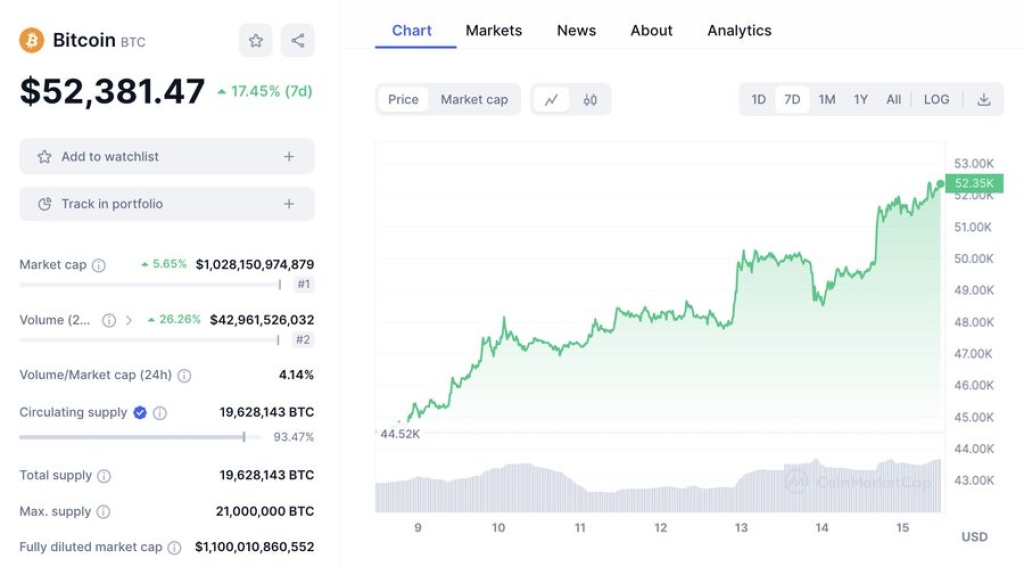

After rallying for seven straight days, the Bitcoin price finally reclaimed the $52,000 level for the first time in over two years. However, Spot On Chain has identified two key upcoming events that could pose threats to Bitcoin’s short-term price action.

Genesis Approved to Sell $1.3B in GBTC

First, Genesis Trading was recently approved by a court to sell $1.3 billion worth of Grayscale Bitcoin Trust (GBTC) shares, totaling over 35 million shares, on February 15th. Spot On Chain notes that previous large-scale GBTC unlocks have preceded Bitcoin price drops.

US Government Plans Sale of Seized BTC

Additionally, the analyst highlights that the US government recently filed notice to sell 2,875 BTC worth around $150 million that were seized from Silk Road. As one of the largest institutional Bitcoin holders, similar previous sales from the government coincided with price dips.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +With Bitcoin facing its highest level in two years, these pending sales present potential headwinds that could interrupt its momentum. However, determined buying support could help the cryptocurrency power through the turbulence.

You may also be interested in:

- Are Ethereum Tips Useful? This Smart Trader Made Over $2 Million in 12 Hours With This Altcoin

- Major Network Upgrade Triggers Surge in Sei Token Price: Analyst Anticipate SEI’s ‘Big Breakout’

- Intuitive streaming platform DeeStream (DST) get Cardano (ADA) & Litecoin (LTC) investors pouring in early as presale looks to hit 40x in months

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.