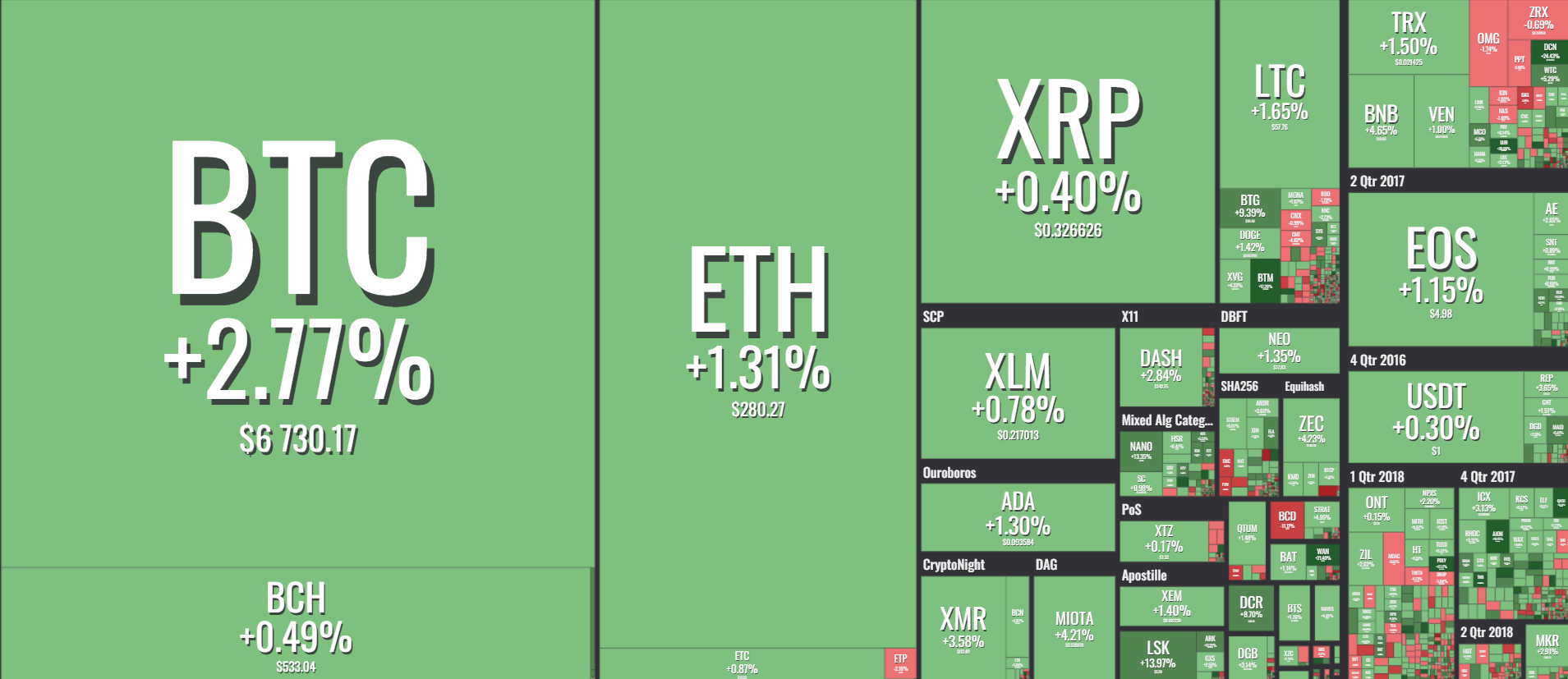

The market was on the move yesterday again as Bitcoin managed to regain some composure and navigate the rocky road towards the highs of $6800. This breakout wasn’t as violent as the one from a couple of days ago; it felt more natural, implying that there was some genuine buying pressure behind the move. At the same time, a lot of people remain skeptical and feel that the run is coming to a close, at least for now.

this is where longs come to die, ur in the wasteland now homie pic.twitter.com/oQ8Yszl8GH

— CryptoGainz (@CryptoGainz1) August 25, 2018

As always, let’s take a look at what some other traders had to say about Bitcoin and other top cryptocurrencies on the market:

Bitcoin (BTC)

CryptoWolfSignal also felt like Bitcoin is about to run out of juice and had some pretty clear targets for the near future:

“When the levels of 6800, 6900 and 6990 are reached, we recommend to become short position and wait for a decline, the sale can be divided into three uniform parts at these levels. We use the stop above the resistance of 7260, and the target zones for the trade on the decline will be the areas near the levels of 5500, 5300, 5120 and 4900.”

There were a couple of notable ideas shared on Twitter as well. @EthereumAddict noticed an Adam and Eve pattern forming:

Bitcoin adam and eve double bottom potential – #BTCUSD chart https://t.co/yAmKufUYAi

— Salt Addict (@EthereumAddict) August 24, 2018

@CryptoCred also posted this analysis on Twitter:

“Daily closed through the range high for the first time. If the breakout is real, blue box should hold as support and lead to higher prices. If it’s another trap and price can’t hold above the range high, I’ll be looking to short down to liquidity (red).”

Finally, @HsakaTrades shared a similar insight:

$BTC Intraday

• Range breakout to the upside

• Range high (green) retest should hold if this isn't a deviation.

• If it doesn't hold, watching the demand zone that formed prior to the range breakout.

• Resistance 1: Weekly level ~6870

• Resistance 2: Supply zone ~7100 pic.twitter.com/iIl2KAcflF— Hsaka (@HsakaTrades) August 25, 2018

Ethereum (ETH)

MarcPMarkets from TradingView thinks Ethereum is still relatively weak. He opens his analysis in a positive manner by pointing out that the price challenged one of its bearish trend lines. He is still vary of the coin as its underperforming when compared to some other alts that have recovered relatively okay during this BTC range. Therefore he concludes the following:

“We have put coins like ETH on standby until they can prove themselves in terms of price structure. This is a defensive measure that helps us maintain our objective of deploying capital toward the prospects that offer the greatest probability of a favorable outcome. We would rather give up the better prices in exchange for better probability.“

According to this account, there are better trading options out there than ETH and traders should (at least for now) avoid it to protect their portfolios. You can read more of the analysis here.

Ripple (XRP)

Shursst from TradingView was very short and rather bullish in his analysis:

“After the inversed Head and Shoulders, XRP has formed a second falling wedge. Bullish sign.”

Bitcoin Cash (BCH)

FxWirePro offered the following thoughts on BCH:

“Bias on the daily chart is neutral, but we see scope for some upside on the hourly charts. On 1H charts, momentum studies have turned bullish and RSI has edged above 50 mark with scope to run further. Break above 1H 100-SMA will see next major hurdle at 1H 200-SMA at 542. Breakout at 1H 200-SMA will see test of 38.2% Fib at 547 ahead of major trend line resistance at 556.”

EOS (EOS)

Trader rludvik thinks EOS is due for some bullish action:

“EOS fell out of downtrend channel and is now moving just above long term support. I’ll take this as beginning of a new chapter and give it a try with trade like:

- entry 72k5

- stop loss bellow that green area, initially at 66k9

- target 1 at 84k (around previous high)

- target 2 at 99k (just below psychological resistance of 100k)

- final target around 38.2% Fib level, will be defined later”

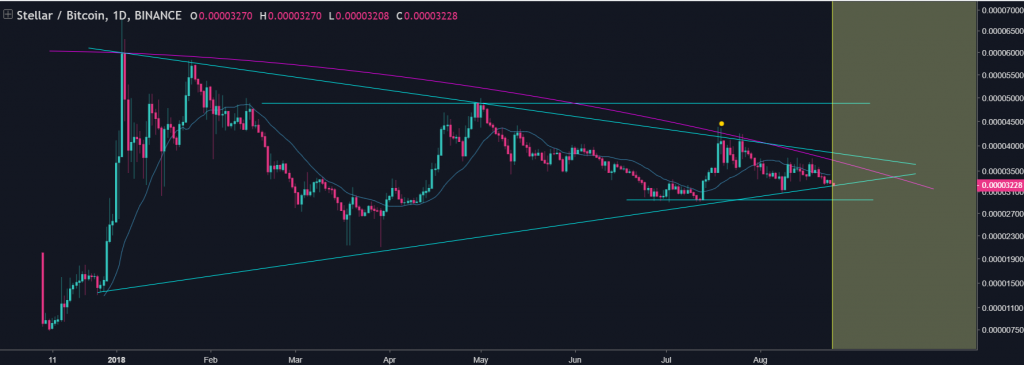

Stellar Lumens (XLM)

Trader senolito thinks XLM is on the brink of a move:

“Always an interesting development within a chart. To know something is going to happen soon is kinda exciting to follow. To me it feels like we’ll have some outbreak soon. The markets seemed to be unimpressed towards the SECs recent denial of further ETF proposals. This only shows that markets are following their own rules and traders are building up some kind of immunity towards a certain kind of real world chatter. We are listening to the silent before the storm.”

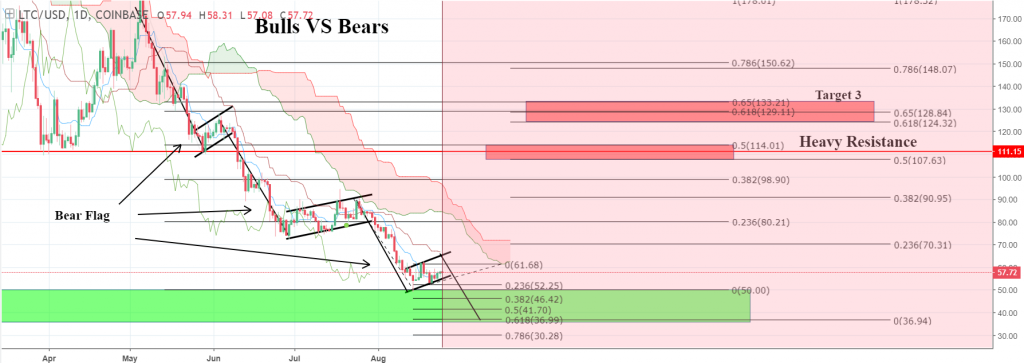

Litecoin (LTC)

Yo_adriiiiaan from TradingView notices an upcoming opportunity with Litecoin:

“Litecoin recently reached a low at just under $50 and is now hovering at $56. With this current sideways movement we are forming another bear flag. As you can see we have formed a series of bear flags. Based on a Fibonacci extension this bear flag would send price down to sub $50 and as low as $36.99. However not every bear flag produces a continuation of the trend.

Check out the complete analysis here to see what his buying/selling targets are.

Other thoughts

The rest of the market took yesterday’s Bitcoin movement as a sign of strength and we saw some decent gains across the board. We had 8 currencies breach the 10% daily gain range; Substratum with 19% was the highest gainer, while Wanchain, Aion, Bytom, Ark, QASH, Lisk and Nano completed the club. Meanwhile there weren’t many currencies in the red, as Bitcoin Diamond topped this side of the beard with a 7% drop on the daily. As of now, we wait to see what Bitcoin is capable of doing at this level and can it turn the $6800 into a support.