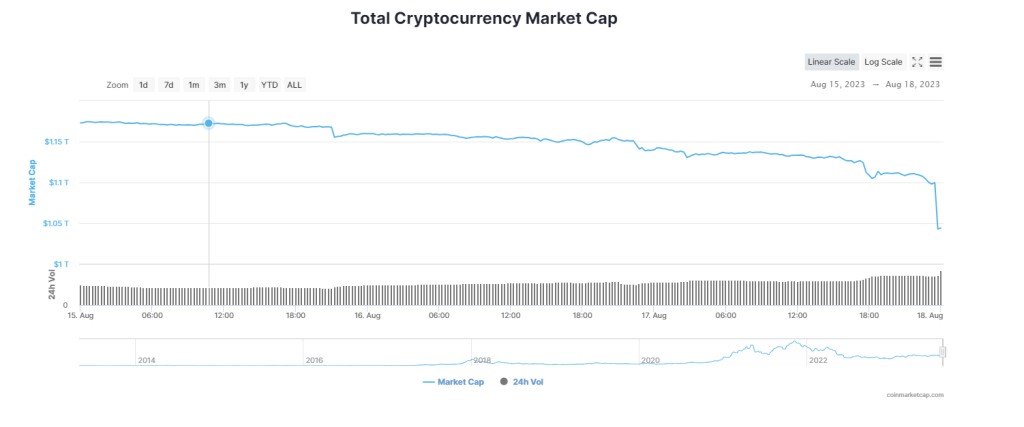

The cryptocurrency market experienced a massive crash today, with the total market capitalization falling over 9% to $1.04 trillion. The two largest cryptocurrencies, Bitcoin and Ethereum, were hit particularly hard, both losing over 10% in the last 24 hours.

Bitcoin is currently trading around the $26,000 level, after breaking below the key support at $28,000 earlier today. Meanwhile, Ethereum has plunged to around $1,600, slicing through the $1,700 support. The steep declines in these two bellwether cryptocurrencies tend to drag down the broader altcoin market.

As expected, major altcoins like XRP and Shiba Inu were caught in the storm, with both losing over 15% of their value today. XRP dropped below the crucial $0.50 support, while Shiba Inu broke below $0.000008. The mass exodus of capital from the crypto space has left many altcoins in freefall.

Nearly $800 million worth of cryptocurrency positions were forcefully closed out in under half an hour today, as prices plunged. Traders unable to meet margin calls saw their bets automatically exited, fueling further declines. The huge level of liquidations highlights the volatile and risky nature of the cryptocurrency market.

Analysts have pointed to several factors that could explain this broad-based crypto sell-off:

- Seasonal Lull: August is historically a slow month for markets in general due to summer vacations. Lower trading volumes tend to exacerbate price declines. Historically, it happened that a market crashes in August, several months before Bitcoin halving in April next year.

- Breaking News: It was revealed today that Elon Musk’s SpaceX has sold its entire Bitcoin holdings of $373 million. This news of a major player exiting the market likely spooked retail investors.

- The court permits the SEC to submit an appeal in the Ripple XRP lawsuit earlier today, impacting the market negatively as well.

- Technical Selloff: Bitcoin has been struggling to hold above $30,000 for some weeks now. The decisive break below this key support triggered stop losses and liquidations of leveraged long positions, catalyzing the steep fall.

The recent weakness in the crypto markets has shaken investor confidence. Some are calling this a classic “bear trap” setup, hoping for a trend reversal. Others worry this could be the start of a deeper downturn, advising caution. Either way, volatility is likely to remain high in the coming days.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.