Bitcoin’s recent struggles have been clear for everyone to see. The perpetual bear market we have struggled with since late December has shown very few signs of slowing down, with reasons for this downturn being so numerous that one could write a whole blockchain’s worth of data to list and explain them all. Saying that, there indeed are reasons to believe that the current downtrend is nearing its exhaustion and that we’re perhaps heading towards an upturn in fortunes in the near future.

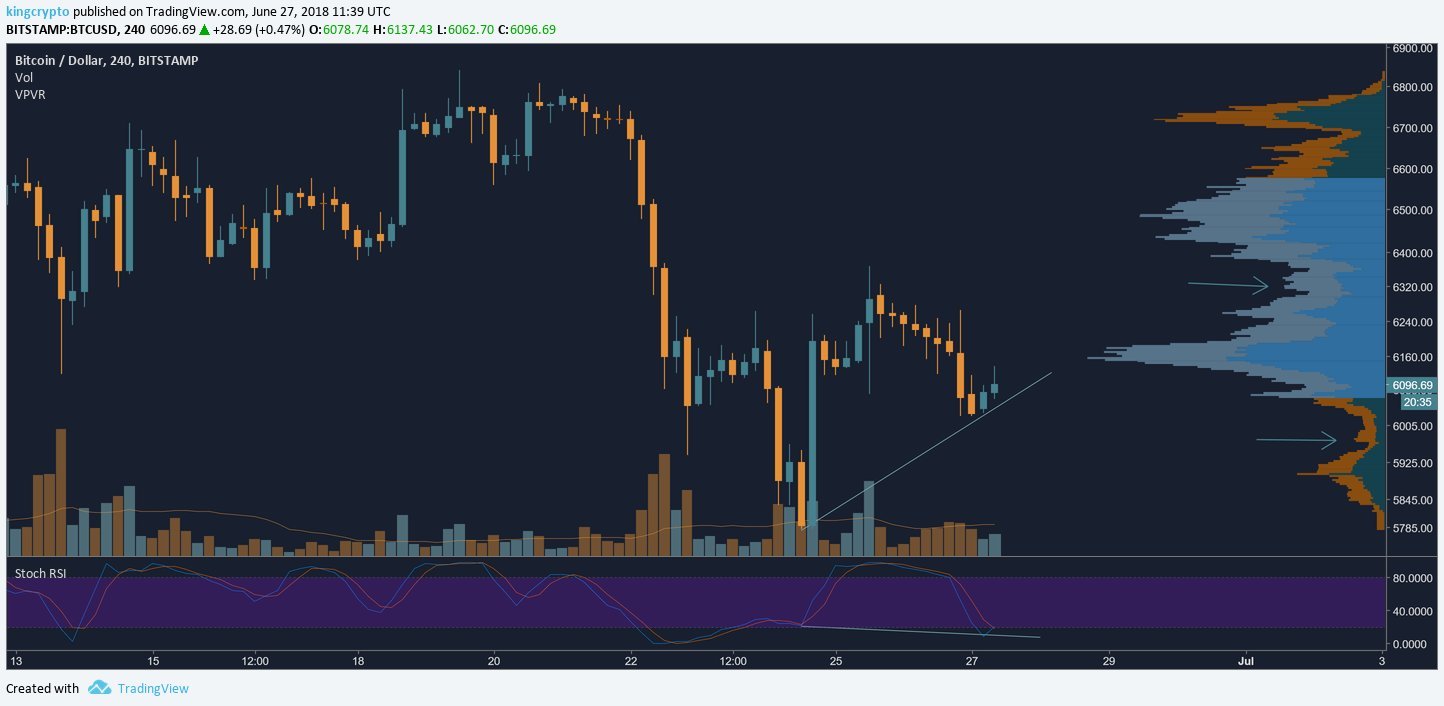

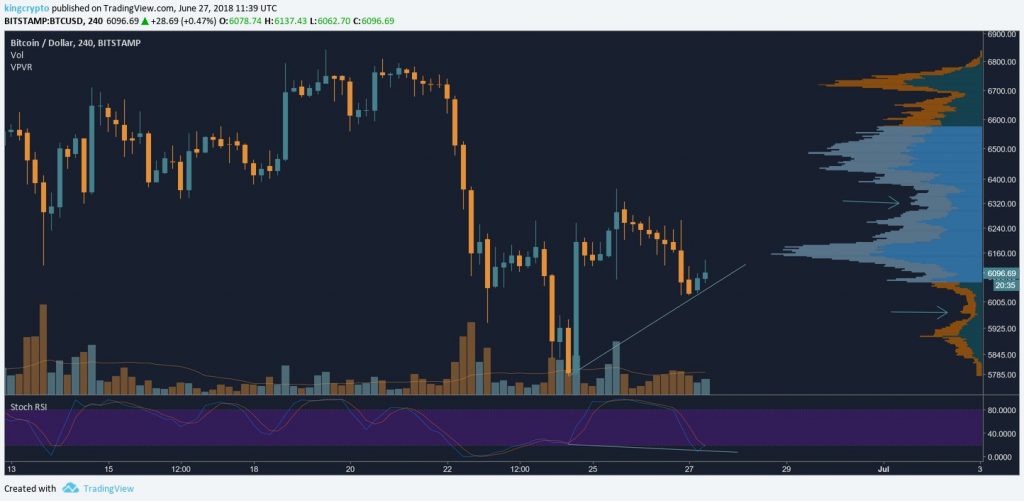

BTC price action has been relatively calm since we last updated you on it. The volume which was accumulated after the latest Tether print has petered out by mid Sunday. Monday brought about an increase in volume levels, and with the price’s continual slow bleed some experts suggest that this could be a sign of a bullish countertrend forming. There have been a total of two low volume areas on BTC’s volume profile in a very short time frame so the things are looking positive from that side.

Bitcoin is currently priced at $6,110.77 USD, which is a 1.34% drop-off in the last 24 hours. For now the price remains just above the $6000 USD psychological barrier, and if the break-out does indeed happen it’s expected to be a minor one, as the current volume of $3,386,420,000 USD is still somewhat too low for any serious recovery.

Read: Best Bitcoin Exchanges 2018

Some very positive analysts think that the mid-term recovery will yield an improvement of around 50% from the current price levels. An article posted by cryptodaily.co.uk notes that they’ve done “calculations” regarding how Bitcoin usually performs in bull-runs. After crunching the January and February numbers, they came to a conclusion that Bitcoin moved in swings of around 50% every time (48% and 41% respectively). If we apply these numbers to the current BTC price, a 50% increase wouldn’t even scratch $10000 USD.

With expectations for Bitcoin being that it could reach $20000 USD by the end of the year, the time is slowly ticking away for this rally to actually happen. It will take a massive influx of buying power to lead us there. But let’s not get ahead of ourselves; the downtrend isn’t even broken yet. The road to 20K will be a difficult one for sure.