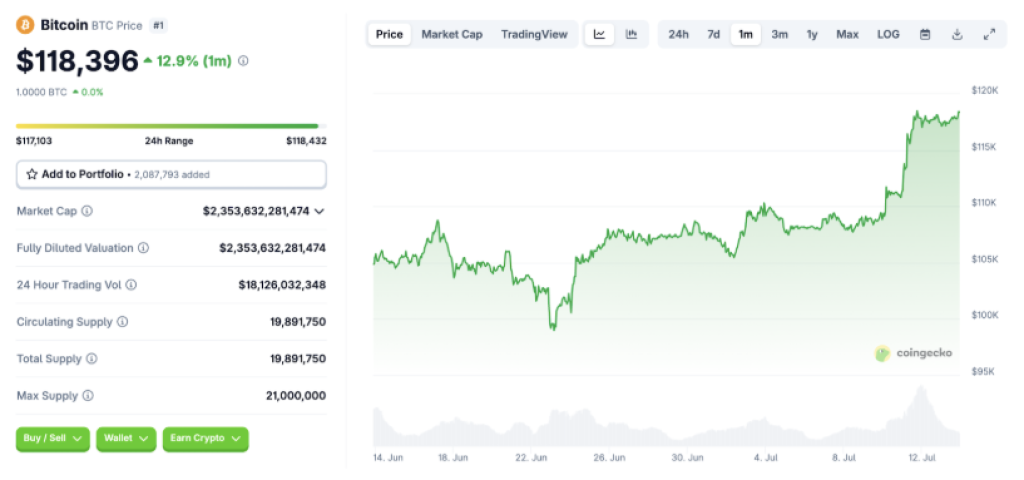

Bitcoin has crossed the $118,000 mark for the first time in history, a move powered by massive inflows into spot ETFs and optimism surrounding potential Fed rate cuts. Analysts point to institutional buying pressure, increased macro uncertainty, and tightening supply as catalysts behind Bitcoin’s recent surge.

This new all-time high highlights Bitcoin’s increasing status as a global macro hedge. As inflation fears remain and fiat devaluation persists in several regions, BTC is emerging as a safe-haven asset not just for retail investors but also for pension funds, asset managers, and sovereign wealth funds.

What you'll learn 👉

ETF Inflows Topping $51B: Spot & Futures Demand

Total ETF inflows into Bitcoin have now exceeded $51 billion as of July 11, 2025, with a record-breaking $1.18 billion entering the market in a single day. BlackRock, Fidelity, and Franklin Templeton are among the top institutional players aggressively scooping up BTC through ETF channels.

This unprecedented ETF demand has been driven in part by easier regulatory frameworks, particularly in the U.S. and select European markets. Analysts note that the accessibility of BTC through retirement accounts and traditional brokerages is a game-changer for mainstream adoption.

Tariffs & Geopolitics Fuel BTC Safe‑Haven Case

Market volatility surrounding upcoming U.S. tariffs, ongoing geopolitical tensions, and speculation around a late-2025 Fed rate cut have positioned Bitcoin as a hedge asset once again. Investors see BTC as a long-term store of value in times of fiat instability.

These macro tailwinds have also ignited risk-on appetite in crypto. Traders are closely watching July’s inflation report and global central bank policy meetings, as dovish stances could signal more upside for both Bitcoin and altcoins.

Altcoin Season Emerges: Ether, Solana & Memecoins Gain

With Bitcoin soaring, capital is rotating into other top-performing assets. Ethereum is up 7%, Solana has risen 4.7%, and XRP is posting double-digit weekly gains. Altcoins are catching wind as traders search for the next breakout plays.

Meme coins and utility-driven tokens are also seeing surges. BONK, PEPE, and FLOKI are gaining traction as traders look for higher beta opportunities. These microcaps often become short-term winners when Bitcoin consolidates.

Meme-Fi 3.0: Utility-Driven Memecoins Take Center Stage

The meme coin space is undergoing an evolution. Instead of pure speculation, Meme-Fi tokens are now incorporating actual utility. Projects like Pengu, Useless, and FloppyPepe (FPPE) are building creator tools, staking features, and AI integrations to offer long-term value.

This new era of meme tokens is drawing attention from both DeFi veterans and new investors who want viral excitement without sacrificing functionality. Many of these tokens are gaining momentum thanks to community-driven governance and scalable ecosystems.

FloppyPepe (FPPE): Leading Meme-Fi with AI & DeFi Edge

FloppyPepe is at the forefront of Meme-Fi’s utility wave. With a viral ecosystem built on Ethereum, FPPE has surged over 18% this week, driven by presale interest and DeFi tools like FloppyAI, FloppyX DEX, and Meme-o-matic.

100% Bonus Tokens – Use code: FLOPPY100

FPPE isn’t just riding hype—it’s building an infrastructure that supports meme creators, traders, and DeFi enthusiasts alike – potential 100x token in the making. Its roadmap includes NFT integrations, community voting, and cross-chain expansion, setting it apart from traditional meme coins.

Retail vs Institutional Rotation: What Flows Tell Us

Retail traders are chasing fast ROI in meme tokens, while institutions continue to pile into Bitcoin via ETFs. The resulting dual narrative is creating a two-speed market: one driven by stability, the other by virality and innovation.

On-chain data shows smaller wallets accumulating meme coins, while whales and funds dominate BTC flows. This parallel movement underlines a broader theme in crypto investing—diversification between safe assets and explosive growth plays.

How ETF Tailwinds Could Propel Meme-Fi’s Next Wave

With institutional money solidifying Bitcoin’s base and meme-Fi gaining traction, the stage is set for a diverse bull market. Tokens like FloppyPepe could emerge as high-risk, high-reward additions as altcoin season unfolds.

As altcoin dominance increases and Bitcoin consolidates, meme-Fi projects with genuine innovation could lead the next phase of the rally. Top picks – FloppyPepe and Pengu, with their DeFi tools and viral marketing approach, could be the top contenders in this altcoin space.

Another potential 100x token in the making – on to our next review – Altcoin – with market cap over 125M on its first week.

July 2025 may go down as the month where Bitcoin confirmed its institutional dominance—and meme-Fi took its first step toward becoming the next breakout star.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.