Bitcoin fell by a steep 8% from high to low yesterday after dropping from $45,510 to reach as low as $41,450.

The cryptocurrency has somewhat recovered as it battles to remain above a long-term trend line, and the bullish narrative is still in play, with the SEC expected to approve a Bitcoin spot ETF in the coming days.

Despite Bitcoin’s price drop, there are some newly emerging projects that continue rising.

In particular, Bitcoin Minetrix ($BTCMTX) continues to turn heads after raising a staggering $7.4 million in fundraising.

Investors are rushing to get positioned in this stake-to-mine ecosystem that overhauls cloud mining ahead of the next Bitcoin block halving.

What you'll learn 👉

Bitcoin Drops By a Steep 8% After Report Suggests SEC ETF Approval Might Be Delayed

Bitcoin underwent a major shakeout yesterday after falling by a steep 8% in just a few hours.

The shakeout caused almost $600 million worth of longs to be liquidated, creating a much-needed reset in the overheated futures market.

The wipeout was primarily attributed to a leaked report that the SEC was about to reject all of the Bitcoin spot ETF proposals for the January 10th window.

The report was released by Matrixport analyst Markus Thielen, who argues that all twelve Bitcoin spot ETF applications still fall short of the SEC requirements.

The report was released on X (formerly Twitter) and caused a sudden capitulation once circulated;

Despite the shakeout, Bitcoin managed to find support at the January 2021 highs of around $42,050 and has since rebounded above a long-term ascending trend line that has been in play since November.

Looking ahead, if the buyers can manufacture a rebound from here, the first level of resistance lies at $44,000.

This is followed by resistance at $44,750 (Feb 2022 resistance), $45,920 (weekly highs), and $46,735 (1.272 Fib Extension).

On the other side, the first level of support toward the downside lies at the rising trend line. Beneath the trend line, support lies at $42,050 (Jan 2021 highs), $41,000, and $40,000.

Investors Start To Look For Alternative Options With $BTCMTX Turning Heads.

With Bitcoin tumbling, investors are looking for alternative options to provide considerably higher returns.

In particular, Bitcoin Minetrix ($BTCMTX) continues turning heads as investors rush to the novel stake-to-mine ecosystem.

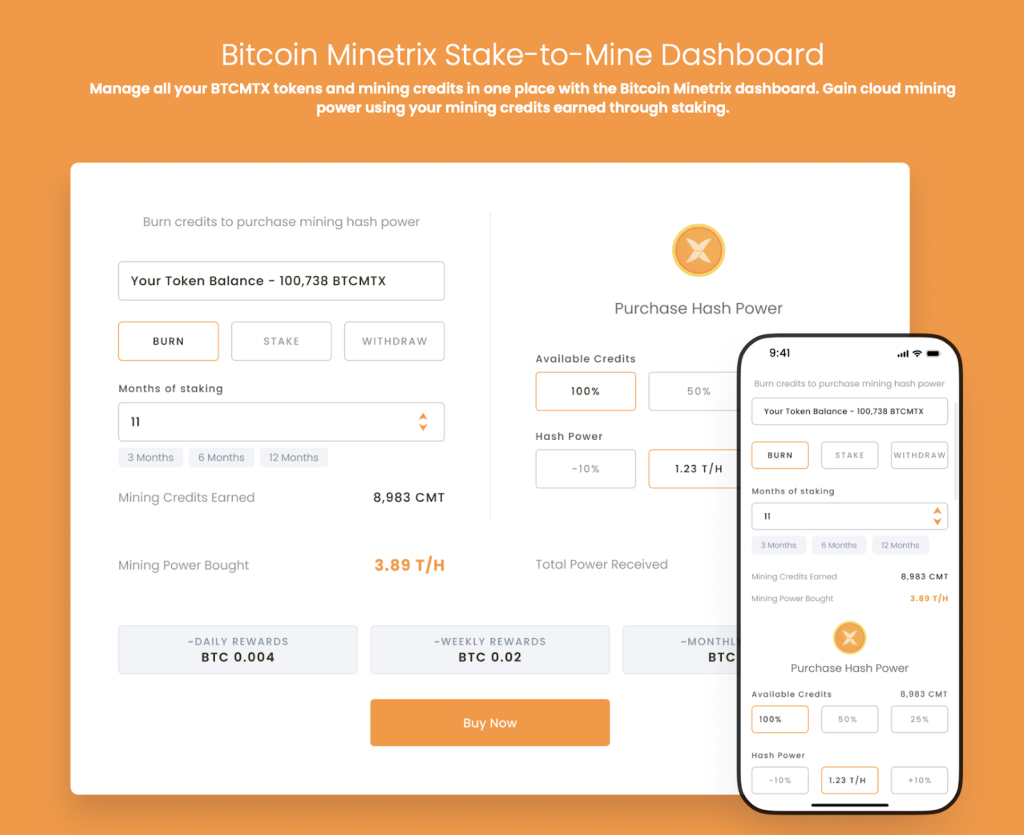

Bitcoin Minetrix seeks to decentralize cloud mining before the next Bitcoin block halving through a tokenized process.

Given the exceptional $7.2 million already raised, it’s clear that investors are touting the project as a disruptive force in the multi-billion dollar cloud mining sector.

Why Has Bitcoin MInetrix Raised a Staggering $7.2 Million So Far?

Bitcoin Minetrix continues raising funds during bearish market conditions as investors believe the market has a strong need for decentralized cloud mining.

Cloud mining isn’t a new feature in the industry. It allows everyday users to mine Bitcoin without buying or maintaining expensive hardware.

However, today’s centralized services exhibit shady business practices that lock miners into long-term contracts and short on expected earnings.

Bitcoin MInetrix intends to change this through a tokenization process.

Miners simply have to buy and stake $BTCMTX tokens to earn Mining Credits, which can then be burnt for mining time on the Bitcoin Minetrix mining solution.

The tokenization means miners can easily unstake and sell their $BTCMTX anytime, meaning they’re always in control of their funds.

Furthermore, as audited smart contracts automatically allocate user allocations, miners will never be left short on their expected mining return.

Double Income Through Stake-to-MIne – Get Positioned Before It’s Too Late

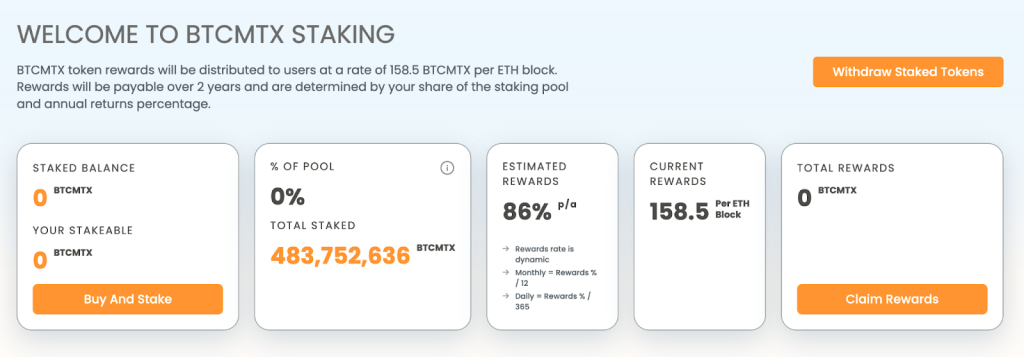

In addition to the mining returns, the income on Bitcoin Minetrix is doubled through its staking infrastructure.

Users have to stake their $BTCMTX tokens to earn Mining Credits to mine. The act of staking provides another source of passive income for participants. For example, those currently mining earn an impressive 86% APY on their holdings.

With the presale gaining momentum, time is running short to get positioned at the early adopter prices.

The presale is currently selling the token for $0.0126.

However, the increasing pricing strategy means the cost of $BTCMTX rises during subsequent presale stages. As a result, those getting positioned earlier benefit the most.

Overall, Bitcoin Minetrix has timed its market entry perfectly, with the Bitcoin block halving scheduled for April. Post-halving, $BTCMTX might be one of the most important projects in the mining sector, so it’s always best to get positioned ahead of the event.

Disclaimer: CaptainAltcoin does not endorse investing in any project mentioned in this article. Exercise caution and do thorough research before investing your money. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the reader. CaptainAltcoin is not liable for any damages or losses from using or relying on this content.