After spending time consolidating around $74,000, the BTC price surged to nearly $97,000, a jump of over 30%. That sharp rise caught a lot of attention, especially as it came ahead of some major macroeconomic events.

Right now, Bitcoin is trading around $94,000, slightly down from its recent local top. But if certain conditions fall into place, an analyst believes we could be looking at a run toward a new all-time high, potentially even above $134,000.

What you'll learn 👉

Bitcoin Price Could Surge If Fed Sparks Market Optimism

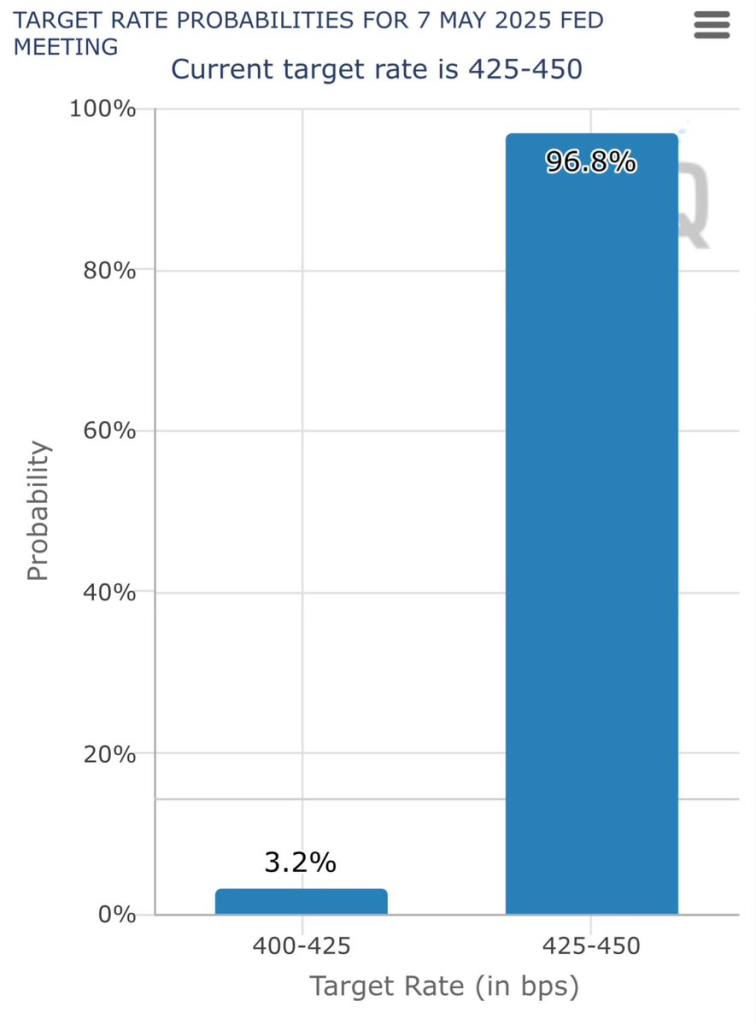

There’s a lot of anticipation around this week’s FOMC meeting. While most analysts expect the Fed to keep rates unchanged, with over 97% odds pointing to no rate cut, what really matters is how Jerome Powell frames the outlook. Markets tend to react more to Powell’s tone and hints about future moves than the actual rate decision. And the crypto space is no exception.

Crypto Patel, an analyst on X, pointed out that this week is packed with events that could influence BTC price action. He specifically mentioned the Fed’s rate decision on Wednesday, as well as the 10-year and 30-year Treasury auctions and the Fed’s balance sheet update. These moments tend to shape investor sentiment and can set the tone for risk assets like Bitcoin.

Crypto Patel also highlighted rising dominance in Ethereum’s stablecoin activity and Solana’s strong performance in chain revenue as signs that the broader crypto market is gaining momentum. But it’s Bitcoin that he’s most excited about. According to Patel, if history rhymes, BTC could rally as high as $134,000.

BTC Price Patterns Suggest the Next Leg Higher May Be Coming

Another key argument for BTC potential rally is based on Bitcoin’s historical halving cycles. Each time a halving occurs, which reduces the new supply of BTC, the price tends to go on a major rally within the following 40 to 50 weeks. The most recent halving happened in April 2024. If the past is any guide, we’re now entering the window where the rally typically starts to accelerate.

Read Also: Hedera (HBAR) Holders Brace for Impact – Trillions Are Flooding On-Chain!

There’s also the institutional factor. Bitcoin spot ETFs have brought in fresh demand from large investors, and that new wave of capital is creating stronger buying pressure.

Crypto Patel has shared similar views in the past, and this time he’s backing his call with a clear price target. He believes that if the Fed signals a softer stance or if institutional demand keeps climbing, Bitcoin could be headed for $134,000, a new all-time high that would leave the previous peak of $109,000 behind.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.