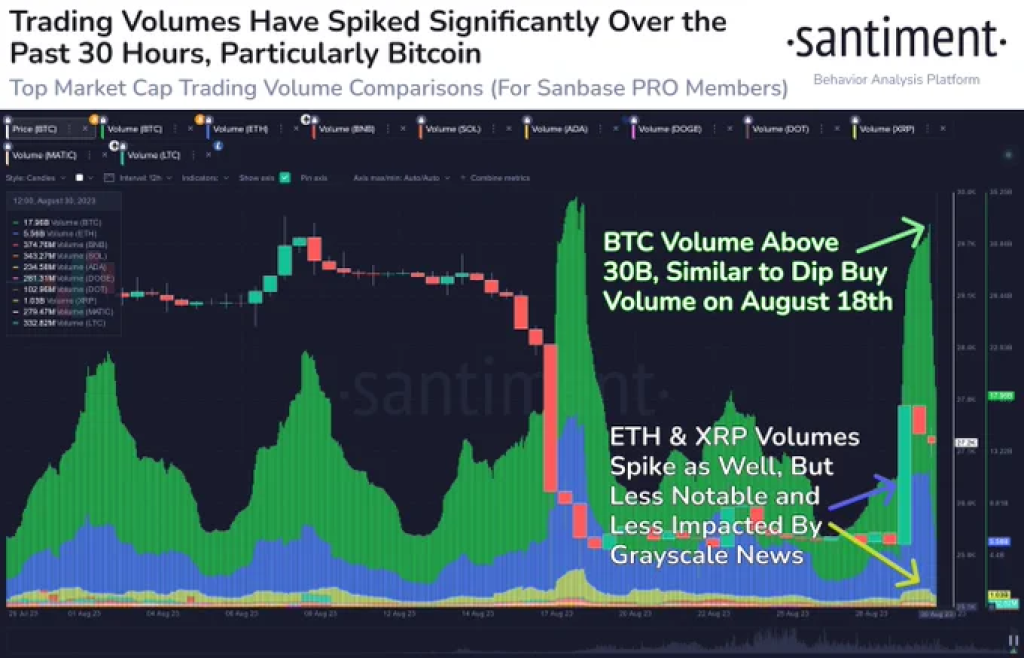

The cryptocurrency market is buzzing once again, with trading volumes experiencing a significant uptick following yesterday’s impressive price surge across the board, according to Santiment data. Notably, Bitcoin (#Bitcoin) is enjoying a revival in trader interest that could be indicative of future market trends.

Elevated trading volume often serves as a vital indicator of robust market sentiment. It could signify an influx of new investors or increased activity from existing ones. However, high trading volume is a double-edged sword. While it points to a potentially bullish outlook, it also paves the way for increased volatility, especially if there is a lack of consensus on future price direction among market participants.

Source: Santiment – Start using it today

What you'll learn 👉

The Critical Price Range for Bitcoin

At the moment, Bitcoin seems to be hovering in the $27,000 to $28,000 range. If the cryptocurrency manages to maintain this position, it could usher in a period of relative market stability. However, deviating from this bracket—either upwards or downwards—could incite a new wave of volatility.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Potential Scenarios

- Stability Within the Range: If Bitcoin stays within this narrow band, it suggests that both buyers and sellers have reached something akin to a temporary equilibrium. In such a scenario, market volatility is likely to decrease, making it a conducive environment for long-term investors.

- Breaking the Range: On the other hand, if Bitcoin leaves the $27K-$28K range in either direction, heightened volatility is almost certain. An upward break could trigger FOMO (Fear of Missing Out), driving prices even higher in the short term. A downward break could result in a cascade of sell-offs, further exacerbating market fluctuations.

The resurgence of trader interest in Bitcoin is not just a one-off event; it could serve as a harbinger of market sentiment. A sustained increase in trading volumes generally spells more robust price movements, be they bullish or bearish. In the case of Bitcoin, this renewed interest could be the fuel that either stabilizes the currency or propels it into a new phase of volatility.

As Bitcoin and the broader cryptocurrency market continue to garner attention, market participants should closely monitor trading volumes and price ranges. For Bitcoin, maintaining its position within the $27K-$28K band is crucial for short-term market stability. Deviations from this range are likely to provoke increased volatility, underscoring the importance of vigilance among traders and investors alike.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.