Bitcoin tends to move in predictable 54-month cycles that could see its next peak arrive well before November 2024, contrary to current sentiment, according to crypto strategist Haejin.

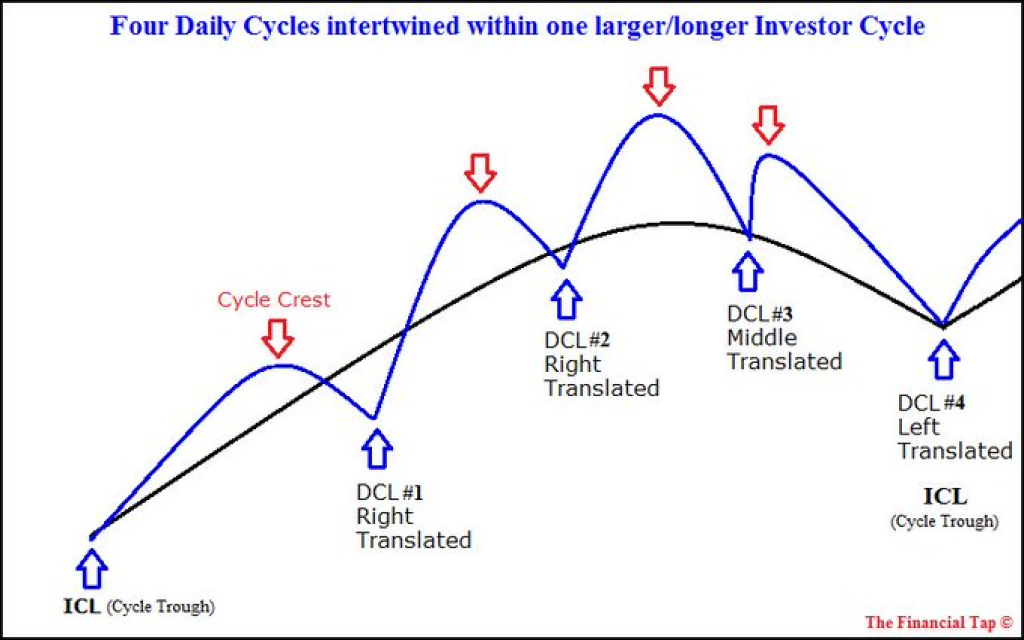

Haejin notes Bitcoin’s price has risen and fallen over three previous 54-month cycles since 2015. Each was aligned with the right-translated pattern where BTC topped out after the cycle midpoint. But historically, the fourth iteration almost always follows a left-translated structure with an earlier peak.

If this pattern holds, it suggests Bitcoin’s current cycle, which started in November 2022, could crest before hitting the halfway mark in November 2024. Rather than the ultra-bullish forecasts dominating social media, a climax ahead of schedule around mid-2023 is plausible when accounting for cyclical tendencies.

While not guaranteed, Haejin urges traders to be open to this cycle inversion and the probability of an earlier-than-expected Bitcoin peak. Previous 54-month translations indicate the next bear market could also last beyond just two years.

Read also:

- Solana Bullish as SOL Reaches $60 First Time Since May, But Initial Retracement to This Level Is Possible

- This BTC Indicator Makes It ‘Incredibly Easy’ to Know if Bitcoin Is in a Bull or Bear Market

- Analyzing Future Prospects: $ROE, XRP, and SOL’s Potential for Market Growth

In summary, Haejin believes most are ignoring Bitcoin’s cycle history, which argues against unchecked euphoria. By mapping cycles, prudent traders can maximize profits and minimize risk rather than fall prey to hopium. While anything is possible, cyclical analysis hints the next Bitcoin fever may arrive sooner and be more short-lived than most expect.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.