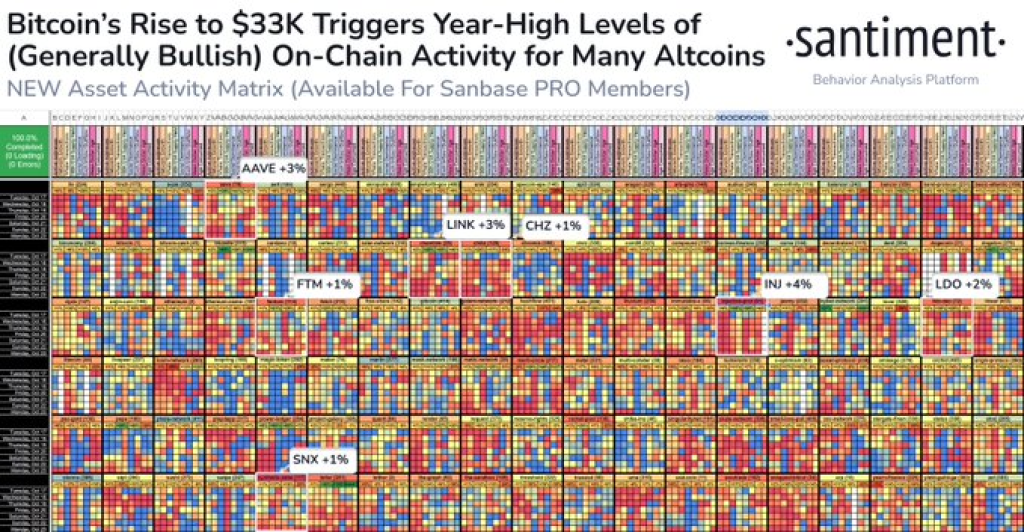

A number of top altcoins have seen a marked increase in whale activity and on-chain transfers this year, according to market intelligence platform Santiment. While the reasons behind the uptick remain unclear, it could signal renewed institutional interest in the altcoins sector.

Santiment reported large spikes in address activity and transactions by whales, or holders of significant token balances, for several leading coins. These include Aave (AAVE), Chainlink (LINK), Chiliz (CHZ), Fantom (FTM), Injective (INJ), Lido DAO (LDO), and Synthetix (SNX).

Source: Santiment – Start using it today

Kyber Network’s KNC token saw the most significant surge, jumping 27% amidst the recent market surge. Kyber facilitates decentralized token swaps and provides liquidity to DeFi protocols.

KNC token appears poised for further gains in the near-term after breaking out of its recent downtrend. According to analysis by altFINS, KNC has reversed into an uptrend across all timeframes after surging over 27% in recent days.

Source: altFINS – Start using it today

The sharp move higher caused KNC to break back above key resistance at $0.57 as well as its 200-day moving average at around $0.63. Unusually high trading volumes during the breakout signal conviction among bulls. With KNC punching into uptrend territory, altFINS sees near-term upside potential to $0.80 if momentum continues.

However, momentum indicators remain mixed currently. The MACD line is still below the signal line, pointing to some lingering bearishness. But the rising MACD histogram suggests bullish momentum could be returning soon. The RSI around 50 reflects a neutral trend strength.

Overall, the technical picture favors further gains for KNC if key support at $0.57 and $0.45 can hold. Initial resistance sits at $0.80, with more formidable hurdles around $0.95 where KNC saw rejection in mid-August. KNC will need to see momentum improve to test those higher levels.

In summary, Kyber Network appears to be in the early stages of a new uptrend after breaking its long-term downtrend. KNC looks positioned to press higher toward $0.80 in the near-term as long as bulls maintain control. The technical setup fits an emerging pullback within a new uptrend pattern.

The reasons driving the increased whale participation are not entirely clear. Some speculate that institutions and venture capitalists may be stocking up on DeFi tokens ahead of a potential crypto market turnaround. Others believe savvy crypto investors are jockeying for positions before major protocol upgrades and product launches.

Either way, the on-chain activity indicates renewed interest in altcoins following the brutal crypto downturn in 2022.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.