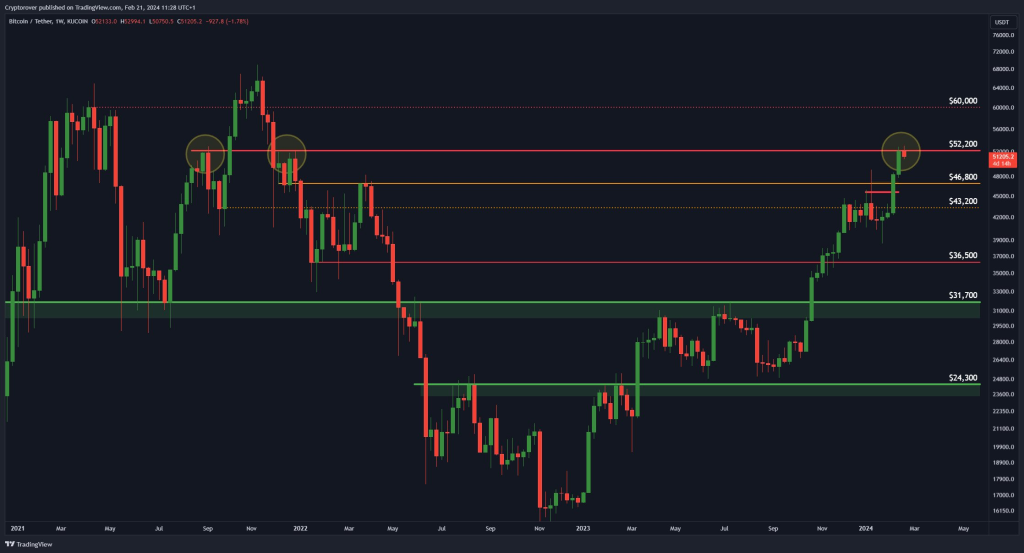

As the crypto market wraps up its most positive February in years, Bitcoin now contends with multiple perspectives on which direction prices will trend next. With BTC navigating just under $52,000 resistance, analysts consider both continued upside and interim pullbacks as the range tightens ahead of an imminent volatility spike.

What you'll learn 👉

Rover Eyes Path to $60,000 on Decisive Breakout

Veteran swing trader Crypto Rover maintains a constructive outlook premised on Bitcoin reclaiming the $52,200 level that capped rallies on multiple recent occasions. In his assessment, a daily close above that barrier can precipitate a swift rally toward formidable resistance at $60,000.

With cautious sentiment permeating crypto X even amidst recent gains, Rover believes meditated fear creates an atmosphere ripe for explosive upside moves should key technical hurdles fall. But until then, whippy two-sided price action looks likely, according to the seasoned trader.

Lower Timeframe Pullback May Offer Final Dip Buy

However, Rover points to a near-term pullback remaining possible in the days ahead. With Bitcoin still ranging between well-defined support and resistance between $51,000 and $52,500, he expects resolution of the tense consolidation one way or another soon.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Notably, analyst Freedom by 40 identifies potential downside areas that could be revisited in the event of a flush-out leg lower. However, he anticipates such a dip, marking “one of the last best chances” for investors to buy Bitcoin and mining equities at discounted levels. With his analysis not ruling out drops as low as $47,000, he maintains a bullish medium-term outlook premised on buying key support.

Cautious Sentiment Sets Stage for Further Growth

According to trader Jelle, market psychology has shifted considerably from Bitcoin’s last break above $50,000 in 2021.

Jelle views this cautious vibe in constructive terms for Bitcoin’s potential growth story. With less euphoria abounding compared to past cycles, he believes patience will pay off handsomely for bulls again in the next leg when capitulation exhausts.

Declining Exchange Balances Offer Hope

Supporting the longer-term bull case, on-chain statistics shared by analyst Bitcoin News reflect shrinking BTC inventory held across major exchanges. At just 11.79% of total circulating supply, current exchange balances mark lows unseen since over 6 years ago in 2018.

Despite blockchain activity, institutional adoption, and developer sentiment around Bitcoin remaining sturdy, the mixed analyst interpretations underscore uncertainty prevalent across market participants.

As exchange balances dwindle to multi-year lows, the coming weeks look pivotal in settling the tense debate between reflexive dip buyers and breach believers. With critical levels now in play across the timeframes, big moves loom as the range tightens ahead of Bitcoin’s moment of truth.

You may also be interested in:

- ‘Ethereum Will Likely Outrun Bitcoin (BTC) This Week’, Analyst Forecasts Next Leg Up for ETH

- Japan’s Jasmycoin Price Soars Amid Whale Movements: Can JASMY Hit New ATH? Pay Attention To This Metric

- BlockDAG’s $2 Million Giveaway and 5000x ROIs Pull in Investors from ScapesMania and Solana

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.