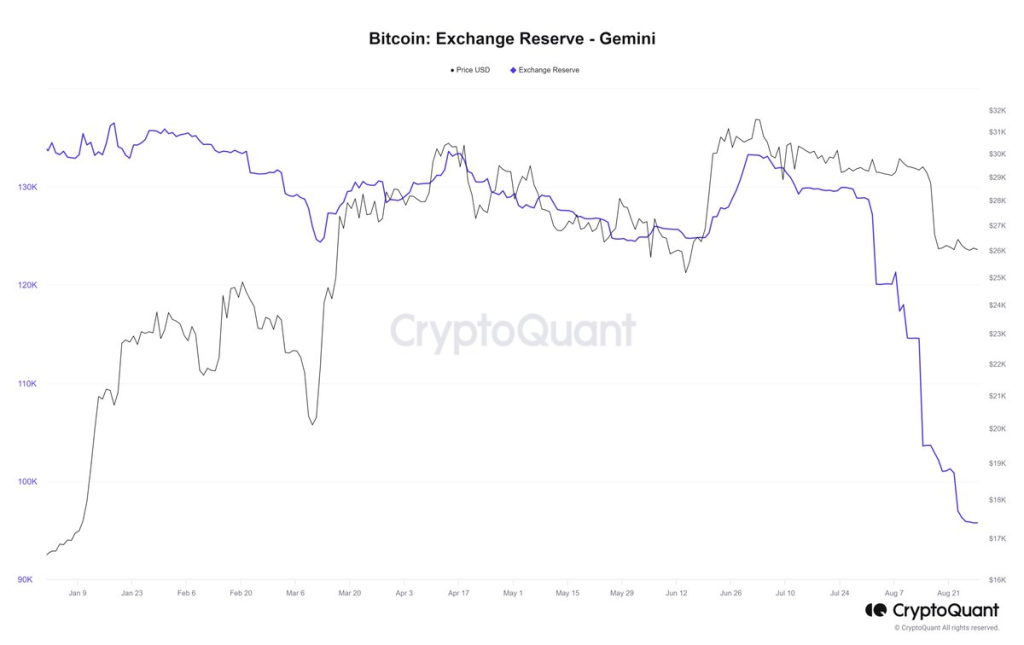

In contrast to the declining reserves on centralized exchanges, there has been a noticeable uptick in institutional accumulation of Bitcoin. Records of wallet deposits and withdrawals indicate that institutions are actively buying Bitcoin. For instance, more than 20,000 BTC, accounting for approximately 25% of the total, were withdrawn from Gemini alone.

Further data reveals that 27,700 BTC were withdrawn from a specific Gemini wallet address and transferred to other wallets. These transactions suggest that institutional investors are moving their assets to private wallets, possibly for long-term holding.

Surge in Futures Market Activity

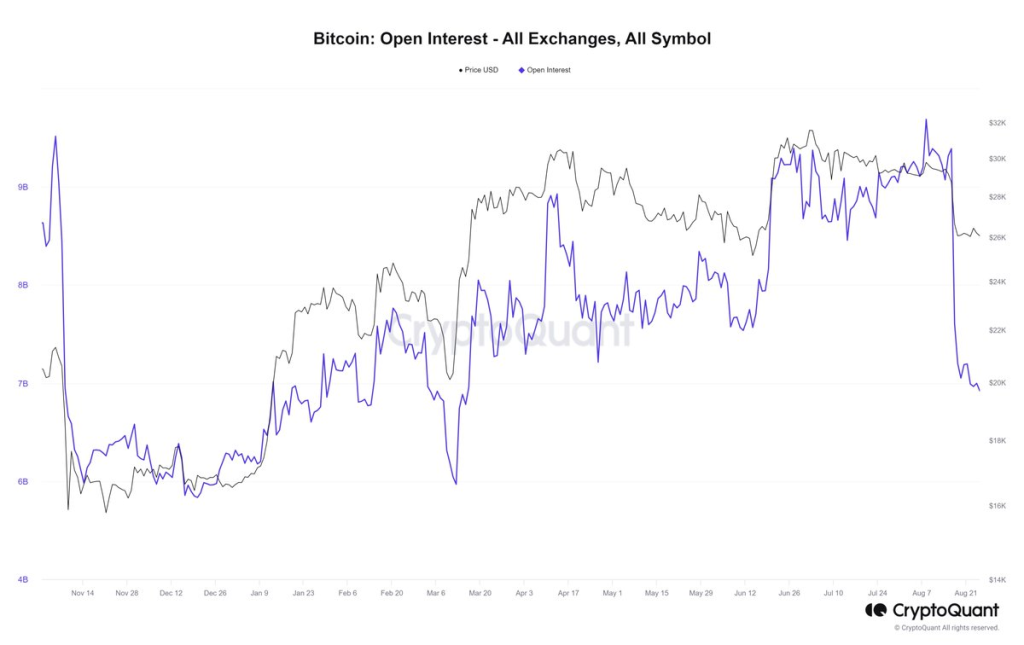

The futures market has also seen a surge in activity, with market participants significantly increasing their exposure to derivative products. Bitcoin’s Open Interest has recorded its highest all-time high since November of the previous year.

However, it’s worth noting that a significant correction occurred in the Bitcoin market recently, resulting in the most substantial long liquidation since the FTX collapse. This event has raised questions about market stability and the risks associated with high exposure to derivatives.

Conclusion

The decline in Bitcoin reserves on centralized exchanges, coupled with increased institutional accumulation and futures market activity, paints a complex picture of the current crypto landscape. While some view these developments as signs of a maturing market, others caution that the increased activity in the futures market could introduce new risks.

For real-time updates on these trends, various platforms offer live dashboards to monitor Bitcoin data.

Note: This article is based on aggregated data and does not aim to provide financial advice.