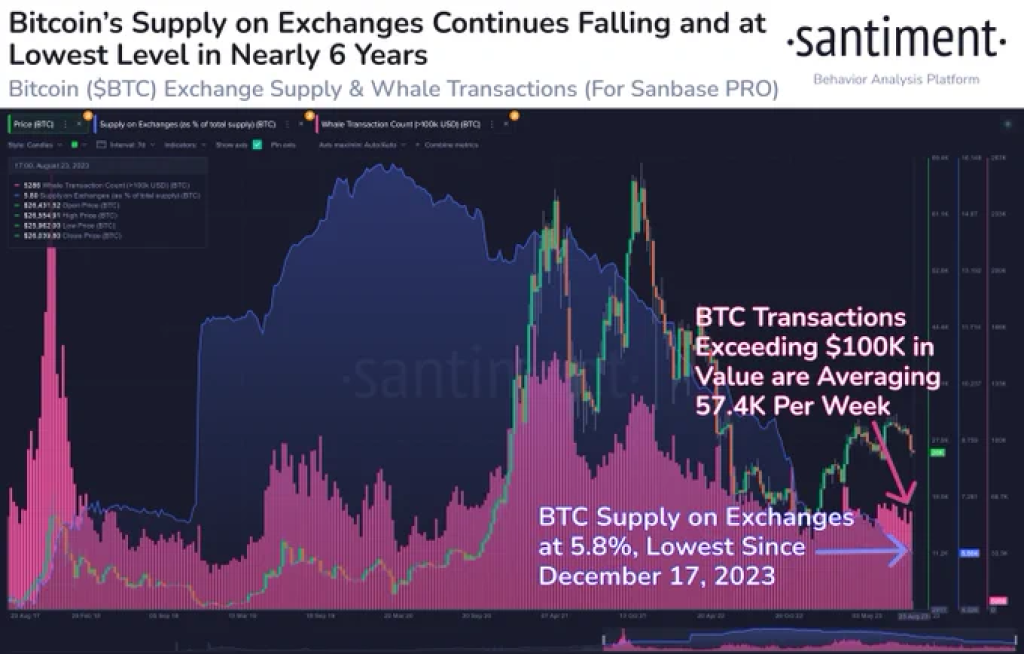

According to on-chain analytics firm Santiment, the amount of Bitcoin currently sitting on cryptocurrency exchanges has dropped to just 5.8% of the total circulating BTC supply. This is the lowest exchange liquidity level tracked for the top crypto asset since December 17, 2017, right before the massive bull run that propelled Bitcoin prices to nearly $20,000.

Source: Santiment – Start using it today

At the same time, Santiment also noted continued strong transaction activity from Bitcoin whales, defined as wallets holding between 1,000 and 10,000 BTC. An average of 57,400 whale transactions per week have been recorded recently.

The plunging Bitcoin exchange reserves underscore a dramatic supply squeeze that could lead to price volatility. When demand spikes occur with limited BTC liquidity, prices tend to shoot upward rapidly. This supply-demand imbalance suggests Bitcoin’s newfound scarcity could result in intense bull runs.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Santiment suggests traders and investors keep a close eye on these supply dynamics as potential fuel for the next major Bitcoin bull market. With demand indicators already flashing bullish signals, the stage may be set for significant upside in BTC prices if supplies remain constrained.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.