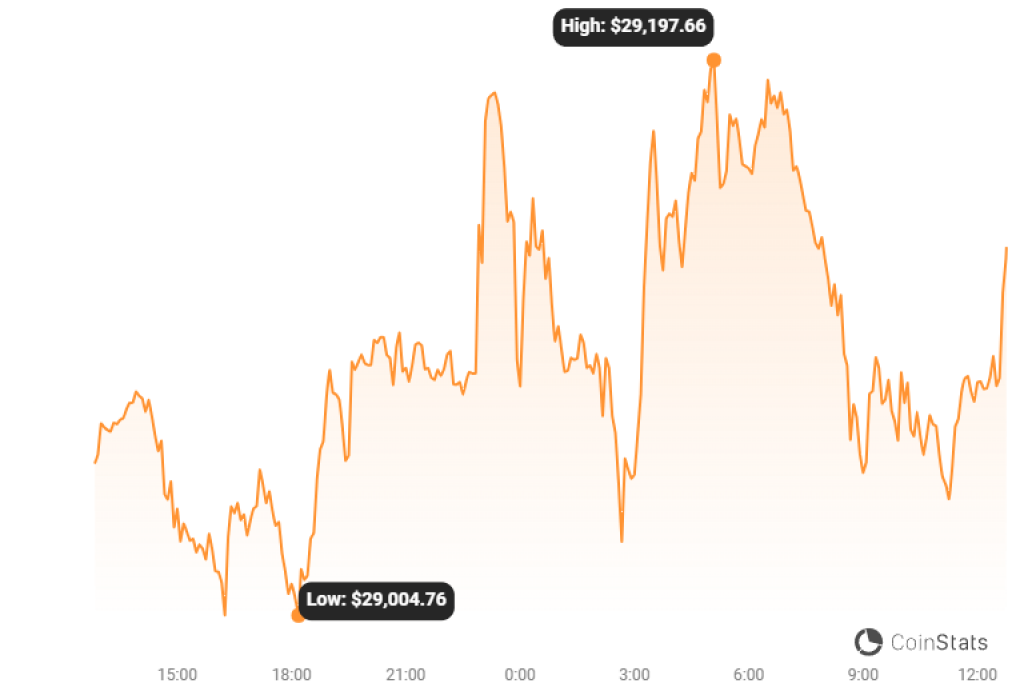

Bitcoin, the world’s premier cryptocurrency, has recently shown signs of vulnerability. Over the past month, the price has struggled to maintain its strong support level at $29,250. This has led to a flux in its value, with a decrease of approximately 4% in the last 30 days. Such movements by Bitcoin indicate a consolidation phase in the market.

Rekt Capital, a top-notch analyst and well-known trader on Twitter, recently shared his insights on Bitcoin’s current market dynamics:

What you'll learn 👉

1. Bearish Bias Concerns:

Bitcoin’s current market position has raised concerns regarding its bearish bias. For the cryptocurrency to move away from this bias, several key actions need to occur:

- Reclaiming Support: Bitcoin must reclaim the $29,250 mark as its support. This level has been a significant point of contention in recent times, and its reclamation is vital for a bullish outlook.

- Breaking the Trend of Lower Highs: Since the late June peak, Bitcoin has been forming a series of lower highs on its price chart. This trend needs to be broken to signal a potential bullish reversal.

- RSI Downtrend: The weekly Relative Strength Index (RSI) is another crucial indicator to watch. For Bitcoin to shake off its bearish bias, the RSI must break its current downtrend, invalidating the ongoing bearish divergence.

Source: CoinStats

2. Double Top Structures:

One of the patterns that has been observed in Bitcoin’s price movement is the formation of double top structures. These structures have specific characteristics:

- Symmetry: Bitcoin’s double top structures tend to be quite symmetrical. The first half of the current double top took around 90 days to form, while the second part has been forming for 56 days.

- Completion Timeframe: If the current pattern holds, the double top could be fully realized by mid-September, signaling potential significant price movements.

3. Potential Resistance at $29,250:

The $29,250 mark has been a significant level for Bitcoin in recent times. Its role in the market dynamics is highlighted by the following:

- Weekly Candle Close: A close below the $29,250 level on the weekly candle chart is not seen as favorable. If Bitcoin fails to maintain this level, it could turn into a new resistance point.

- Double Top Formation: If the aforementioned resistance is established, Bitcoin could potentially reject lower values, leading to the formation of the second part of its double top.

- Bearish Divergence: The presence of a weekly bearish divergence adds to the bearish outlook, emphasizing the importance of the $29,250 level.

Conclusion: Rekt Capital, the technical analysis expert, provides a comprehensive view of Bitcoin’s current market position. The consolidation phase, coupled with the potential formation of a double top and the challenges around the $29,250 mark, are pivotal areas to monitor. As the market evolves, these insights will be invaluable for investors and traders aiming to navigate the crypto landscape effectively.