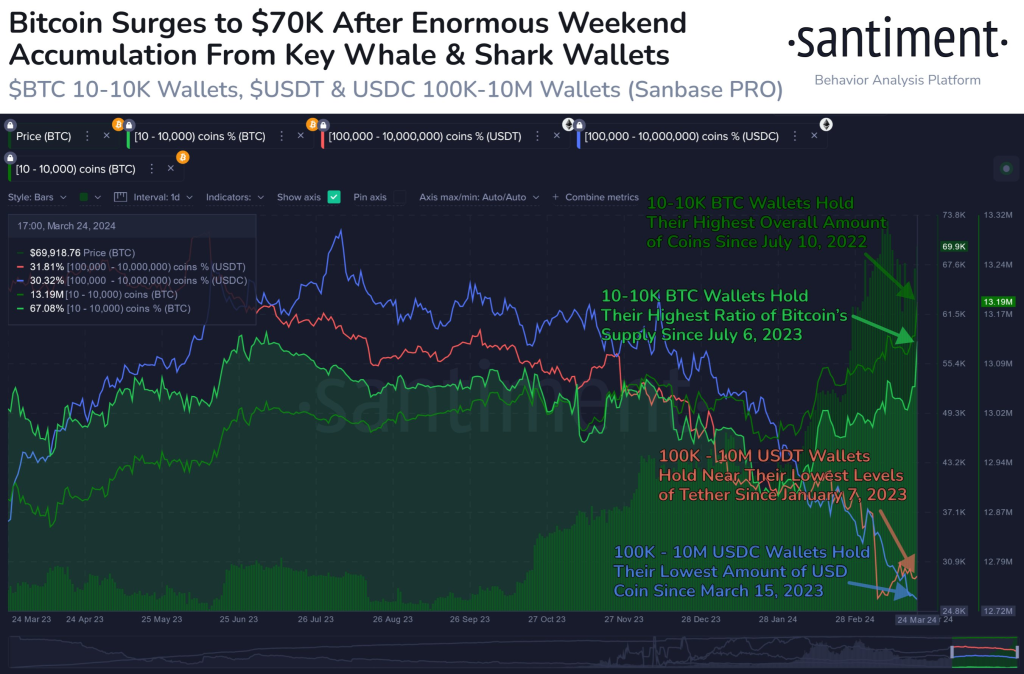

The world’s largest cryptocurrency has once again caught traders off guard with a massive rebound, surging past the $70,000 mark after a recent market correction. According to data from Santiment, a leading on-chain analytics platform, the reason behind this unexpected rally can be attributed to a significant accumulation trend among key Bitcoin stakeholders.

Last week, as Bitcoin was trading below $61,000 following a market correction, wallets holding between 10 and 10,000 BTC collectively accumulated 51,959 Bitcoin.

This massive influx of buying pressure accounts for 0.263% of the entire currently available Bitcoin supply, making it one of the single largest accumulation days for these mid-tier holders in years.

Santiment’s report highlights that as the Bitcoin halving event approaches on April 19th, it would be unsurprising to see these wallets continue to grow, potentially resulting in a positive impact on the broader cryptocurrency market caps.

The halving, which occurs every four years, is a predetermined event that reduces the rate at which new Bitcoin is created and introduced into circulation, thereby effectively reducing the supply of new coins.

While this accumulation trend among mid-tier holders is encouraging, Santiment notes that it’s crucial for whales and sharks (large institutional investors) to maintain their “dry powder,” referring to their holdings of stablecoins like USDT and USDC.

This dry powder allows them to continuously swap for more cryptocurrency at any given time, providing the necessary liquidity and stability to the market.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Conclusion

Bitcoin’s recent surge to $70,000 has caught traders off guard, but the underlying reason for this rally appears to be a significant accumulation trend among key Bitcoin stakeholders. As the highly anticipated Bitcoin halving event approaches, the cryptocurrency market is likely to witness increased volatility and potentially further upward price movements.

However, the long-term sustainability of this rally will depend on the continued participation of whales and sharks, who play a crucial role in maintaining market liquidity and stability.

You may also be interested in:

- Is the Solana Era Ending? Elite Analyst Bets on Coinbase’s Layer 2 Ecosystem – Here’s His Outlook

- Stacks (STX) Price Eyes $4 Following 30% Pump While The Graph (GRT) Consolidates – Here’s Why

- The 2024 Launchpad Token Outlook: Bull Run Investment Strategy

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.