In a recent tweet, financial analyst Alex Thorn set the crypto community abuzz with his predictions about the potential impact of Bitcoin exchange-traded funds (ETFs) in the United States.

Thorn’s insights, though not definitive, offer a thought-provoking perspective on the ripple effect that these investment vehicles could have on the world’s leading cryptocurrency.

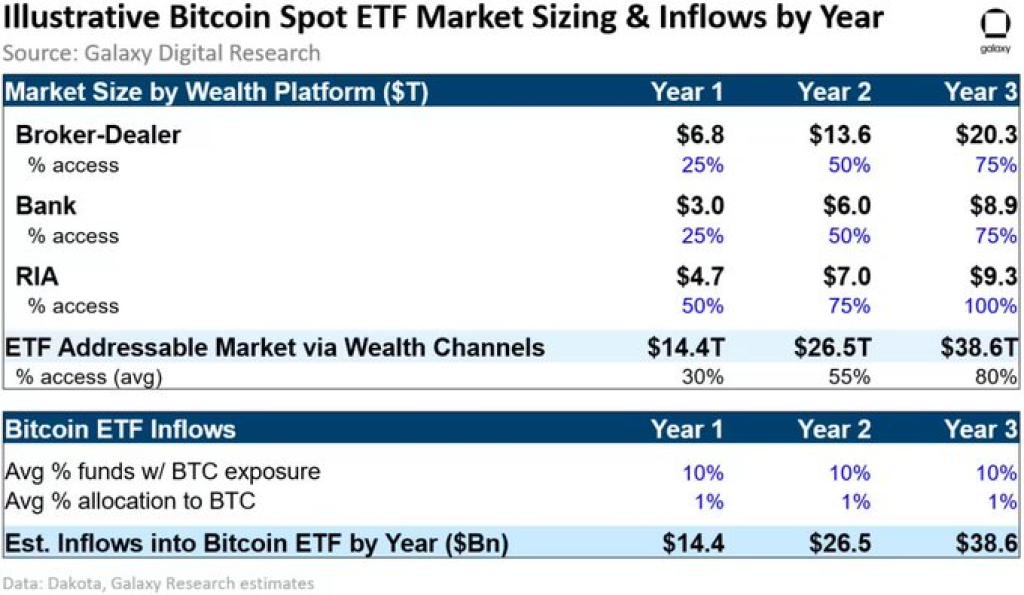

Thorn’s tweet states that Bitcoin ETFs, once approved, could usher in a wave of substantial capital inflows. In the first year alone, he anticipates a minimum of $14.4 billion pouring into these ETFs. This figure is projected to swell to a staggering $38.6 billion in the third year following approval. Such inflows, according to Thorn’s analysis, could potentially drive a 75% appreciation in the price of Bitcoin the year after approvals.

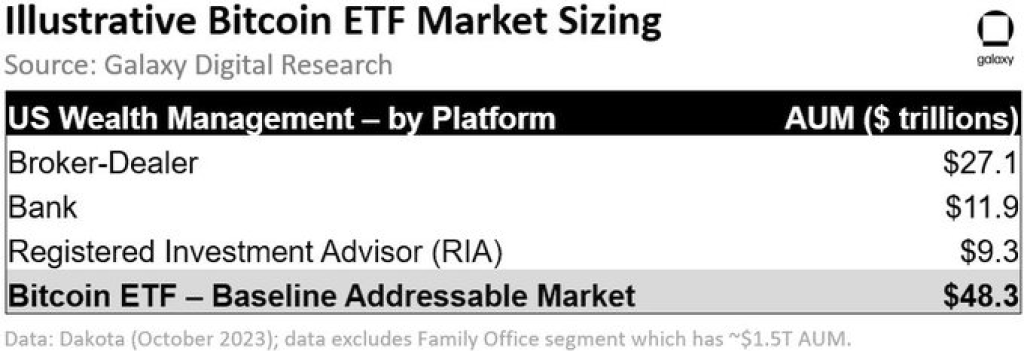

The analyst identifies the wealth management channel, specifically encompassing bank/BD platforms and independent Registered Investment Advisors (RIAs), as the primary market sector poised to benefit from increased access to Bitcoin exposure.

In the United States, these two segments collectively manage an impressive $47 trillion in assets under management (AUM). Thorn emphasizes that the focus on these channels is strategic, as they stand to gain the most from the introduction of Bitcoin ETFs.

Thorn’s conservative estimates suggest that 10% of the addressable AUM in these wealth management channels might choose to allocate just 1% of their assets to Bitcoin. This allocation strategy remains consistent across all three years of his analysis.

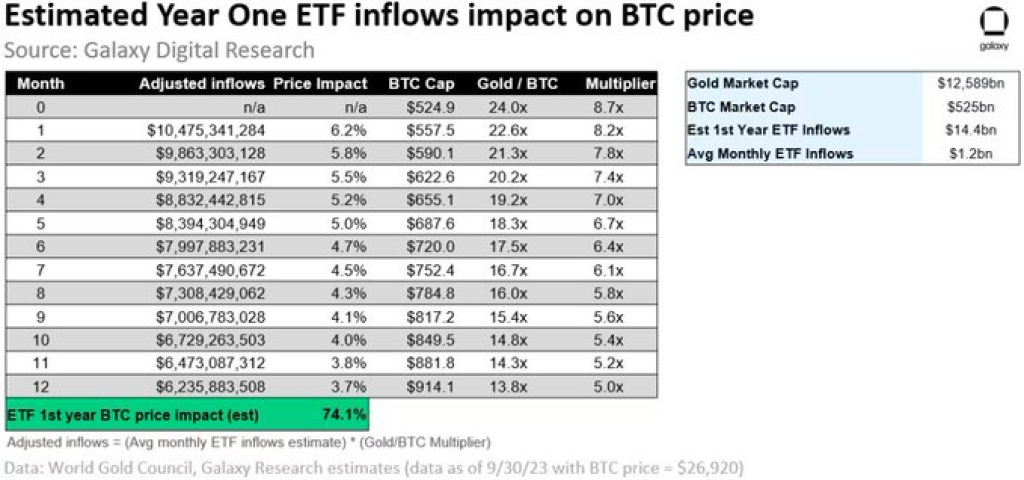

Estimating the impact of these anticipated inflows on Bitcoin’s spot prices is a complex task, as it hinges on several factors, including liquidity and timing. Thorn attempts to shed light on the potential outcomes by drawing parallels to the gold market.

Gold, with its approximately 24 times larger market capitalization and 36% less supply held in investment vehicles compared to Bitcoin, serves as a reference point. Thorn’s analysis posits that fund inflows into Bitcoin ETFs could have a significantly greater impact, approximately 8.8 times greater, on Bitcoin markets than they do on gold markets.

Taking his year-one estimate of $14.4 billion in inflows (equating to approximately $1.2 billion per month or about $10.5 billion when adjusted with the 8.8x multiplier), Thorn draws a comparison with the historical relationship between gold ETF fund flows and changes in gold prices. He estimates an impressive +6.2% price impact for Bitcoin in the first month.

However, he cautions that as time progresses, monthly returns could gradually decrease from +6.2% in the first month to +3.7% by the last month of the first year. This cumulative effect is expected to result in a remarkable +74% increase in Bitcoin’s value during the first year following ETF approval, using a starting point of $26,920 as of September 30, 2023.

Nonetheless, Thorn emphasizes that while these insights are compelling, they are not set in stone. ETF approvals are not guaranteed, and the timing remains uncertain. His report, therefore, is intended to be illustrative rather than definitive, offering a reasonable framework for contemplating the potential impact of a U.S. spot-based Bitcoin ETF.

As the cryptocurrency space continues to evolve, Thorn’s projections provide investors and enthusiasts alike with valuable food for thought regarding the dynamic interplay between institutional investment and the world of digital assets. While the future of Bitcoin ETFs in the U.S. remains uncertain, Thorn’s analysis paints a vivid picture of the profound effects they could have on the world of crypto.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.