Bitcoin’s price action shows early evidence of basing behavior but remains vulnerable to final capitulation moves towards pivotal macro support. However, analysts broadly expect the worst bear forces to subside soon, setting the stage for accumulation ahead of the resumed upside.

What you'll learn 👉

Long-Term Support Needs Retest

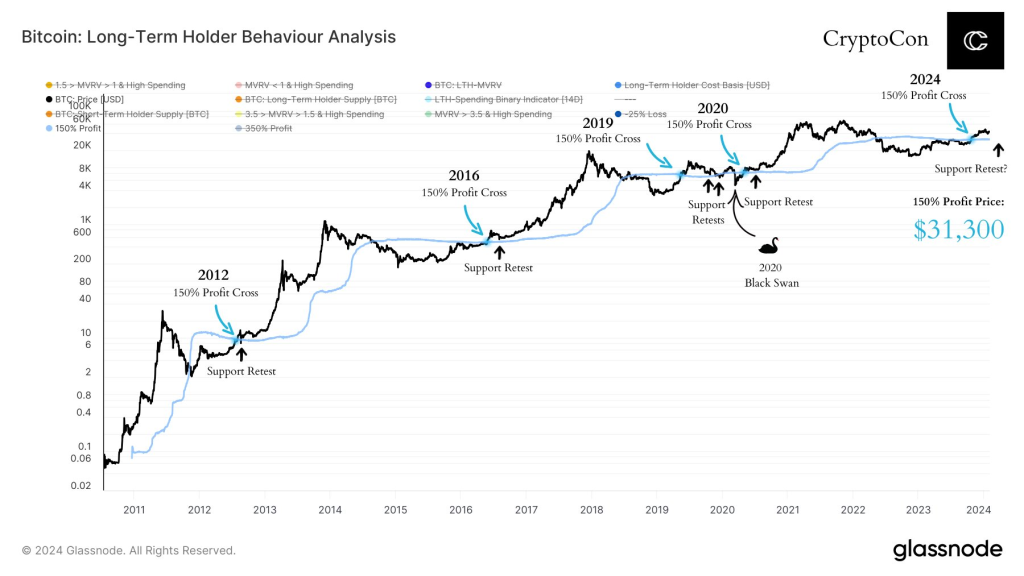

According to analyst CryptoCon, historical cycles argue another support retest likely occurs to reset negative sentiment and structural technicals:

“No #Bitcoin cycle has ever escaped a retest of the 150% long-term holder support line…This tells us according to this metric, price needs to visit around $31,300.”

Notably, this support area matches the 20-month moving average that capped previous macro bottoms. So an impending revisit could carve out durable lows ahead of renewed optimism.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Pre-Halving Rallies Seem Imminent

Meanwhile, analysts like Rekt Capital and Captain Faibik spot signs of accumulation as the next pre-halving impulse wave likely begins as soon as next month around March:

“Next bullish Rally is set to Start in mid-March,” says Faibik. While Rekt Capital stated that BTC could begin its pre-halving rally as soon as next week.

This would fit elegantly with historical cycles that tend to see Bitcoin bottoming phases complete a year before each scheduled halving event that cuts the new BTC subsidy supply in half every four years.

So in summary, while short-term data remains inconclusive, the confluence of price, momentum, and volatility indicators foreshadow that the long, cold bear winter may end soon.

This makes any final capitulation an attractive zone for re-accumulation. Once support confirms and pre-halving momentum accelerates through spring, Bitcoin seems primed to launch on its next exponential growth wave into 2024 and potentially new highs.

You may also be interested in:

- Why is Arcblock Price Up By 140%? Analyst Warns ABT Investors Of This Metric

- Why Ronin’s Price Tumbled After a Major Exchange’s Listing Mix-Up: Will the RON Listing Lead to a Rebound?

- Presale grows and grows – Ripple (XRP) & BNB (BNB) holders continue the bull run in Pushd (PUSHD) presale as 2024 shows big rewards

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.