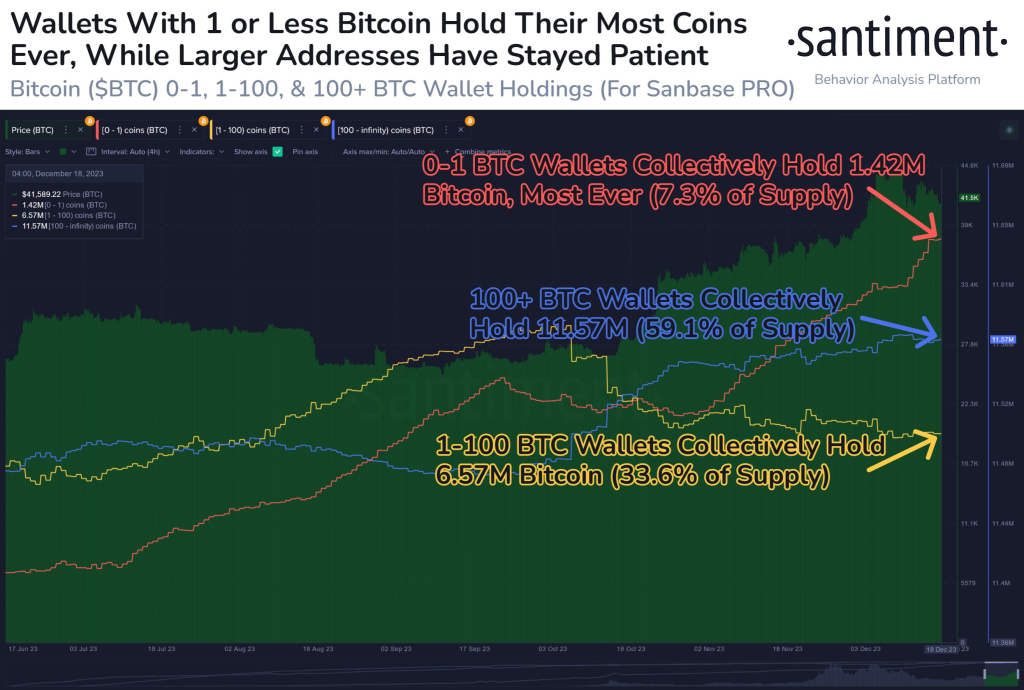

Santiment reported an interesting trend in Bitcoin wallet distributions:

“#Bitcoin’s wallets holding 1 or less $BTC hold their most coins ever, as they aggressively picked up their accumulation since the beginning of November. Mid-tier wallets are slightly down in the past couple months, while whales have increased.”

This indicates that smaller retail investors have been accumulating Bitcoin more aggressively since early November, likely taking advantage of prices under $35,000. Meanwhile, whales (wallets with large balances) have also increased their holdings, potentially anticipating higher prices. However, mid-sized wallets slightly decreased over the past couple months, possibly taking profits during rallies

.

This on-chain data suggests strong retail and institutional interest under $35k, which could provide support on further pullbacks. The appetite for accumulation indicates potential for a bullish trend reversal if momentum continues building.

In terms of price action, Bitcoin is currently trading around $42,600, up 2.5% in the last 24 hours. This is still below its yearly peak of over $44,000 reached in early December when optimism spread about a potential bottom.

Support around $42k aligns with the 21-week exponential moving average, an important technical indicator that could propel Bitcoin higher if convincingly broken.

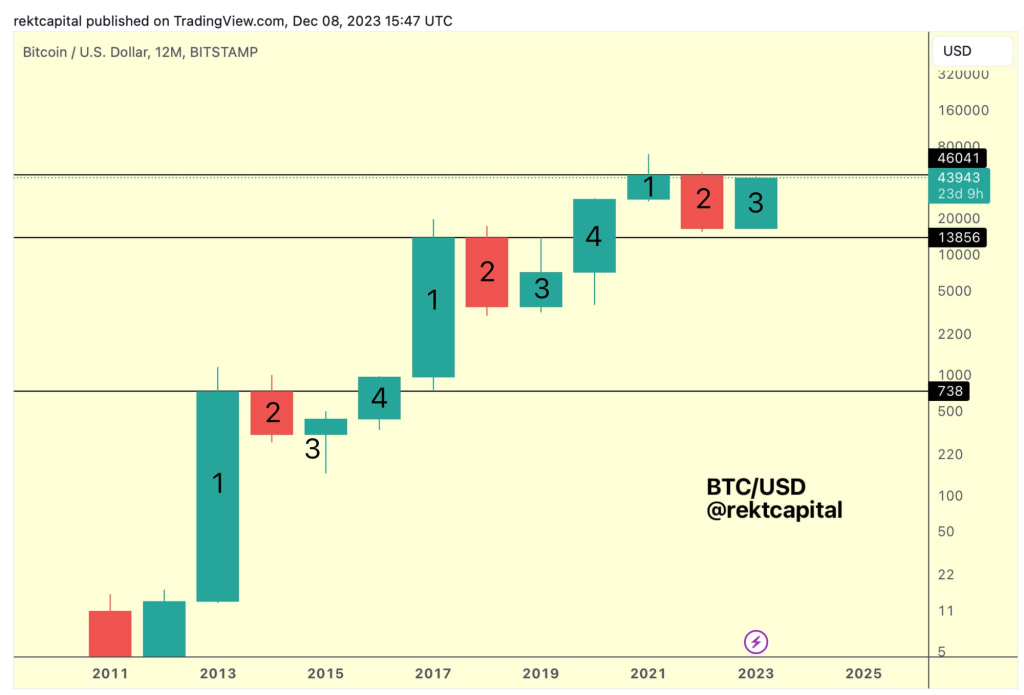

Crypto analyst Rekt Capital also cited an intriguing four-year cycle pattern that Bitcoin has followed from halving to halving:

“Bitcoin has never broken its Four Year Cycle resistance (black) in a Pre-Halving year (Candle 3) But in the new Candle 4 (2024) Bitcoin will comfortably break beyond $46000”

This suggests Bitcoin is still in its third year after the 2020 halving and has not yet broken its four-year resistance level around $46k. If past cycles repeat, Rekt expects 2024 (the fourth year) to witness a comfortable breakout over $46,000 as adoption continues growing post-halving.

In summary, on-chain and price data indicate growing retail and institutional interest, technical and macro support near current levels, and historic upside potential in 2024 once the four-year halving cycle progresses further. These insights provide cautious optimism for patient Bitcoin investors over the medium to long term.

You may also be interested in:

- Bitcoin Correction Coming According to Experts, BTC Price Could Plunge +30% to Key Support Levels

- Shiba Inu (SHIB) Price to Spike Over 30% If This Crucial Support Holds

- Coinbase Lists $BONK Token — New Pump Incoming or Is This Memecoin Presale a Better Bet?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.