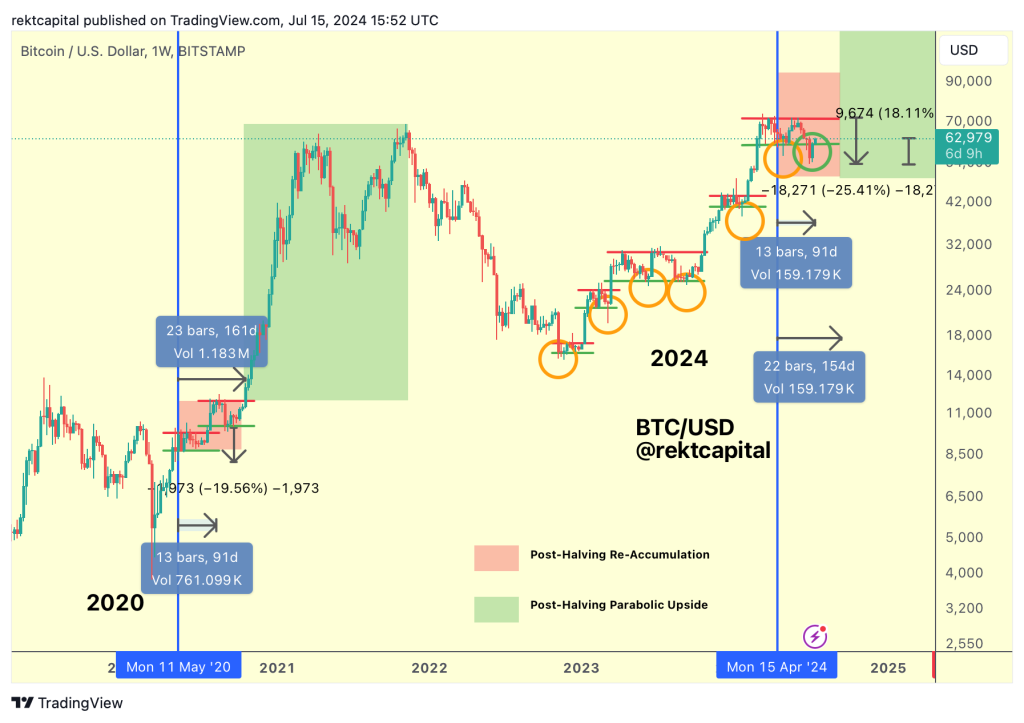

Rekt Capital presents an outlook on Bitcoin’s price action and how it could affect its next direction in his latest newsletter. The release shows the most recent breakout and strong support that could propel BTC’s price upward to new heights.

The newsletter begins by revisiting last week’s analysis of Bitcoin’s Re-Accumulation Range. Despite an initial breakdown below the $60,600 level, Bitcoin has managed to invalidate this bearish signal by closing above this crucial support level on a weekly timeframe.

This move effectively reclaims the Re-Accumulation Range, turning what appeared to be a breakdown into a “fake-breakdown” scenario.

Rekt Capital emphasizes that the recent price behavior below the Re-Accumulation Range lows is consistent with previous cycles, where such dips have typically represented “downside wicks into bargain-buying territory.” The analyst notes that while the outcome aligns with historical patterns, the manner in which Bitcoin achieved this reclamation may have caught many investors off guard.

Read Also: Mantra Price Pumps and Hits New ATH, But is OM Rally Sustainable? Here’s the Catch

What you'll learn 👉

Higher Timeframe Support Levels Holding Strong

Various strong supports have also been holding, suggesting the price could be ready for a continued rally

Monthly Timeframe Analysis

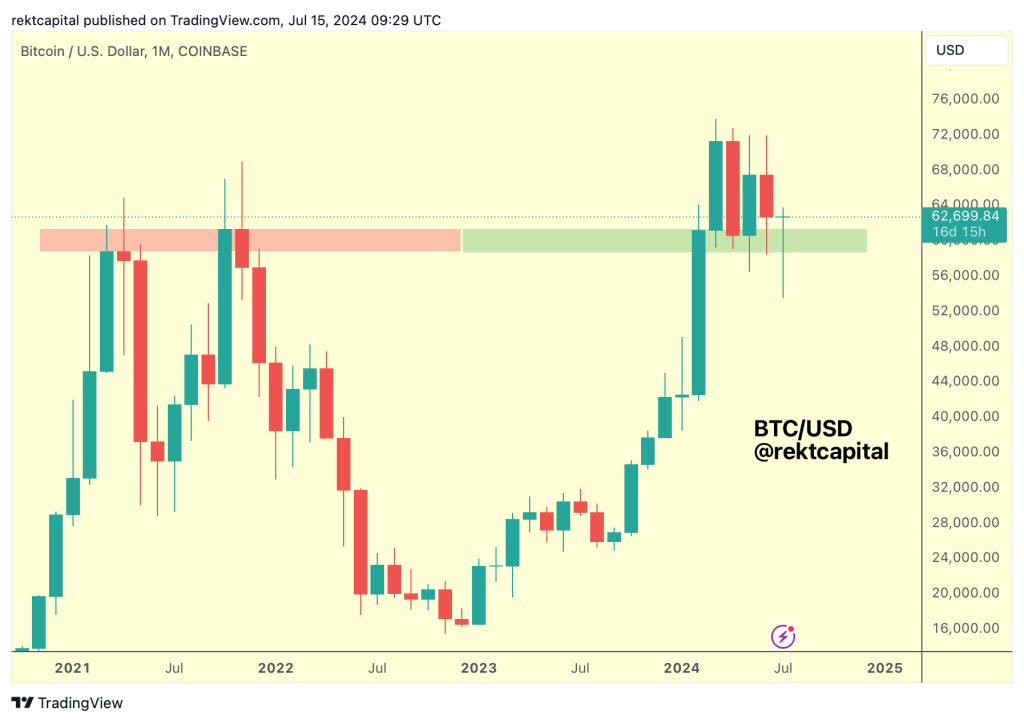

The newsletter also delves into Bitcoin’s performance on higher timeframes, starting with the monthly chart. July’s price action has resulted in a long downside wick, with Bitcoin returning above the previous all-time high area.

This level has now acted as support for five consecutive months, which Rekt Capital views as a promising sign. The analyst suggests that this movement allows Bitcoin to “grab liquidity at lower levels while still maintaining a higher timeframe demand area as support.”

Quarterly Timeframe Perspective

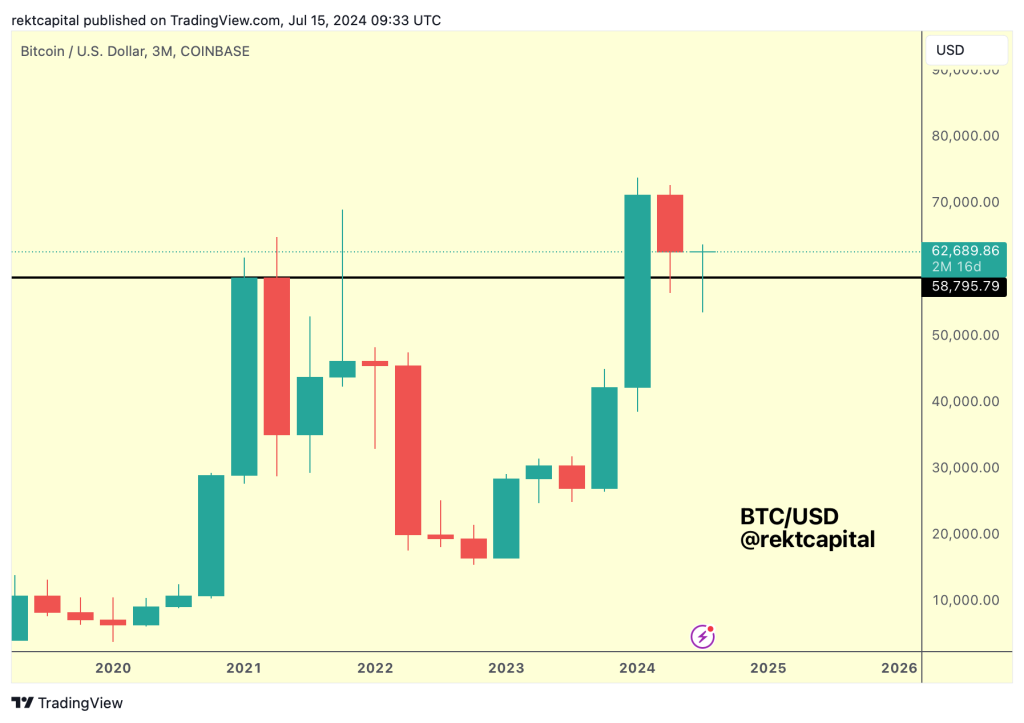

Extending the analysis to an even broader view, the quarterly chart shows Bitcoin successfully retesting old resistance as new support for two consecutive quarters.

While acknowledging that the quarterly close is still distant and further retests are possible, Rekt Capital emphasizes that Bitcoin is displaying positive signs of holding major demand areas as support on higher timeframes.

Technical Prerequisite for New All-Time Highs

The newsletter concludes by stating that Bitcoin’s current price action, particularly its ability to maintain support at critical levels across various timeframes, represents a “technical prerequisite” for a potential breakout to new all-time highs.

The analyst thinks that this setup could potentially usher in the “Parabolic Phase” of the current market cycle.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.