The term ‘HODLing’ has emerged as a popular strategy among long-term Bitcoin holders. This term, originating from a misspelling of ‘hold’, has come to signify the act of holding onto a cryptocurrency, particularly Bitcoin, for a long period without selling it.

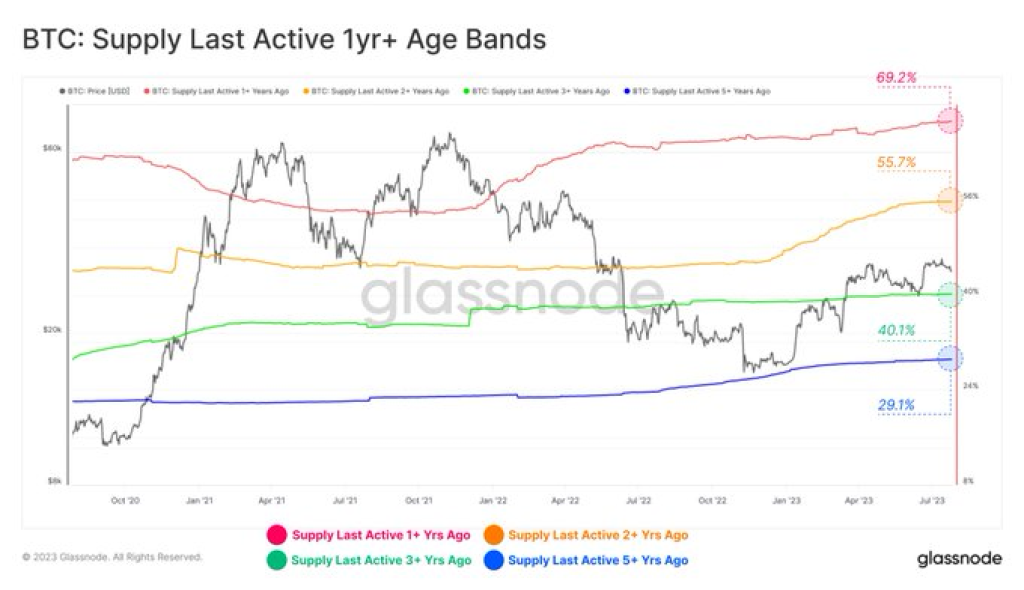

The recent data from Glassnode, a renowned blockchain analytics firm, reveals an intriguing trend in the Bitcoin market. The Bitcoin Supply Last Active Age Bands, which represent the percentage of the total Bitcoin supply that has remained inactive for a certain period, are currently at all-time highs (ATHs). This suggests that HODLing is the primary dynamic across all subsections of the long-term holder cohort.

An astonishing 69.2% of the total Bitcoin supply has been inactive for more than a year. This indicates a strong belief among holders in the long-term value of Bitcoin, despite the notorious volatility of the crypto market.

Delving deeper, we find that 55.7% of the Bitcoin supply has not seen any activity for over two years. This group of steadfast holders further underscores the prevalence of the HODLing strategy.

The trend continues with 40.1% of the Bitcoin supply remaining dormant for more than three years. These holders, undeterred by market fluctuations, demonstrate an unwavering faith in the potential of Bitcoin.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Finally, the ultimate HODLers, those who have held onto their Bitcoin for over five years, make up 29.1% of the total supply. Their commitment to the long-term prospects of Bitcoin is truly remarkable.

The HODLing strategy has a significant impact on Bitcoin’s price. When a large portion of the Bitcoin supply remains inactive, it reduces the available supply in the market. This scarcity, coupled with increasing demand, can exert upward pressure on the price.

In essence, the HODLing strategy, as reflected in the Bitcoin Supply Last Active Age Bands, is a testament to the long-term faith in Bitcoin’s value. It’s a fascinating insight into the psychology of the crypto market, revealing a collective commitment to weather the short-term storms in anticipation of long-term gains.