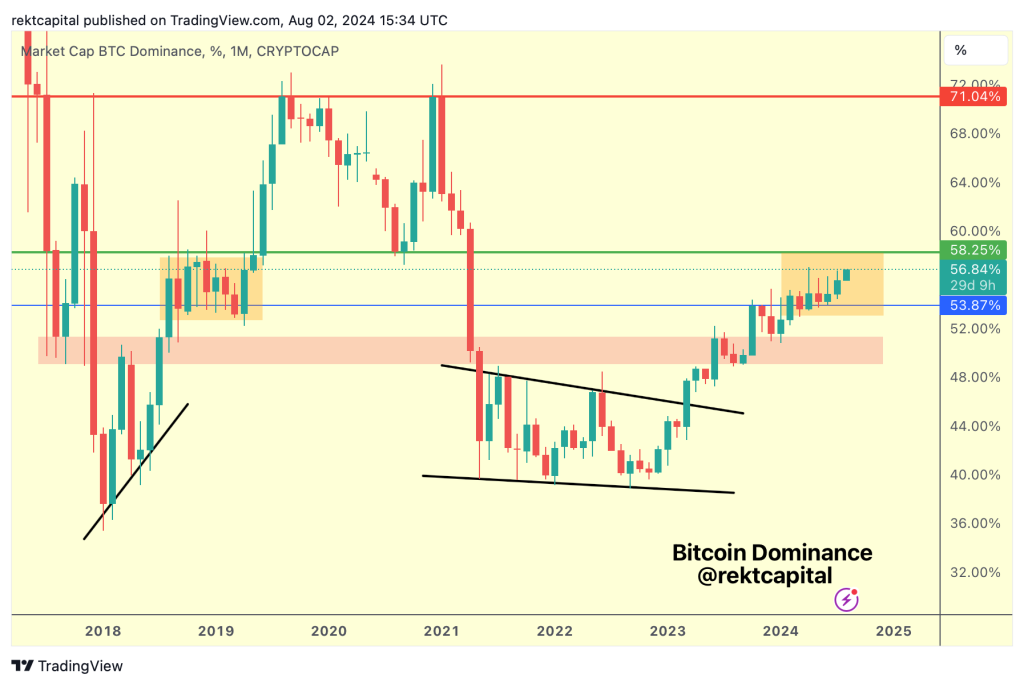

Rekt Capital’s latest newsletter addresses Bitcoin’s dominance in relation to Altcoins’ price direction. The analyst says that when Bitcoin’s dominance is increasing, altcoin prices rarely remain stable.

During that period, altcoins (every other cryptocurrency apart from BTC) dropped in valuation.

According to the newsletter, this month marks the third consecutive one that Bitcoin’s dominance has been moving up, and the analyst thinks it is going to revisit the 58.25% mark identified with the green line on the chart.

If the price breaks above that green line level, we could see a fast increase in BTC dominance to as high as 71%, which is marked with the red line on the chart. This fast increase has happened twice in the past: in late 2017 and mid-2019.

In 2020, BTC dominance bounced off the 58.25% level as support, and from there it spiked to the 71% mark. Based on the analysis, breaking above 58.25% is likely, and this could make Altcoins shed their value.

Ethereum, Cardano and other altcoins have been bearish for some days, a continued rise to BTC dominance means they could continued to fall in value.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Read Also: Here’s Why Ripple Has ‘The Upper Hand’ Against SEC – Will XRP Price Hit $1?

However, the analyst expects BTC dominance to drop drastically when it reaches 71%, which could allow other cryptocurrencies to spike in price—this is usually referred to as Altseason.

The analyst warned that Bitcoin’s dominance will remain in a state of consolidation within the orange zone until the 58.25% level breaks.

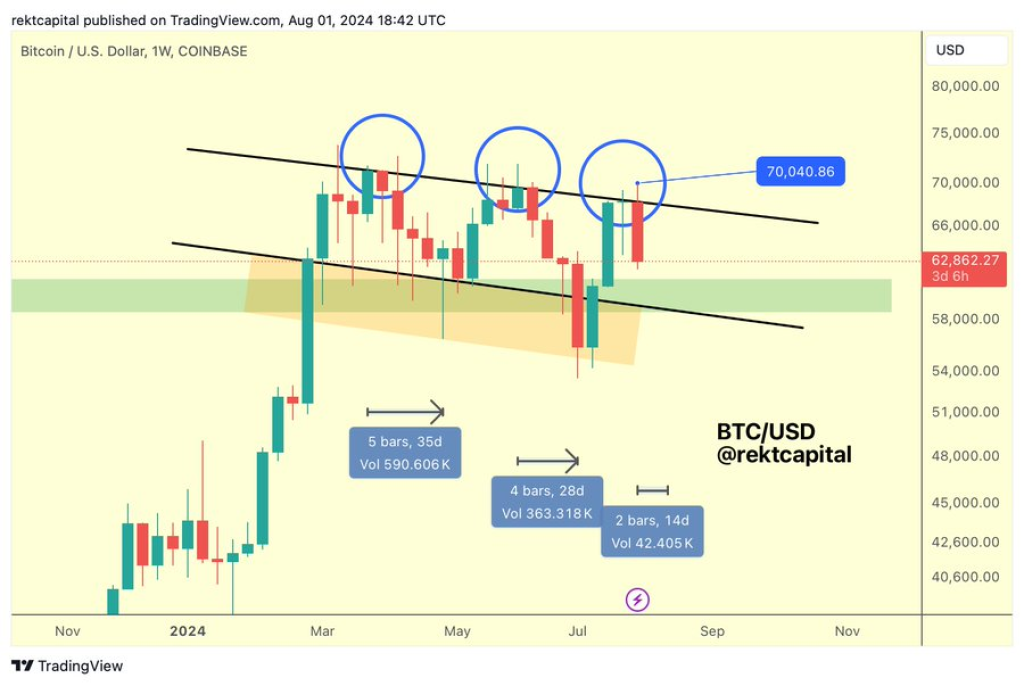

Bitcoin Price Could Bottom Earlier to Resume Rally

Rekt Capital also delved into Bitcoin price analysis. The analyst noted that the price has been declining since it hit resistance at $71,000.

The price is expected to recover around $60,000, where it had been held by strong support in the past. The past traces took around 5 weeks, but since the price, which is now at $61,000, is close to the support zone, we could see a recovery earlier.

On this ground, Rekt Capital thinks we could see only 2 to 3 weeks of retracement compared to the 5 weeks of pullbacks experienced in the previous ones.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.