Bitcoin saw a surge today, trading as high as $44,250 before pulling back to $43,600. This brings it close to its 2023 high near $44.5k reached on December 8th. However, crypto analysts are warning that history may repeat itself with a retracement.

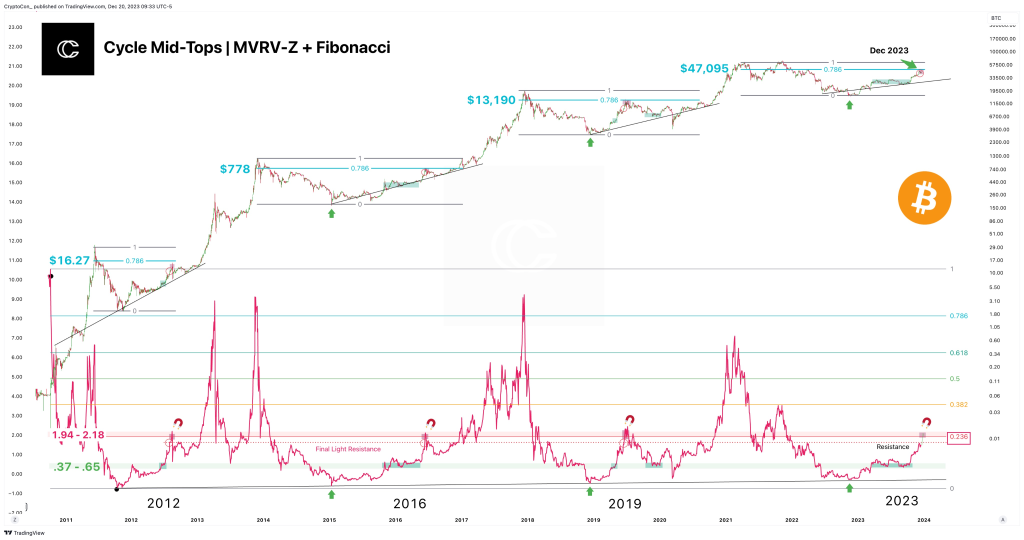

Popular crypto analyst CryptoCon, with over 70k Twitter followers, commented on the recent price action: “Is Bitcoin price more optimistic than I thought? It makes sense that as some data fired, others would be thinking ahead and the 48k target that seems to be unanimously agreed upon would not be reached.”

What CryptoCon means is that many analysts have been expecting Bitcoin to top out around $48k based on various indicators. However, if those indicators did not align perfectly, it leaves room for Bitcoin to potentially break out above $48k if new highs are achieved. CryptoCon explains “If the cycle mid-top is not in and Bitcoin breaks into new highs, then MVRV-Z aligning in its red zone makes sense, along with a few other indicators that have missed their mark. Then we head to the famed 47-49k mark.”

Another top analyst, Ali, with over 30k Twitter followers, also urged caution in the current market: “From capitulation to belief, the mood in the #Bitcoin market has seen a full spectrum of changes. However, it’s worth noting that historically, every time sentiment has shifted from capitulation to belief, $BTC has experienced a retracement. Could history repeat itself?”

What Ali is getting at is that market sentiment has moved from extreme fear during the summer capitulation event back to optimism and “belief” in Bitcoin. If history rhymes, sudden sentiment shifts like this have preceded retracements. So despite Bitcoin’s surge, a pullback may still occur.

On the technical side, Bitcoin’s daily relative strength index (RSI) now reads 63. An RSI above 70 is considered overbought territory, while a reading below 30 is oversold. So at 63, Bitcoin is getting closer to overbought conditions but still has some room left before hitting historically overextended levels.

Finally, there is hype building around a potential Bitcoin exchange-traded fund (ETF) approval by January 2024. The crypto community widely expects such an event, which could drive Bitcoin back toward the $50k threshold. With the deadline impending, the next few weeks will be an interesting period for Bitcoin price action.

You may also be interested in:

- Whales Are Accumulating Chainlink (LINK) and This Major Altcoin: Report

- Ethereum Set to Reach $10,000 Soon, Expert Explains Why ETH Is Programmed To Hit That Price

- The Investment Turnaround: Why TRON and Dogecoin Investors Are Flocking to This New Cryptocurrency with 150% ROI?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.