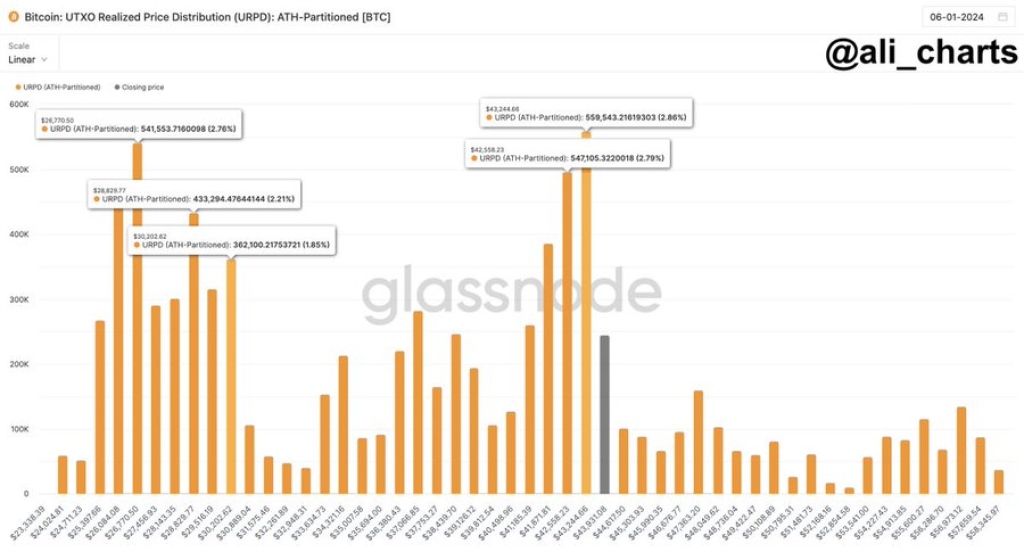

According to crypto market analyst Ali, Bitcoin is demonstrating remarkable support around the $42,500 to $43,250 level. He notes that approximately 1.11 million BTC were accumulated in this price range without yet being sold off. This makes it one of the most significant support zones for the cryptocurrency.

In a recent tweet, Ali pointed out that “If Bitcoin can hold above this level, there is not much significant resistance ahead that will prevent it from advancing further.” However, he cautions that a failure to maintain the support could result in a downward move to retest lower areas between $26,770 and $30,220.

Strong hands accumulating

The buy-side pressure absorbing around 1.11 million BTC indicates confident market participants establishing positions with a long-term outlook. As Ali highlights, their unwillingness to sell below the approx. $43,000 threshold demonstrates a strong conviction that higher prices lie ahead.

Such well-defined support bodes well for further upside once immediate selling pressure exhausts itself.

Limited overhead resistance

Should Bitcoin maintain or build upon its existing support, Ali notes there are few remaining barriers overhead before the cryptocurrency can enter price discovery mode. This indicates plenty of open-air room for the bulls to stretch their wings, unimpeded by prior technically-significant levels.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The analyst seems to suggest Bitcoin finding acceptance above $43,000 paves the way for a retest of annual highs around $69,000. Perhaps even setting the stage for a breakout to unprecedented heights as forecasters eye a six-figure BTC price.

However, Bitcoin is no stranger to volatility, as one veteran investor points out: “This market gives and takes away with equal ruthlessness. The key is keeping perspective through the ups and downs.”

Downside risk remains In the likely event of the support zone failing to hold up, Ali cautions there is risk of a 30-40% retracement to the $26,000 to $30,000 area. This range previously offered both resistance on the way up and buying interest on subsequent pullbacks. It represents the last stand before an even deeper correction.

Nonetheless, for the committed crypto believer, such a drawdown may represent a long-term buying opportunity. As the saying goes, “Be fearful when others are greedy and greedy when others are fearful.”

So while Bitcoin remains at the mercy of fickle market sentiment, its long-term investment case holds strong. Those able to stomach the volatility can consider staking a position in case this leading cryptocurrency indeed breaks out to fresh all-time highs later this year.

You may also be interested in:

- Kaspa Consistently Follows a Multi-Year Support Trendline, Indicating KAS Price Cannot Dip Below This Level

- Expert Predicts Bitcoin (BTC) Will Reach +100k and Altcoins to Surge 100x as Soon as These Happen in the Crypto Market

- Market Enthusiasts Reveal: Secrets to Transforming $100 into $1000 in the Thriving Cryptocurrency Scene!

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.