The outlook for Bitcoin remains uncertain in early 2024 as analysts debate whether a definitive bottom is establishing itself or whether more downside awaits. On one hand, positive momentum signals are emerging. But crucial technical levels must still hold to sustain the nascent uptrend.

BTC price actually surged past $43k today for the first time following Bitcoin ETF approvals sell-off.

What you'll learn 👉

Bullish Sentiment Building

According to crypto trader Titan of Crypto:

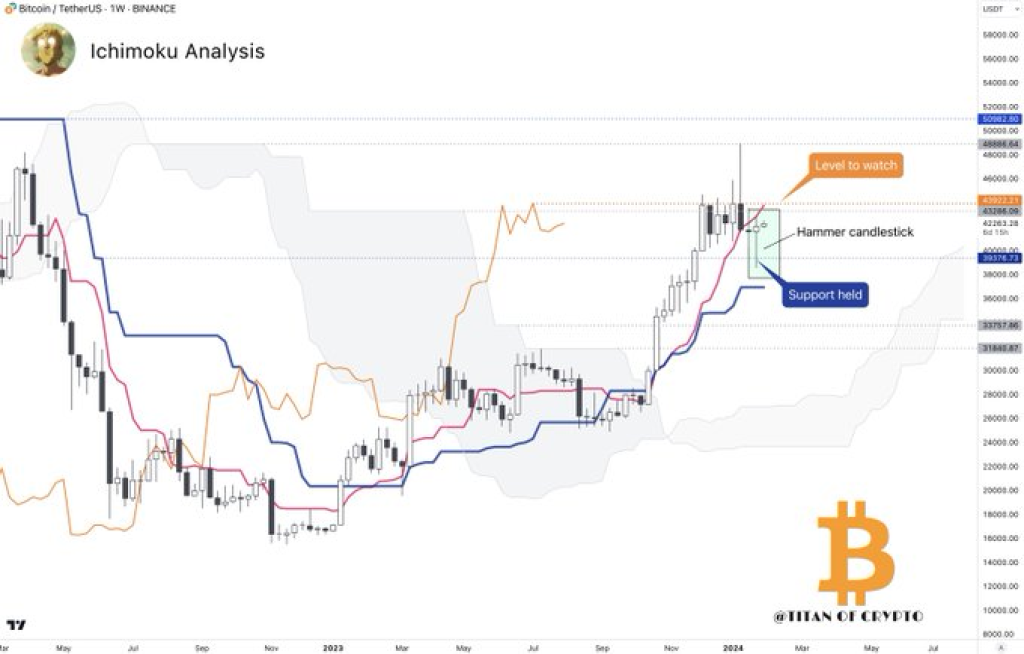

“The weekly bullish hammer candlestick I told you about past week has been confirmed in closing. #BTC could reach $43.9k this week.”

The bullish hammer candle close contributes to a developing positive momentum case. In addition, Moustache highlights the ADX/DI indicator crossing bullishly for the first time in nearly 8 years. These shifting technicals suggest upside conviction may be returning after extreme fear conditions.

Uptrend Vulnerable Below $40K

However, analyst Alex asserts Bitcoin still needs to reclaim key levels to avoid “one last nuke” downside move ahead of the 2024 halving:

“Right now, I am targeting the naked range highs and distribution above those levels, and then maybe a last nuke before the #BTC halving.”

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +So in essence, the coming days and weeks seem crucial for determining whether Bitcoin has indeed bottomed or whether lower supports await. Multiple momentum indications suggest the bear capitulation may have played out with upside ahead.

You may also be interested in:

- Ripple’s XRP Following Expert’s Prediction, a 15% Rally to This Price Level Is Next

- Bitcoin, Solana, and These 5 Cryptos Have Significant Events That Could Help You Profit This Week

- Why Investors From Solana (SOL) and Toncoin (TON) Are Showing Interest In the New Kelexo (KLXO) Presale

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.